From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market: Activity Surges Amid US-EU Trade Tensions

The Asian steel market shows increased activity, particularly in Japan and the UAE, while the EU and US navigate escalating trade disputes. Recent developments in US-EU trade relations, as highlighted in articles such as “EU presents new trade proposal to the US – Bloomberg” and “Trumps US-Zölle im FAZ-Liveticker: Trump zu Zöllen auf EU-Waren: Nicht auf Suche nach Deal | FAZ,” do not have a directly observable impact on current Asian plant activity levels based on the current data.

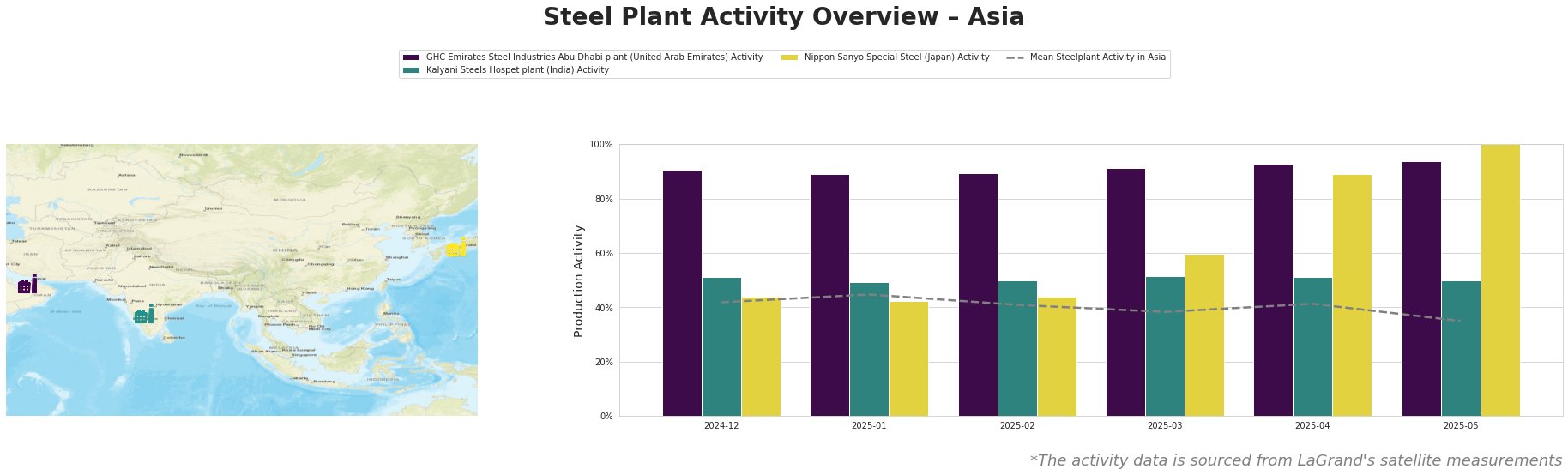

The mean steel plant activity in Asia has fluctuated, reaching a high of 45% in January 2025 and dipping to a low of 35% in May 2025. GHC Emirates Steel Industries Abu Dhabi plant consistently operates at a high level, ranging from 89% to 94%. Kalyani Steels Hospet plant activity is relatively stable, fluctuating between 49% and 52%. Nippon Sanyo Special Steel has shown a marked increase in activity, jumping from 44% in February 2025 to 100% in May 2025.

GHC Emirates Steel Industries Abu Dhabi plant

GHC Emirates Steel Industries Abu Dhabi plant, a DRI-based EAF steelmaker with a crude steel capacity of 3.5 million tons per annum, has shown consistently high activity, peaking at 94% in May 2025. This stable high-level operation suggests a robust demand for its products, including rebar, wire rod, and heavy sections. No direct link can be established between this activity and the news articles provided.

Kalyani Steels Hospet plant

Kalyani Steels Hospet plant, an integrated BF and DRI-based steel plant with a crude steel capacity of 860,000 tons per annum, has maintained a relatively stable activity level around 50%. Their product range includes rolled bars and rounds, serving the automotive and infrastructure sectors. No direct link can be established between this activity and the news articles provided.

Nippon Sanyo Special Steel

Nippon Sanyo Special Steel, an EAF-based steel plant with a crude steel capacity of 1.596 million tons per annum, has experienced a significant surge in activity, reaching 100% in May 2025. This plant produces billets, rolled products, tubes, and bars for various sectors. No direct link can be established between this activity and the news articles provided.

Evaluated Market Implications

The increased activity at Nippon Sanyo Special Steel in Japan, reaching its all-time high, indicates strong regional demand and potential supply pressure in the long products segment. While the European and US trade dynamic detailed in “US-Strafzölle: Hummer-Deal soll Trump Lust auf mehr machen” and “Studie: Was ein “Zollkrieg” mit den USA bedeuten würde” doesn’t explicitly relate to this specific plant’s operation, broader trade tensions may indirectly influence global steel demand and pricing.

Recommended Procurement Actions: Steel buyers focused on sourcing long products, especially in Asia, should closely monitor lead times and pricing from Nippon Sanyo Special Steel and alternative suppliers. Given the high activity level, potential for delays exists. Buyers should secure supply agreements well in advance to mitigate risks. The stability of GHC Emirates Steel Industries Abu Dhabi plant suggests this could be a reliable source for certain products, but buyers should continue to monitor developments related to global trade tensions.