From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Trade Deals Fuel Optimism Amidst Plant Activity Shifts

Asia’s steel market sentiment remains very positive, driven by proactive trade negotiations. The “India, Canada Discuss Ways To Promote Bilateral Trade, Investments” and “‘Winning Partnership’: Piyush Goyal Lauds New Zealand Trade Minister Amid India-NZ FTA Talks” articles suggest potential demand increases for steel products. However, no direct relationship could be established between these trade talks and the observed plant activity. A clearer connection may be found in the article, “Goyal Leads 60-Member India Inc Delegation To Israel For Big FTA, Trade Push“, as the steel industry is likely represented within the delegation and could influence domestic steel plant production in the coming months.

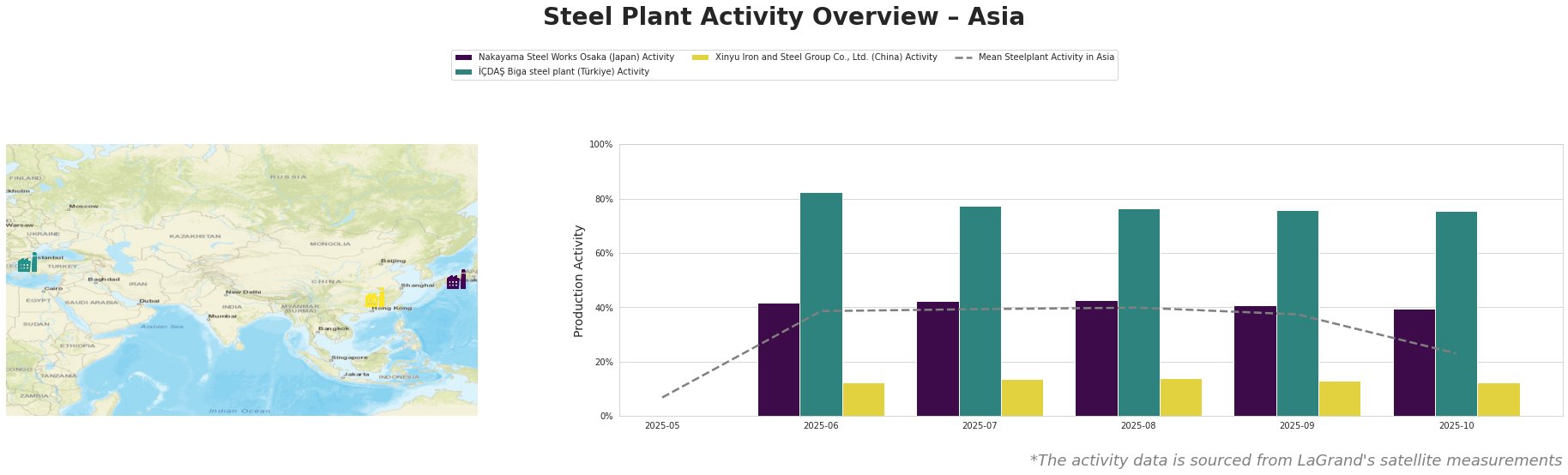

The mean steel plant activity in Asia peaked at 40% in August 2025 and has since declined to 23% by October 2025. The most significant activity was observed at the İÇDAŞ Biga steel plant, while activity at Xinyu Iron and Steel Group remained relatively low.

Nakayama Steel Works Osaka, an EAF-based steel plant in Kansai, Japan, with a crude steel capacity of 660 ttpa, maintained a relatively stable activity level between 40% and 43% from June to October 2025, consistently exceeding the Asian mean. Its focus on coil, plate, bars, and wire rods for building, energy, and transport sectors suggests it is well positioned to capitalize on any increased demand resulting from the trade talks reported in “India, Canada Discuss Ways To Promote Bilateral Trade, Investments” and “‘Winning Partnership’: Piyush Goyal Lauds New Zealand Trade Minister Amid India-NZ FTA Talks,” although no direct connection can be established.

İÇDAŞ Biga steel plant, located in Çanakkale, Türkiye, operates with a substantial 2500 ttpa crude steel capacity based on EAF technology and produces semi-finished and finished rolled products. The plant has shown significant activity, peaking at 82% in June 2025, with subsequent months stabilizing around 76%. This plant’s high activity relative to the Asian average may reflect strong regional demand, although no specific link to the provided news articles can be established.

Xinyu Iron and Steel Group Co., Ltd., situated in Jiangxi, China, is an integrated BF-BOF steel plant boasting a crude steel capacity of 10,000 ttpa. Unlike the other plants, its activity remained consistently low, fluctuating between 12% and 14%. While “Goyal Leads 60-Member India Inc Delegation To Israel For Big FTA, Trade Push” indicates India’s efforts to expand trade, there is no evidence to suggest a direct influence on the activity of Xinyu Iron and Steel.

Given the decline in average Asian steel plant activity alongside India’s FTA efforts, steel buyers should closely monitor Indian domestic steel prices for potential increases in the coming months. In particular, steel buyers should monitor the price of medium, thick, and extra-thick plates, as these are the primary products of Xinyu Iron and Steel, and any increased trade due to “Goyal Leads 60-Member India Inc Delegation To Israel For Big FTA, Trade Push” could lead to upward pressure on prices. Diversification of steel sourcing to include suppliers from regions with higher activity, such as those served by the İÇDAŞ Biga steel plant, is recommended to mitigate potential supply risks.