From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel: Trump’s Tariffs Loom as Plant Activity Diverges; Monitor Indian Supply

In Asia, steel markets face uncertainty due to potential US tariff implementations. Recent activity trends show a sharp drop in the mean steel plant activity levels across Asia, coinciding with escalating trade tensions detailed in news articles like “US to lay out tariff demands in coming days: Trump” and “Briefe an Handelspartner: Höhere US-Zölle drohen ab August“. While the overall activity has dropped significantly, individual plants show varying responses, suggesting localized factors are also at play.

The threat of US tariffs, as reported in “Trump verlängert Zoll-Frist – und droht erneut“, casts a shadow over Asian steel exports, even as “Marktbericht: Rückschlag nach starkem Wochenstart” notes that uncertainty itself is impacting markets. This overall sentiment is further fueled by “Warum die Zölle ein Problem für US-Firmen sind“, with US Businesses struggling with increased cost due to the tariffs imposed. However, no direct correlations can be established between these news items and activities for the GHC Emirates Steel Industries Abu Dhabi plant and the Nippon Sanyo Special Steel plant, implying other market forces are at play for these facilities.

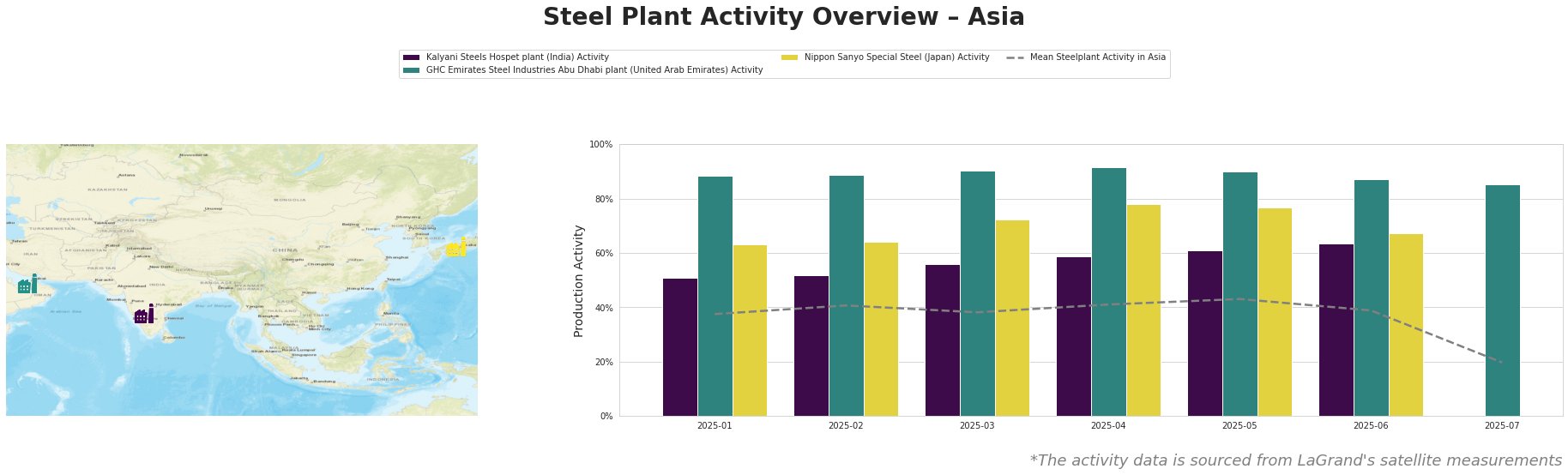

The mean steel plant activity in Asia exhibited a generally stable trend from January to June 2025, fluctuating between 38% and 43%. However, July saw a sharp decline to 20%. Kalyani Steels Hospet plant showed a consistent increase in activity from 51% in January to 64% in June. GHC Emirates Steel Industries in Abu Dhabi maintained high activity levels, ranging from 85% to 91% throughout the period. Nippon Sanyo Special Steel’s activity varied, peaking at 78% in April before dropping to 67% in June.

Kalyani Steels Hospet plant: This integrated steel plant in Karnataka, India, with a crude steel capacity of 860 ttpa, utilizes both BF and DRI production routes. Notably, while the mean activity across Asian steel plants dropped sharply in July, the Kalyani Steels Hospet plant has consistently increased production levels until June, reaching 64% in June. If this trend has continued through July, against the overall trend, this may present a stable supply for the Indian market, particularly for its rolled bars and rounds, catering to automotive and construction sectors. There is no direct connection can be established between this production increase and the mentioned news articles.

GHC Emirates Steel Industries Abu Dhabi plant: This plant in Abu Dhabi, relying on DRI and EAF technologies to produce 3500 ttpa of crude steel, has maintained high activity, hovering near 90% throughout the observed period, before dropping slightly to 85% in July. This suggests stable production of rebar, wire rod and sections and resilience to the immediate tariff threats. No direct link can be established between activity levels at the GHC Emirates Steel Industries Abu Dhabi plant and the cited news articles.

Nippon Sanyo Special Steel: This Japanese plant, focused on special steel production via EAF with a capacity of 1596 ttpa, experienced fluctuating activity. From January to April, the production ramped up from 63% to 78% and then gradually declined to 67% in June. The plant mainly produces billets, rolled products, tubes and bars for the automotive, and engineering sectors. No direct link can be established between activity levels at the Nippon Sanyo Special Steel plant and the cited news articles.

Evaluated Market Implications:

Given the potential for US tariffs on steel imports, particularly as the US Administration begins sending out tariff letters (“US to lay out tariff demands in coming days: Trump” and “Briefe an Handelspartner: Höhere US-Zölle drohen ab August”), the following actions are recommended:

- Potential Supply Disruption: The overall drop in mean steel plant activity in Asia, coupled with the looming tariff threats, suggests potential supply disruptions.

- Procurement Actions:

- Indian Market Focus: Steel buyers should investigate and potentially strengthen relationships with Indian steel producers such as Kalyani Steels Hospet, given its increased production trend, as a mitigating strategy against tariff-related supply chain disruptions.

- Monitor Emirates Steel: Closely monitor the GHC Emirates Steel Industries Abu Dhabi plant’s production and export strategies to gauge its response to the evolving trade landscape.

- Assess Japanese Special Steel Supply: Analyze whether there is an impact on the supply chain on Automotive and engineering sectors due to the decline in activity at Nippon Sanyo Special Steel.

This analysis is based on the limited information provided, and further on-the-ground due diligence is recommended to confirm these insights.