From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Update: Navigating Chinese Overcapacity and Global Trade Pressures

Asia is currently facing significant challenges in its steel market, primarily attributed to China’s persistent overcapacity and diminishing domestic demand. Notably, “China’s excess capacity problem has no quick fix – WorldSteel“ and “Worldsteel: The problem of excess steel production capacity in China will not be easy to solve“ highlight how record steel exports are impacting pricing and international trade dynamics due to increasing tariffs. Notably, satellite-observed activity levels indicate a continuing trend of reduced production in China, particularly as steel demand is projected to decline by 2% in 2025 and 1% in 2026.

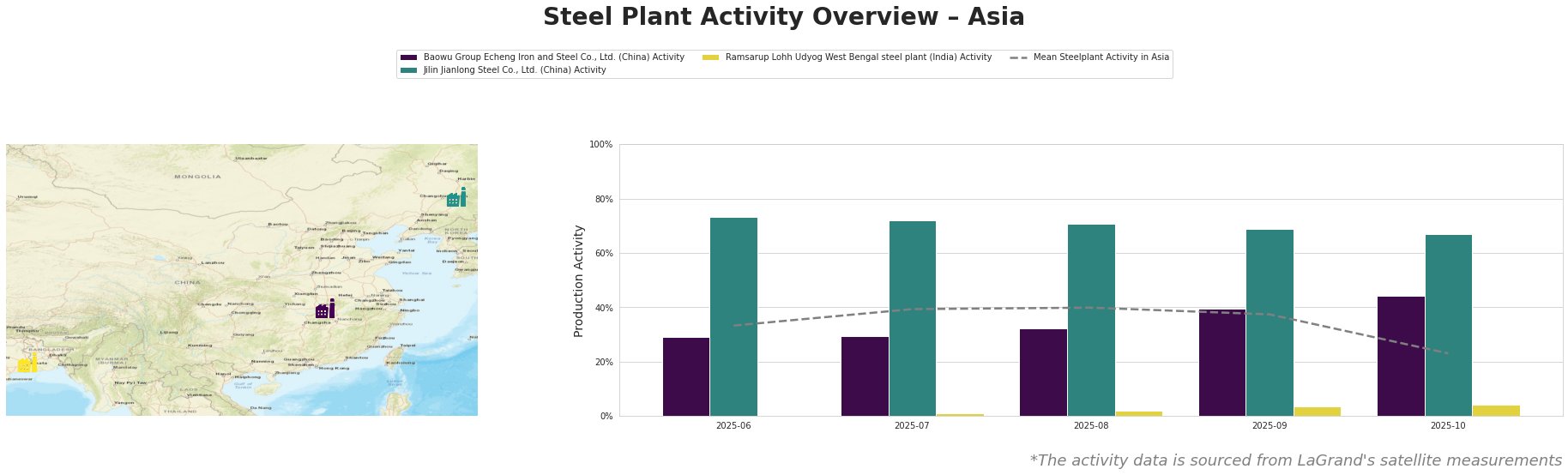

Recent data shows that the mean activity level across steel plants in Asia peaked in August 2025 at 40% before declining to 23% in October 2025. The Baowu Group Echeng Iron and Steel Co. experienced a remarkable increase from 29.0% in June to 44.0% in October, aligning with the operational adjustments amid China’s export surge noted in “Worldsteel: China’s steel overcapacity won’t be easy to resolve.” In contrast, the Jilin Jianlong Steel Co. saw a steady decline, from 73.0% in June to 67.0% in October, highlighting potential challenges in maintaining stability amidst broader market disruptions. The Ramsarup Lohh Udyog plant remains significantly less active, with only 4.0% in October, not directly correlated to any findings from the cited articles.

The Baowu Group, located in Hubei, displays a considerable fluctuation in activity, particularly rising to 44.0% in October. This increase may reflect strategic production adjustments in response to external pressures as indicated by WorldSteel’s recognition of China’s increasing export activity driving down global prices. Jilin Jianlong Steel Co., based in Jilin, shows a trend of gradual decline from a high of 73.0% to 67.0%, which suggests misalignments in production with the falling domestic demand forecasted in the articles. Its operations could be adversely affected by increasing tariffs and anti-dumping measures from countries like the U.S.

The Ramsarup Lohh Udyog plant’s consistent lower activity may indicate its vulnerability to supply chain fluctuations, especially since its modest growth from 0.0% to 4.0% implies dependency on specific end-user sectors, particularly energy.

Given the current conditions, steel buyers should prepare for potential supply disruptions predominantly from Chinese plants facing reduced demand and operational changes. Procurement strategies should focus on diversifying suppliers, especially considering the notable tariff measures affecting Chinese steel imports. With expanding trade barriers as emphasized in “Worldsteel: China’s steel surplus becoming increasingly difficult to address,” buyers are advised to secure contracts ahead of anticipated price volatility in the upcoming year.