From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Faces Turbulence Amid Trump’s Tariff Turmoil

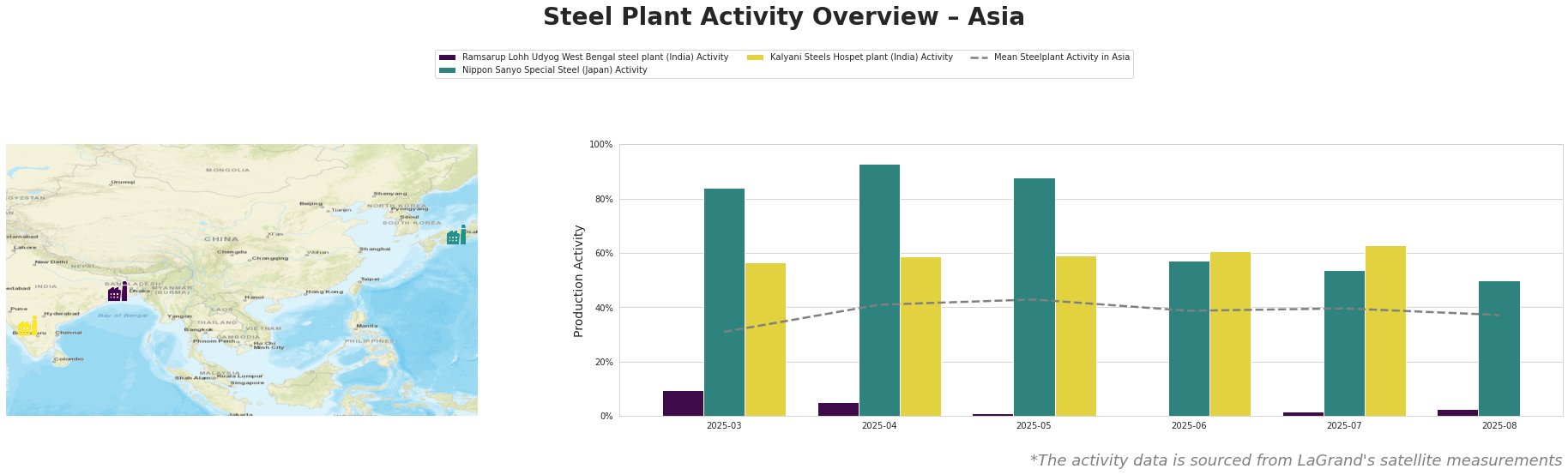

Steel activity levels in Asia are under pressure, reflecting a negative market sentiment driven by geopolitical developments linked to U.S. tariff policies. Recent rulings, such as “US-Gericht erklärt Donald Trumps Strafzölle für illegal”, highlight heightened uncertainty surrounding steel imports and tariffs. These decisions directly correlate with satellite-observed declines in activity across major steel plants.

The Ramsarup Lohh Udyog plant in West Bengal has seen a drastic decline in activity, plummeting from 10% in March to a mere 3% by August 2025. This downward trend appears disconnected from recent tariff developments but indicates potential operational difficulties, possibly exacerbated by broader market conditions.

In contrast, Nippon Sanyo Special Steel in Japan displayed relatively high activity, though it too dipped from 93% in April to 50% in August. Such fluctuations may signal supply chain constraints and shifting market dynamics in response to U.S. tariffs highlighted in articles like “Trump’s tariff push overstepped presidential powers, appeals court says”.

Finally, Kalyani Steels Hospet plant’s activity fluctuated slightly, maintaining levels around 63% in July before ceasing to report in August, showing it might have been affected by the regional uncertainty created by the tariffs.

These changes indicate potential supply disruptions across the region as companies reassess import dependencies and operational viability amid tariff scrutiny.

For steel buyers and market analysts, it is recommended to secure contracts with suppliers who display stable production capabilities, such as Nippon Sanyo, while also preparing for disruptions in sourcing from less active plants such as Ramsarup Lohh Udyog. Further, remain vigilant of developments surrounding U.S. tariffs, especially in light of the ongoing judicial review and its potential impacts on import costs and availability.