From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Mixed: China Production Cuts Offset by Stable Plant Activity in India and Japan

In Asia, steel production trends are diverging. While “China cut steel production to a 9-month low in August,” plant activity outside of China shows resilience. Observed activity at Baosteel Zhanjiang Iron & Steel Co., Ltd. in China remained stable, suggesting localized impacts. No direct relationship between the Chinese production cuts and the stability of Baosteel Zhanjiang’s activity levels could be established.

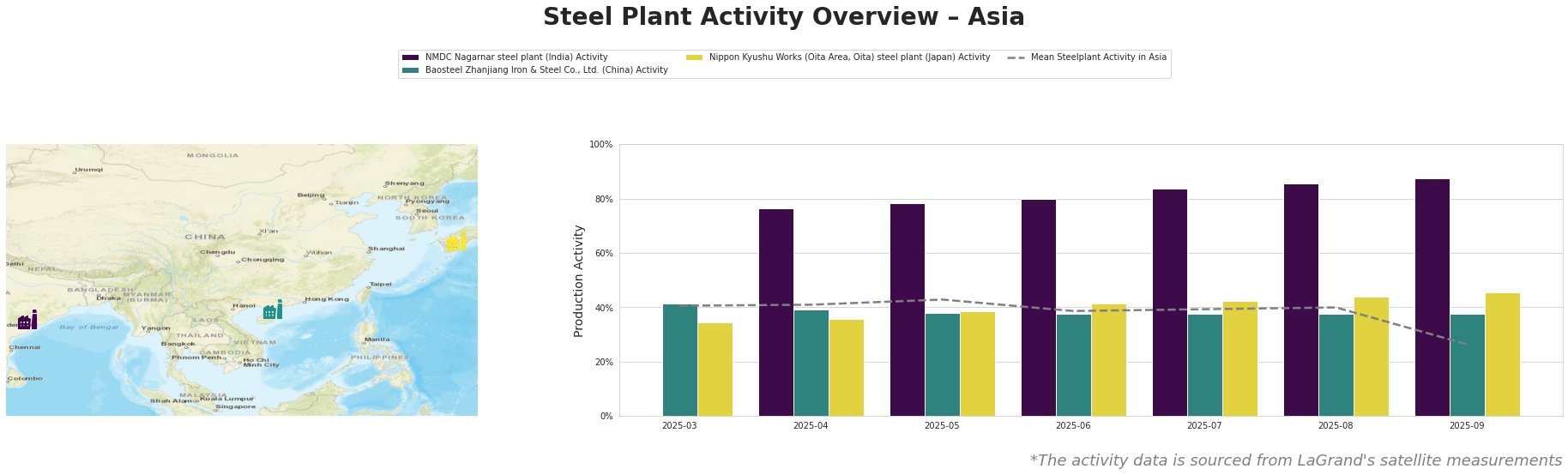

The mean steel plant activity in Asia initially fluctuated between 39% and 43% from May to July, then slightly decreased to 40% in August, ending with a significant drop to 26% in September. In contrast, the NMDC Nagarnar steel plant in India demonstrated a strong upward trend, increasing from 76% in April to 88% in September, consistently outperforming the Asian average. Baosteel Zhanjiang Iron & Steel Co., Ltd. in China showed relatively stable activity at approximately 38-42% throughout the observation period. The Nippon Kyushu Works (Oita Area, Oita) steel plant in Japan steadily increased its activity from 35% in March to 45% in September, also remaining above the overall Asian mean for most of the period.

NMDC Nagarnar steel plant, an integrated BF-BOF plant in Chhattisgarh, India, producing 3 million tonnes per annum (ttpa) of crude steel and specializing in hot rolled coils, sheets, and plates, has seen a consistent increase in activity. Plant activity rose steadily from 76% in April 2025 to 88% by September 2025. This increase occurred during a period when “China cut steel production to a 9-month low in August,” suggesting a possible shift in regional supply dynamics, but no direct impact is discernable.

Baosteel Zhanjiang Iron & Steel Co., Ltd., located in Guangdong, China, is an integrated BF-BOF steel plant with a capacity of 12.528 million ttpa of crude steel and known for producing hot rolled plates, cold rolled sheets, and hot-dip galvanized plates. Satellite observations indicate consistent plant activity around 38-42% between March and September 2025. While “China cut steel production to a 9-month low in August,” the Baosteel Zhanjiang plant’s activity remained stable. No direct relationship between the Chinese production cuts and the stability of Baosteel Zhanjiang’s activity levels could be established. Furthermore, China’s steel sheet/plate exports decreased significantly in August, according to the article “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025“, however, the production volumes and activities of the plant remained constant, which implies that this plant likely focused on the domestic market.

Nippon Kyushu Works (Oita Area, Oita) steel plant in Kyūshū, Japan, is an integrated BF-BOF steel plant with a crude steel capacity of 10 million ttpa, producing hot rolled steel sheets and steel plates. Satellite data shows a gradual increase in plant activity from 35% in March 2025 to 45% in September 2025, outpacing the mean Asian activity during that time. No direct relationship between this increasing activity and the provided news articles can be established.

The decrease in Chinese production, as reported in “China cut steel production to a 9-month low in August,” could create supply vulnerabilities, particularly for steel sheet and plate, given the concurrent report, “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025.” However, stable activity at Baosteel Zhanjiang suggests localized impacts within China. For steel buyers: Diversify procurement sources to mitigate risks associated with potential Chinese supply disruptions. Given the increasing activity at NMDC Nagarnar in India, consider exploring opportunities with Indian suppliers for hot rolled products. Closely monitor Japanese export data, considering the steady activity increase in Nippon Kyushu Works.