From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Under Pressure: Production Cuts and Weak Demand Signal Procurement Challenges

The Asian steel market faces ongoing pressure due to weak demand and production adjustments, particularly in China. According to “Asian steel market to remain under pressure in Q4 – S&P Global“, Q4 is expected to bring continued challenges. This aligns with the observed activity, as supported by “China cut steel production to a four-year low in October” and “China reduced steel production by 12.1%“, although a direct link between these articles and individual plant activity as observed via satellite cannot be explicitly established.

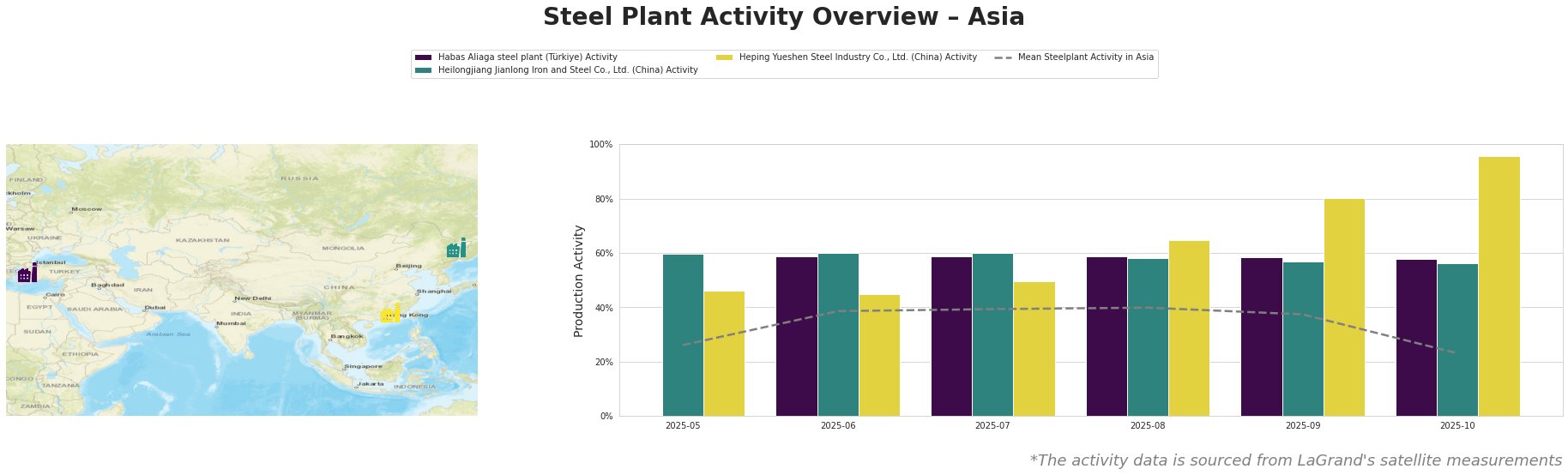

The mean steel plant activity in Asia shows a significant drop in October to 23%, after hovering around 37-40% in the preceding months.

Habas Aliaga steel plant, located in İzmir, Türkiye, maintains a relatively stable activity level around 58-59% throughout the observed period. This EAF-based plant, with a crude steel capacity of 4.5 million tonnes per annum and production focus on semi-finished and finished rolled products like billets, slabs, rebar, wire rod, and hot rolled coil, shows no immediate impact from the Chinese production cuts detailed in “China cut steel production to a four-year low in October“. While the news article “Asian steel market to remain under pressure in Q4 – S&P Global” discusses pressure in the Asian steel market and protectionist measures, specifically India’s import duties affecting the market, a direct connection to Habas Aliaga’s activity cannot be explicitly established based on the provided information.

Heilongjiang Jianlong Iron and Steel Co., Ltd. in China, shows a gradual decline in activity, from 60% in May-July to 56% in October. The integrated BF/BOF plant with a 2 million tonnes crude steel capacity primarily produces finished rolled products like hot rolled ribbed steel bars and rebar. This decline could be linked to the reported production cuts mentioned in “China cut steel production to a four-year low in October” and “China reduced steel production by 12.1%” driven by weakening consumption, particularly in the real estate sector.

Heping Yueshen Steel Industry Co., Ltd., also located in China, shows a consistent increase in activity over the months, reaching 96% in October, significantly above the Asian mean. This EAF-based plant produces finished rolled products like hot rolled rebar. This rise is contrary to the overall trend of production cuts described in “China cut steel production to a four-year low in October” and “China reduced steel production by 12.1%” therefore no explicit connection can be established.

The reported production cuts in China, coupled with the S&P Global assessment in “Asian steel market to remain under pressure in Q4 – S&P Global“, suggest potential supply disruptions, particularly for steel products originating from integrated Chinese mills, for example products from Heilongjiang Jianlong Iron and Steel Co., Ltd.

Steel buyers should:

- Prioritize securing supply of rebar and related products, given production cuts in China and ensure a reliable secondary supplier is in place.

- Closely monitor price developments in the hot-rolled coil market considering potential negative effects driven by protectionist measures in Southeast Asia.

- Consider Turkish suppliers like Habas Aliaga where available production capacity remains high.