From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Optimistic Despite CBAM Uncertainty; Indian Coil Prices Dip, HRC Rises Globally

Asia’s steel market demonstrates overall positive sentiment, despite challenges posed by the EU’s Carbon Border Adjustment Mechanism (CBAM). The Middle East Iron & Steel Conference (MEIS) noted that “MEIS: Asian steel exports to be impacted more by safeguard measures than CBAM“, suggesting that EU safeguard measures will curtail Asian exports more than CBAM itself. This aligns with general HRC upward price trends in all regions other than China, as noted in “The global market for hot-rolled coil has been growing steadily since early November“.

However, “India-EU coil prices drop amid CBAM benchmark leaks” and “India and EU roll Prices fall due to CBAM Benchmark leaks” highlight immediate price adjustments due to CBAM uncertainty, demonstrating a complex market landscape. No direct connection between these articles and observed plant activity levels could be immediately established.

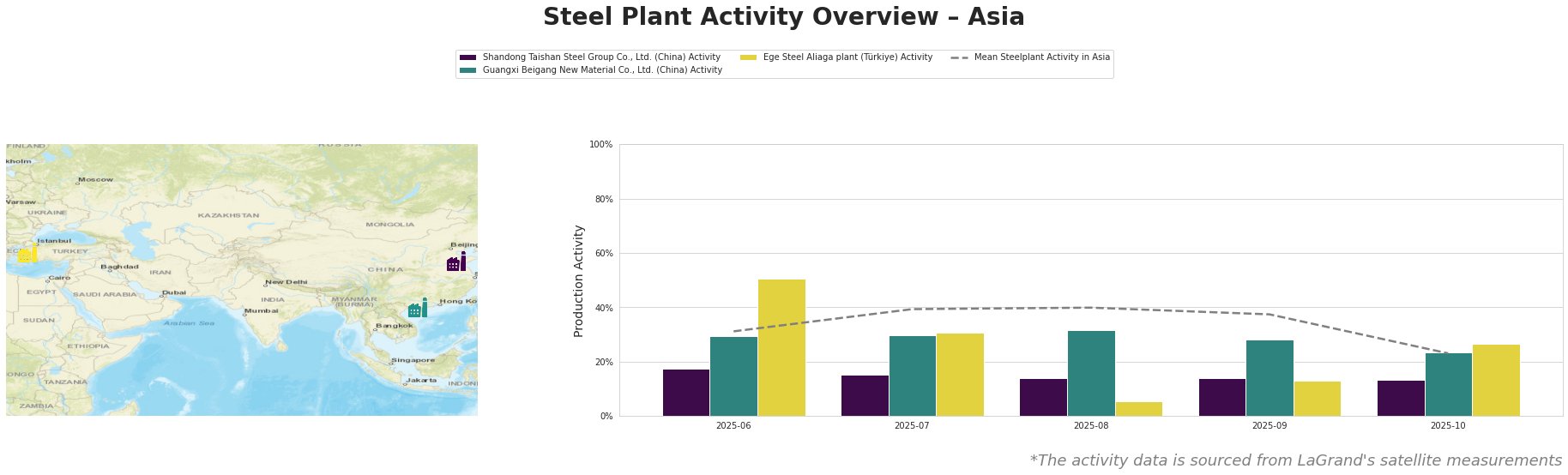

The mean steel plant activity in Asia saw a sharp decrease in October (23.0) compared to previous months.

Shandong Taishan Steel Group Co., Ltd.

Shandong Taishan Steel Group, an integrated BF producer with a 5 million tonne crude steel capacity, has consistently operated well below the Asian average. Activity remained nearly flat, declining from 17% in June to 13% in October. This low and stable activity level could not be directly related to any of the news articles. The company produces hot-rolled coil, cold-rolled coil, and stainless steel, indicating a focus on flat products.

Guangxi Beigang New Material Co., Ltd.

Guangxi Beigang New Material, another integrated BF producer with 3.4 million tonnes EAF-based crude steel production, shows a similar trend to Shandong Taishan. Activity decreased from 30% in June to 23% in October, mirroring the overall Asian average decline, but without any direct news linkage. The company manufactures hot and cold-rolled coil, alongside nickel-chromium alloy slabs and tubes.

Ege Steel Aliaga plant

Ege Steel’s Aliaga plant in Türkiye, an EAF-based producer with a 2 million tonne capacity focused on rebar and wire rod, shows high initial activity (50% in June) but experiences a sharp decline to only 5% in August. There are no articles in the list which directly address the cause of this decline. A recovery to 27% by October suggests some stabilization, but significant volatility remains. The “Chinese steel will lose its price advantage in Europe with the introduction of CBAM – forecast” article may explain some of the volatility as CBAM impacts Turkish producers less severely than Chinese and Indian producers.

Evaluated Market Implications

The observed decline in Indian coil prices due to CBAM benchmark leaks, as reported in “India-EU coil prices drop amid CBAM benchmark leaks” and “India and EU roll Prices fall due to CBAM Benchmark leaks,” presents a short-term opportunity for European buyers to secure more favorable deals on Indian HRC and CRC. However, the MEIS conference highlights the EU’s safeguard measures as a more significant long-term risk to Asian exports than CBAM, suggesting potential future supply constraints from Asia. Buyers should proactively diversify their supply base, considering producers in regions less affected by EU safeguard measures. The low activity observed at Shandong Taishan and Guangxi Beigang, combined with general price decreases driven by CBAM-related uncertainty, suggests oversupply of coil in Asia. In contrast, the volatility in Turkey´s Ege Steel Aliaga Plant warrants caution when sourcing long steel products from there.