From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Faces Crisis: Output Drops, Imports Surge, Capacity Underutilized

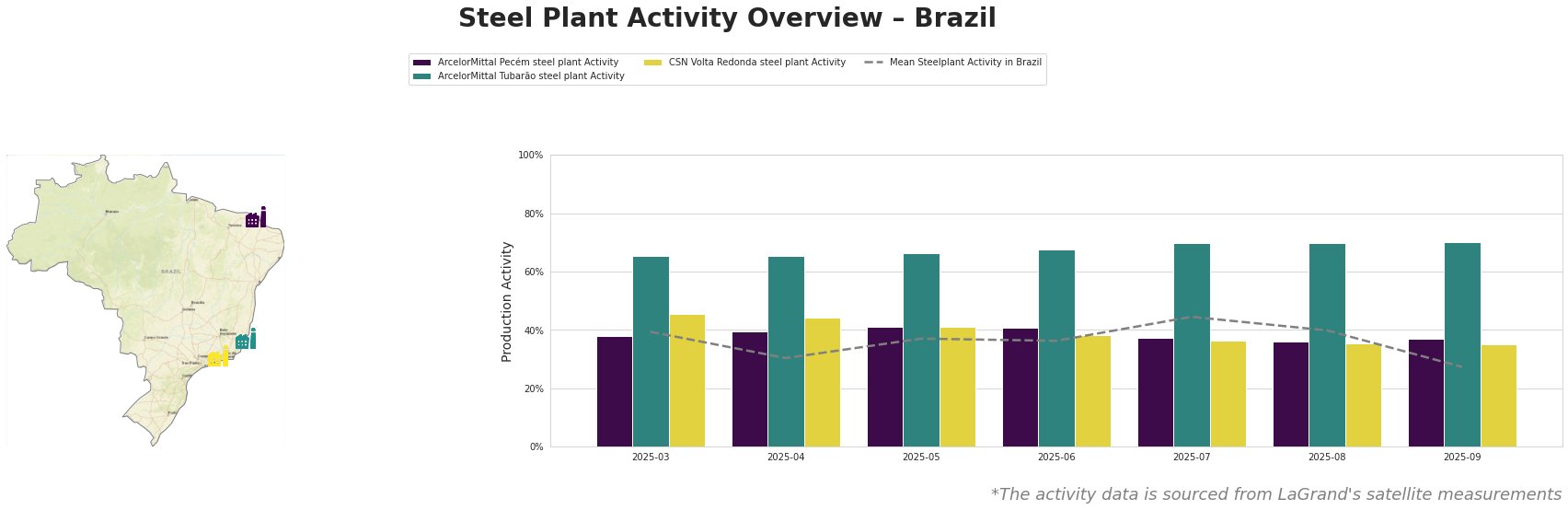

Brazil’s steel industry is facing significant headwinds, with declining output and rising import pressures. Recent struggles align with the news articles “Brazil steel output, imports fall in August” and “Brazilian crude steel production declines 4.6 percent in August 2025“. These articles corroborate the observed drop in the mean steel plant activity in Brazil in September. Additionally, the concerns raised in “Gerdau warns of crisis risks for Brazil’s steel industry” regarding rising imports and underutilized capacity seem consistent with overall declining activity across multiple plants.

Overall steel plant activity in Brazil has shown a declining trend, particularly evident in the sharp drop to 27% in September. This represents a substantial decrease from the 45% activity level observed in July. ArcelorMittal Tubarão consistently showed the highest activity levels among the observed plants, maintaining 70% activity for the past three months, significantly above the national average. The activity levels at ArcelorMittal Pecém are below the national average in the last three months, while CSN Volta Redonda has experienced a consistent decrease from 45% to 35% from March to September, below the mean Brazilian steel plant activity.

ArcelorMittal Pecém, located in Ceará, is an integrated BF steel plant with a crude steel capacity of 3000 ttpa. Specializing in slabs, plates, and rolled steel for automotive, building, energy, and transport sectors, it relies on BF/BOF technology. The plant’s activity remained relatively stable around 40% until July. A drop to 37% in July and further to 36% in August suggests a recent reduction in output, before showing a slight rebound to 37% in September. While “Brazil steel output, imports fall in August” mentions a drop in slab production, no direct connection can be explicitly established to link it to ArcelorMittal Pecém, since the plant also produces plates and rolled steel.

ArcelorMittal Tubarão, situated in Espírito Santo, is a major integrated BF steel plant with a crude steel capacity of 7500 ttpa. Its product range includes slabs, hot-rolled coils, and cold-rolled and galvanized steel, serving diverse sectors. Notably, ArcelorMittal Tubarão has maintained a high and stable activity level of 70% in recent months, consistently exceeding the national average. This could indicate a strategic focus on exports, as “Brazilian crude steel production declines 4.6 percent in August 2025” mentions a rise in exports, but no direct connection can be explicitly established since there is no data that confirms ArcelorMittal Tubarão is linked to this increase.

CSN Volta Redonda, located in Rio de Janeiro, is an integrated BF steel plant with a crude steel capacity of 6250 ttpa, also operating an EAF. The plant produces a wide array of products, including slabs, hot- and cold-rolled steel, galvanized steel, rebar, wire rod, and structural shapes for various industries. Its activity has steadily declined, from 45% in March to 35% in August and September. This decline coincides with the overall downturn described in “Brazil steel output, imports fall in August” and “Gerdau warns of crisis risks for Brazil’s steel industry,” possibly reflecting reduced domestic sales and increased competition from imports.

The news article “Brazil steel output, imports fall in August” reports that Brazil’s crude steel production has declined 4.6%, partially caused by the US doubling import tariffs. This has caused Brazilian steelmakers to redirect steel slab exports to other Latin American markets, resulting in only a slight increase in overall slab exports. Given this shift, steel buyers should consider diversifying their slab supply sources beyond the US, focusing on securing contracts with Brazilian steelmakers targeting Latin American markets and securing supply with longer-term contracts.

The warning in “Gerdau warns of crisis risks for Brazil’s steel industry” about rising imports and underutilized capacity suggests a potential for further production cuts, particularly at plants like CSN Volta Redonda that are experiencing declining activity. Steel buyers reliant on CSN Volta Redonda for products like rebar and wire rod should proactively engage with CSN to confirm supply commitments and explore alternative suppliers to mitigate potential disruptions. Additionally, analysts should closely monitor import data and capacity utilization rates to anticipate further market volatility.