From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Downturn: Weak Demand Signals Procurement Caution Despite Plant Activity Shifts

Asia’s steel market is facing headwinds due to weak demand and oversupply. The IREPAS Short Range Outlook: September 2025 highlights challenges including production cuts and low profits for mills, though no explicit link to recent satellite data can be established. Simultaneously, The global hot-rolled coil market showed mixed trends in August reveals that Chinese prices remained stable despite high inventories and sluggish exports, while European prices rose in anticipation of trade restrictions.

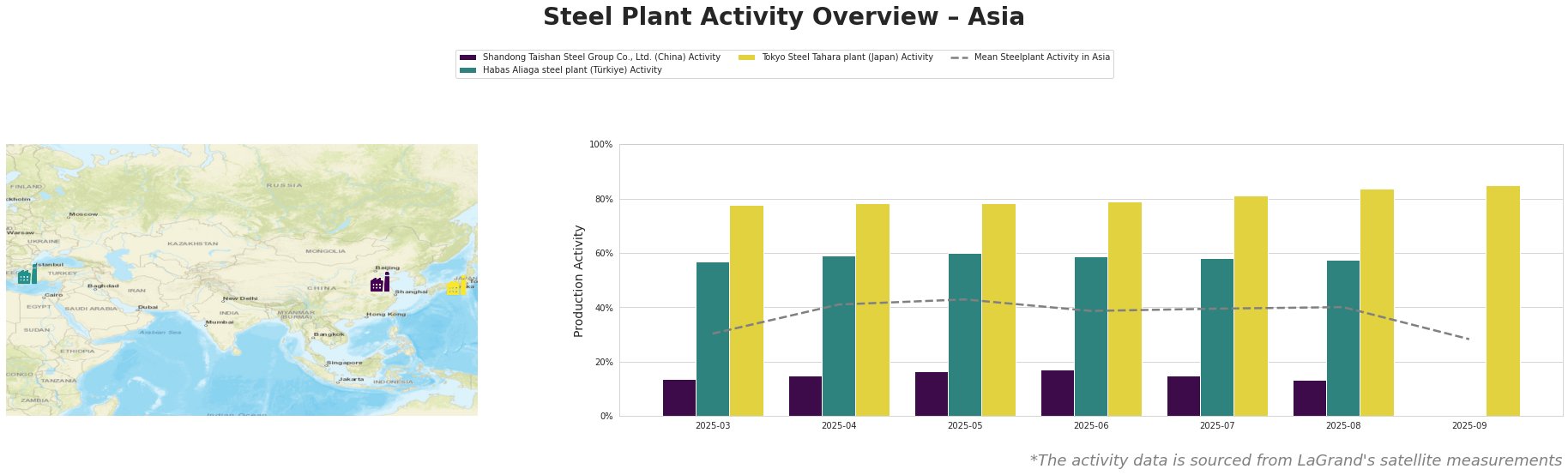

Here’s an overview of recent steel plant activity:

The mean steel plant activity in Asia saw an overall decline in September, hitting 28%, down from an average of 40% the previous months.

Shandong Taishan Steel Group Co., Ltd., a major integrated steel producer in China with a crude steel capacity of 5000 ttpa using BF and BOF technologies and producing hot and cold rolled coil, shows a fluctuating activity level. Activity steadily increased from 14% in March to 17% in May and June. The activity has since decreased, hitting a recent low of 13% in August, which is significantly below the Asian average. The global hot-rolled coil market showed mixed trends in August indicates stable prices in China despite high inventories, but a direct link to Shandong Taishan’s activity cannot be established.

Habas Aliaga steel plant, a Turkish EAF-based producer with a capacity of 4500 ttpa, mainly focused on semi-finished and finished rolled products, including hot rolled coil, experienced a slight increase in activity from 57% in March to 60% in May, followed by a consistent decrease to 57% in August, which remains significantly above the Asian average. Italian coil market starts slow after August break notes that Turkish mills had filled order books before the holiday. However, with quotas now exhausted, there is potential for a future decrease in Habas Aliaga’s activity.

Tokyo Steel Tahara plant, an EAF-based producer in Japan with a capacity of 2500 ttpa specializing in hot rolled coils and steel sheets, demonstrates a consistent upward trend in activity, rising from 78% in March to 85% in September, significantly exceeding the Asian average. No direct link to the provided news articles can be established.

Given the weak demand indicated by the IREPAS Short Range Outlook: September 2025 and the Italian coil market starts slow after August break, coupled with declining average plant activity in Asia, steel buyers should:

- Exercise caution in near-term procurement: The combination of high inventories (mentioned in The global hot-rolled coil market showed mixed trends in August) and weak demand suggests potential for further price softening. Delay large-volume purchases where possible.

- Monitor Turkish quota developments: As indicated by the Italian coil market starts slow after August break, exhausted Turkish quotas may lead to price increases in Europe but could simultaneously lead to production cuts at plants like Habas Aliaga. Closely track any changes to quota policies.

- Focus on supply chain diversification: Given the unstable market outlook presented in the IREPAS Short Range Outlook: September 2025, reliance on single suppliers or regions is risky. Explore alternative sourcing options to mitigate potential disruptions.