From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustrian Steel Market Signals Strong Performance Amidst Rising Global Iron Ore Output

Austria’s steel sector exhibits robust activity, particularly within Voestalpine’s facilities, despite fluctuations in individual plant performance. The market’s positive sentiment coincides with significant increases in Australian iron ore production, as highlighted in “Australia’s Mineral Resources posts higher iron ore output for FY 2024-25” and “Australia’s Fenix Resources posts sharp rise in output and sales for FY 2024-25“. While these articles point to increased global supply of raw materials, no immediate causal link can be established between this increased ore supply and the activity levels at Austrian plants.

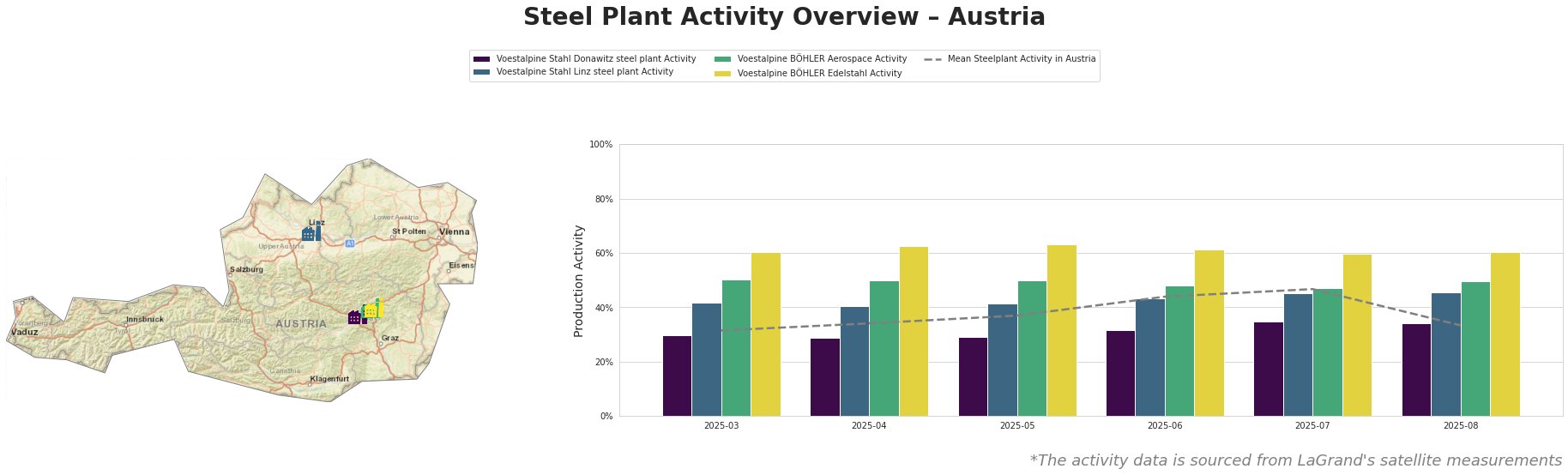

The mean steel plant activity in Austria peaked in July at 47.0% before dropping significantly to 33.0% in August. Notably, Voestalpine BÖHLER Edelstahl consistently operated above the Austrian mean, while Voestalpine Stahl Donawitz operated below the mean in each month except for August.

Voestalpine Stahl Donawitz, an integrated steel plant in Styria with a BOF capacity of 1,570,000 tonnes per year, experienced a fluctuating activity level. Starting at 30.0% in March, activity dipped to 29.0% in April and May before rising steadily, peaking at 35.0% in July, then showing a small drop to 34.0% in August. Given the plant’s reliance on BF/BOF processes, the increase in iron ore shipments from Australia, as reported in “Australia’s Fenix Resources posts sharp rise in output and sales for FY 2024-25“, could potentially support continued production at Donawitz, although a direct relationship is not evident in the data.

Voestalpine Stahl Linz, a major integrated steel plant in Upper Austria, boasting a BOF capacity of 6,000,000 tonnes annually, demonstrated a gradual increase in activity from 42.0% in March to 46.0% in August. Like Donawitz, it relies on BF/BOF, and hence, the increase in iron ore supply outlined in “Australia’s Mineral Resources posts higher iron ore output for FY 2024-25“, may contribute positively to its operations. However, direct linkage remains unsubstantiated.

Voestalpine BÖHLER Aerospace in Kapfenberg, while showing stable activity around 50%, has limited available detail, and there is no indication of its crude steel capacity. It is equipped with an EAF, and increased ore output doesn’t directly affect its activity. Voestalpine BÖHLER Edelstahl in Kapfenberg, also equipped with an EAF, maintained high activity levels exceeding the Austrian mean. The “Manganese ore shipments via Port Hedland up 16.2 percent in July 2025 from June” may indicate better availability of this specific alloy component, given that special steel grades are produced.

The increases in iron ore supply discussed in “Australia’s Mineral Resources posts higher iron ore output for FY 2024-25” and “Australia’s Fenix Resources posts sharp rise in output and sales for FY 2024-25” may positively influence costs for Voestalpine Stahl Donawitz and Voestalpine Stahl Linz, reducing the risk of immediate disruptions. Steel buyers should closely monitor monthly activity reports from plants as indicators of supply chain reliability and potential cost fluctuations. Given the increase in ore supply, buyers should look for opportunities to negotiate prices, particularly for products derived from BF/BOF processes. Conversely, buyers should closely monitor manganese prices as it will be difficult to evaluate the link mentioned in the report “Manganese ore shipments via Port Hedland up 16.2 percent in July 2025 from June“.