From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Downturn: Activity Declines Signal Weakening Demand Amidst Global Trade Pressures

Asia’s steel market faces increasing headwinds, mirroring global trends observed in Europe. While activity data reveals recent dips in Asian steel plant operations, direct connections to the European market situation outlined in “Real steel consumption in the EU fell by 5.5% y/y in Q1 – EUROFER“, “Steel imports to the EU fell by 3% y/y in Q2 – EUROFER“, and “Steel exports from the EU fell by 12% y/y in Q2 – EUROFER” cannot be conclusively established. However, the downward trend indicates a similar weakening of demand.

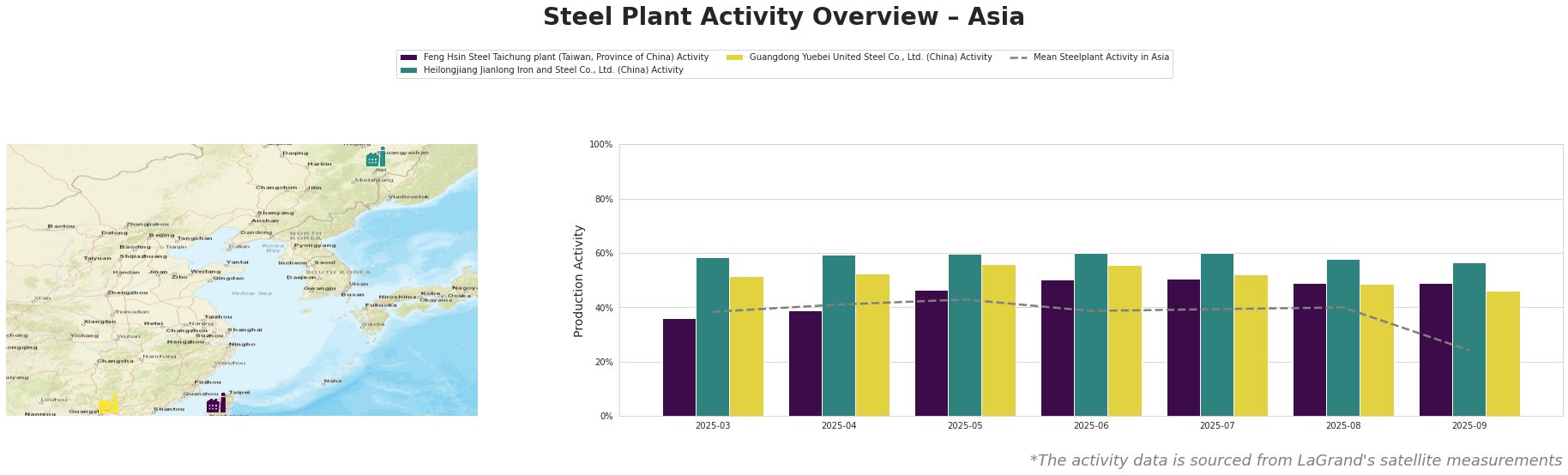

The mean steel plant activity in Asia shows a significant drop to 24.0% in September, down from 40.0% in August, indicating a broad slowdown.

Feng Hsin Steel’s Taichung plant, a Taiwanese EAF steelmaker with a 1.2 million tonne crude steel capacity focused on producing rebars and long products, has seen its activity remain relatively stable between March and September, fluctuating between 36% and 50%. While the overall average activity in Asia has decreased in September, the Feng Hsin Steel Taichung plant has remained stable at 49% activity, which means it is significantly above the Asian average. The activity shifts at Feng Hsin Steel Taichung plant does not appear to have a clear or direct relationship with the recent news about the EU steel market.

Heilongjiang Jianlong Iron and Steel Co., Ltd., a major Chinese integrated steel producer with a 2 million tonne capacity, predominantly producing rebar and seamless steel tubes, has demonstrated a consistent activity level between March and August, ranging from 58% to 60%. However, September shows a slight dip to 56%, which follows the downward trend of the Asian average. The observed fluctuations at Heilongjiang Jianlong Iron and Steel Co., Ltd. do not appear to be directly related to the challenges faced by the EU steel market.

Guangdong Yuebei United Steel Co., Ltd., a Chinese steel plant with a 2 million tonne crude steel capacity, including both BF and EAF processes, focuses on rebar production for the construction sector. Activity at Guangdong Yuebei United Steel began at 51% in March and increased to 56% until June. From July until September activity levels have been decreasing to 46%. The decline observed in Guangdong Yuebei United Steel’s activity does not have a direct link to the specific news events in the EU steel market.

The sharp decrease in average steel plant activity across Asia in September may foreshadow potential supply disruptions, though pinpointing precise causes is challenging.

Procurement Recommendations:

Given the marked drop in average Asian steel plant activity in September, steel buyers should:

- Prioritize securing existing contracts: Reach out to suppliers, especially those sourcing from plants exhibiting declining activity like Guangdong Yuebei United Steel, to confirm order fulfillment and delivery timelines.

- Increase inventory monitoring: Closely track inventory levels and consumption rates to proactively address potential shortfalls resulting from possible production cuts.