From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Tata Steel Expansion Drives Optimism Amidst Plant-Level Variances

Asia’s steel market shows positive sentiment, driven by Tata Steel’s strategic expansions in India and Europe, despite regional plant-level activity variations. The reported increase in domestic production and strategic capital expenditure discussed in “India’s Tata Steel sees 117% rise in consolidated net profit in Q4 FY 2024-25, profits decline from domestic operations” and “Tata Steel plans $1.76 billion capex for operations in India, UK and Netherlands in FY 2025-26” aligns with observed activity levels at specific Indian steel plants. While direct correlation to Tata’s activities cannot be explicitly established from provided data, these investment plans suggest a broader trend of capacity enhancement.

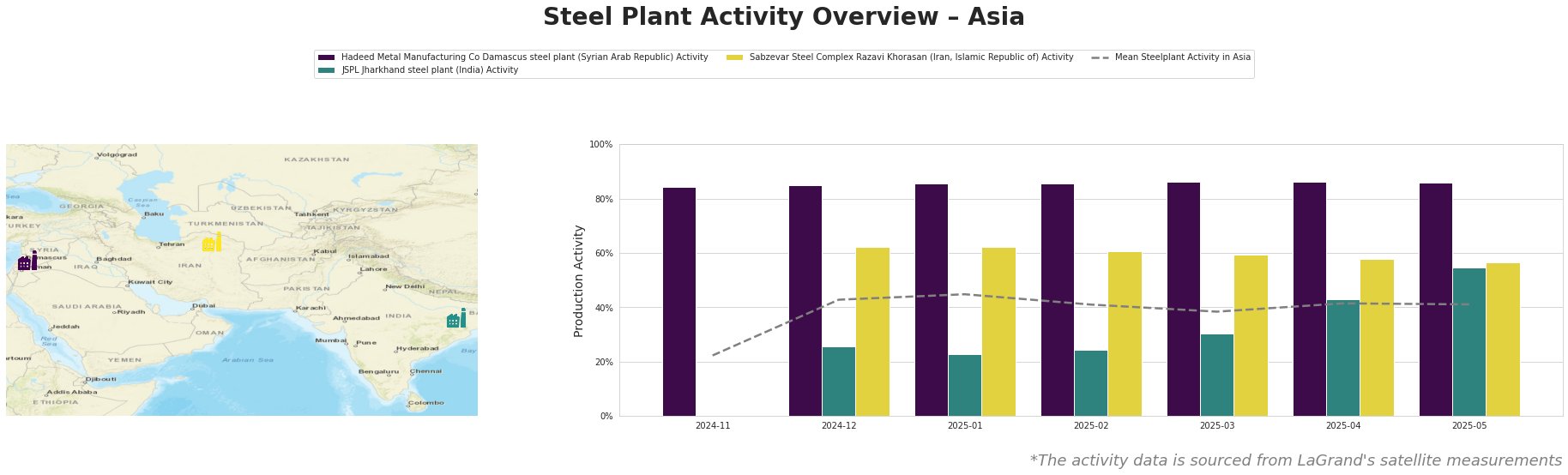

The mean steel plant activity in Asia fluctuated, peaking at 45% in January 2025 and stabilizing at 41% for April and May 2025. Hadeed Metal Manufacturing Co Damascus steel plant consistently showed high activity, remaining stable at 86% from January 2025. JSPL Jharkhand steel plant activity increased steadily from 26% in December 2024 to 55% in May 2025. Sabzevar Steel Complex Razavi Khorasan saw a slight decline from 62% in December 2024 and January 2025 to 56% in May 2025.

Hadeed Metal Manufacturing Co Damascus steel plant, operating with a 1.4 million tonnes per annum (ttpa) EAF capacity and focusing on rebar and billets for building infrastructure, consistently exhibits activity levels significantly above the Asian average, remaining steady at 86% from January 2025 through May 2025. This elevated, stable activity suggests consistent demand within its regional market. No direct connection can be established between these high activity levels and the provided news articles.

JSPL Jharkhand steel plant, an EAF-based facility with a 1.6 million ttpa crude steel capacity producing semi-finished products like wire rod and bars, demonstrates a marked increase in activity from 26% in December 2024 to 55% in May 2025. This growth trend potentially reflects increased domestic demand or capacity utilization improvements as also discussed in “Tata Steel increased steel production in India by 4% y/y in FY2024/2025“, although a direct link cannot be definitively confirmed with the available information. The company is Responsible Steel Certified, which could contribute to increasing sales of their products and output.

Sabzevar Steel Complex Razavi Khorasan, equipped with EAF technology and an 800,000 ttpa crude steel capacity, shows a slight decline in activity from 62% in December 2024 to 56% in May 2025. This suggests a possible moderation in regional demand or production adjustments, although no explicit connection to the provided news articles can be established.

Tata Steel’s investment, as outlined in “Tata Steel plans $1.76 billion capex for operations in India, UK and Netherlands in FY 2025-26” and “India’s Tata Steel to infuse $2.5 billion into Singapore arm to bolster European businesses“, indicates a long-term commitment to expanding production capacity and transitioning to more sustainable practices. While the observed increases in JSPL Jharkhand steel plant’s activity potentially reflect broader positive trends in the Indian steel market, the data does not provide explicit support. However, the increased production levels of Tata Steel do imply higher overall production and utilization in the plants.

Evaluated Market Implications:

Given the planned capacity expansions by Tata Steel, steel buyers can anticipate increased supply from Indian operations in the medium to long term. Based on the news articles “Tata Steel plans $1.76 billion capex for operations in India, UK and Netherlands in FY 2025-26” and “Tata Steel increased steel production in India by 4% y/y in FY2024/2025“, procurement professionals focused on the Indian market should explore opportunities to secure long-term supply contracts with Tata Steel, leveraging their increased production and potential cost efficiencies. Diversification of procurement sources within Asia remains advisable, given the stable high activity at Hadeed Metal Manufacturing Co Damascus steel plant and the fluctuating activity at Sabzevar Steel Complex Razavi Khorasan, as it suggests potential regional supply vulnerabilities.