From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Shows Resilience Despite Global Headwinds: Japanese Production Surges

Asia’s steel market demonstrates underlying strength amidst concerns regarding global economic growth and trade uncertainties. Recent satellite observations indicate increased activity at specific steel plants, even as economic forecasts are being downgraded. While some global factors may negatively impact overall demand in Asia, specific plants exhibit trends suggesting the market is not uniformly bearish.

The recent increase in observed activity at the Nippon Sanyo Special Steel plant can not directly linked to any of the provided news articles. However, the provided articles cite a general economic downturn.

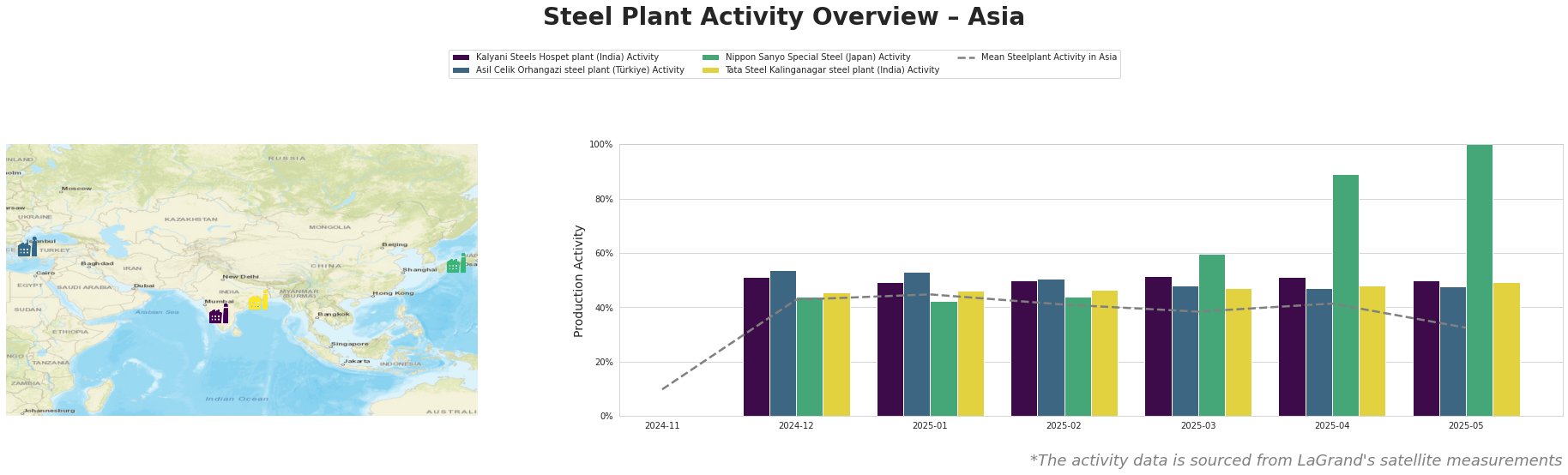

Here’s a summary of monthly aggregated plant activities in % (0% = lowest ever measured, 100% = all-time high):

Overall, average steel plant activity in Asia has shown a fluctuating trend, peaking at 45% in January 2025, and then declined to 32% in May 2025.

Kalyani Steels Hospet plant, an integrated BF and DRI based steel plant in India, maintained a relatively stable activity level between 49% and 52% from December 2024 to March 2025, decreasing to 50% in May 2025. This indicates consistent production for its rolled bars and rounds used in the automotive and building sectors. No direct connection to the provided news articles could be established.

Asil Celik Orhangazi steel plant, an EAF-based plant in Turkey, producing crude, semi-finished, and finished rolled steel, demonstrated similar stability, fluctuating between 54% in December 2024 and 47% in April 2025, before going to 48% in May 2025. This suggests steady demand for its products in the energy, transport, and automotive sectors. No direct connection to the provided news articles could be established.

Nippon Sanyo Special Steel in Japan, an EAF-based special steel producer, showed a significant surge in activity, reaching 100% in May 2025, after sitting at 44% in February 2025. This could indicate a surge in demand for its specialized billet, rolled products, and bars, possibly driven by specific sector growth. No direct link to the provided news articles could be established.

Tata Steel Kalinganagar steel plant, an integrated BF-based plant in India producing finished rolled steel, also maintained relatively stable activity, fluctuating between 46% and 49%. This suggests consistent demand from the automotive sector. No direct connection to the provided news articles could be established.

Given the overall decline in average activity levels across Asia in May 2025, the surge in activity at the Nippon Sanyo Special Steel plant to 100% warrants particular attention. This suggests either a targeted demand increase for their specific products or potentially localized supply chain dynamics. Steel buyers should investigate the specific drivers behind Nippon Sanyo’s increased output. Diversifying procurement sources should be evaluated to mitigate any potential supply chain risks associated with broader economic headwinds. Given the lack of explicit connections between plant activities and specific news items, procurement decisions should prioritize up-to-date market-specific data and direct supplier communication.