From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Under Pressure: Activity Declines Amidst Global Uncertainty

Asia’s steel market faces mounting pressure as evidenced by declining plant activity amidst global political uncertainty. News events such as the “Liveblog USA unter Trump: Richter erklärt Trumps Militäreinsatz in Los Angeles für rechtswidrig” and other political instability indicators indirectly affect market sentiment, contributing to a cautious outlook. However, no direct, explicit link between these news items and steel plant activity levels can be established based on the provided information.

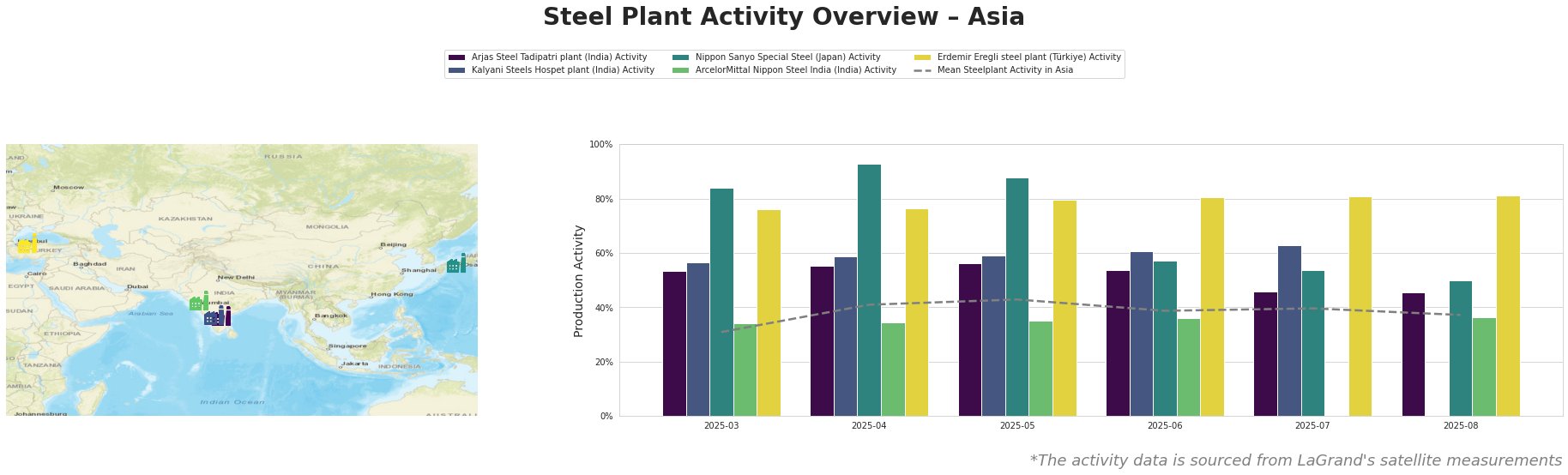

Recent monthly activity trends are summarized below:

The mean steel plant activity in Asia has generally decreased from a peak of 43.0 in May to 37.0 in August. Arjas Steel Tadipatri plant showed a consistent decline from 56.0 in May to 45.0 in August. Kalyani Steels Hospet plant has been relatively stable until July with 63.0 then missing data for August. Nippon Sanyo Special Steel experienced a sharp drop in activity from 93.0 in April to 50.0 in August. ArcelorMittal Nippon Steel India’s activity has remained relatively stable around 35% over the observed period. Erdemir Eregli steel plant shows relatively stable activity around 80%.

Arjas Steel Tadipatri plant, an integrated BF-BOF steel plant in Andhra Pradesh, India, producing finished and semi-finished rolled products, has seen its activity drop from 56% in May to 45% in August. The news articles provided do not give any direct reasons for this drop.

Kalyani Steels Hospet plant, another Indian steel plant, uses both BF and DRI processes. Its activity peaked at 63.0 in July before data became unavailable in August. Again, no direct connection to the news articles can be established.

Nippon Sanyo Special Steel, a Japanese EAF-based steel plant producing specialty steel, shows a significant decline in activity from 93.0 in April to 50.0 in August, indicating a substantial production cut. With the information provided, there is no explanation for this decline in the provided news articles.

ArcelorMittal Nippon Steel India, a large integrated steel plant in Gujarat with both BF and DRI, exhibits stable activity around 35-36%, indicating consistent, though comparatively lower, production levels. No connection to external factors is apparent.

Erdemir Eregli steel plant, a Turkish integrated BF-BOF plant producing flat steel products, displays a stable, high activity level around 80-81%, suggesting consistent output unaffected by the factors impacting other plants. The news articles provided do not give any direct reasons.

Based on the activity declines observed at Arjas Steel Tadipatri plant and the steep drop at Nippon Sanyo Special Steel, potential supply disruptions for bars, squares, and profiles from India and specialty steel from Japan could occur.

* Recommendation for Steel Buyers: Given the instability in the Asian steel market and the observed drops in specific plant activities, steel buyers should diversify their supplier base, especially for products sourced from Arjas Steel Tadipatri plant and Nippon Sanyo Special Steel.

* Recommendation for Market Analysts: Closely monitor the political climate in the US and Asia and also the plants mentioned above. Focus on inventory levels, lead times, and pricing trends to anticipate potential supply chain bottlenecks.