From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Faces Downturn: Production Cuts Loom Amidst Weak Demand

The Asian steel market faces increasing headwinds, primarily driven by weak demand and import pressures, especially in Europe, impacting global steel dynamics. While “Baosteel raises hot-rolled coil prices by $14/t for August sales” indicates a price increase in China, this is primarily due to cost pressures rather than robust demand. Observed declines in Asian steel plant activity, detailed below, do not directly correlate with this Baosteel announcement, suggesting localized factors are at play.

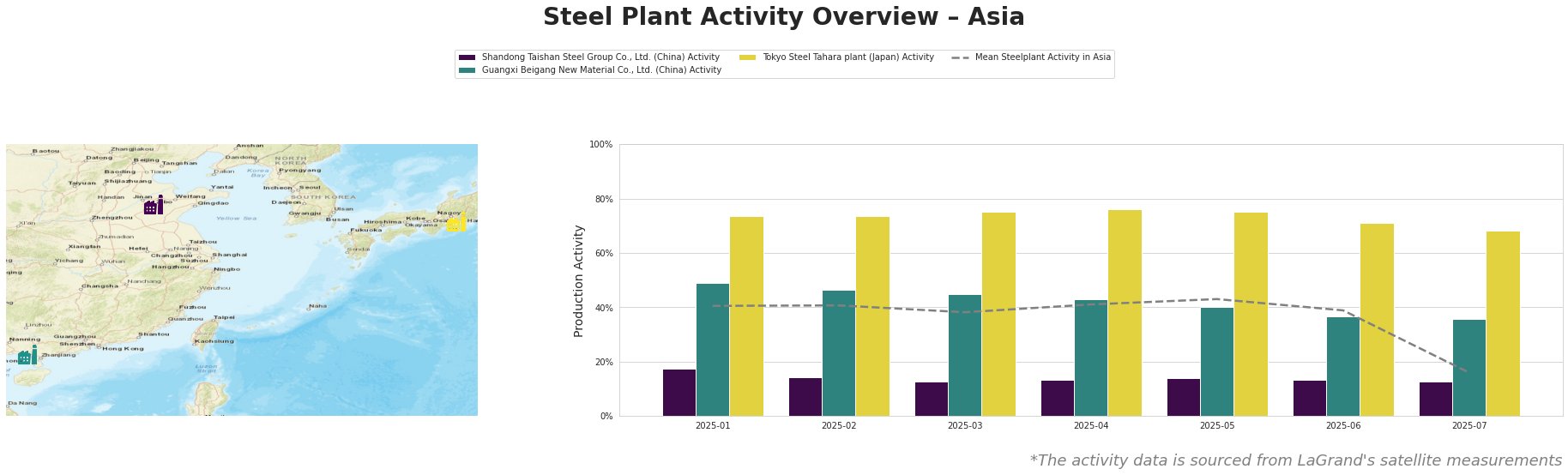

The mean steel plant activity in Asia shows a significant drop to 16.0% in July, a stark contrast to the previous months. Shandong Taishan Steel Group Co., Ltd. consistently operated at very low levels, around 13-18% throughout the observed period, with no significant change in activity. Guangxi Beigang New Material Co., Ltd. saw a gradual decrease from 49% in January to 36% in July. Tokyo Steel Tahara plant experienced a decline from 74% in January-April to 68% in July. These declines in plant activity do not appear to have a direct relationship with the “Baosteel raises hot-rolled coil prices by $14/t for August sales” article, suggesting that factors beyond domestic Chinese pricing influence these plants.

Shandong Taishan Steel Group Co., Ltd., an integrated BF steel plant with a crude steel capacity of 5000 ttpa, has maintained extremely low activity levels (around 13%) since March. Specializing in hot-rolled coil, cold-rolled coil, and stainless steel, its consistently low activity suggests potential operational challenges or strategic production cuts. No direct connection can be established between Shandong Taishan Steel’s performance and the news article “Baosteel raises hot-rolled coil prices by $14/t for August sales”.

Guangxi Beigang New Material Co., Ltd., an integrated BF/EAF steel plant producing 3400 ttpa of crude steel, has shown a steady decline in activity from 49% in January to 36% in July. This integrated plant, which produces both hot-rolled and cold-rolled coil, alongside specialized products like nickel-chromium alloy slabs, square tubes, and round tubes, indicates a possible production slowdown. The decline does not seem to be related to “Baosteel raises hot-rolled coil prices by $14/t for August sales”.

Tokyo Steel Tahara plant, an EAF-based plant with a 2500 ttpa crude steel capacity, experienced a decline in activity from approximately 75% in April to 68% in July. As a major producer of hot-rolled coils and steel sheets, the observed production slowdown does not align with “Baosteel raises hot-rolled coil prices by $14/t for August sales”, suggesting localized factors are responsible for the decrease in the activity of Tokyo Steel Tahara Plant.

Given the significant drop in overall Asian steel plant activity and considering that “European HRC market slow; mills offer discounts to battle imports” and “European HRC market slows down; factories offer discounts to fight imports” indicate that European mills are struggling with imports, especially from Indonesia and Turkey, the implication is that steel, potentially from the Asian market, is being redirected due to weak domestic demand. Therefore:

- Supply Disruption Risk: Expect potential supply disruptions from the mentioned Asian plants due to production cuts, particularly impacting hot-rolled and cold-rolled coil availability.

- Procurement Action: Steel buyers should closely monitor inventory levels and consider diversifying their supply base to mitigate risks associated with potential production slowdowns in Asia. Prioritize building relationships with suppliers outside of the directly impacted regions, and assess the feasibility of forward purchasing to secure supply amidst potential disruptions.