From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges: Indian Capacity Boosts Offset China’s July Dip

Asia’s steel market presents a very positive outlook driven by capacity expansions in India, despite a notable activity dip in some Chinese plants in July. “India’s Jeevaka Industries partners with Primetals for high-speed rebar mill in Hyderabad“ and “India’s JIL receives approval for $420.2 million steel plant project“ signal significant future supply increases. While no direct relationship can be established between these expansions and the observed satellite activity, it indicates a generally favorable market for steel buyers.

Here’s a breakdown of recent plant activity:

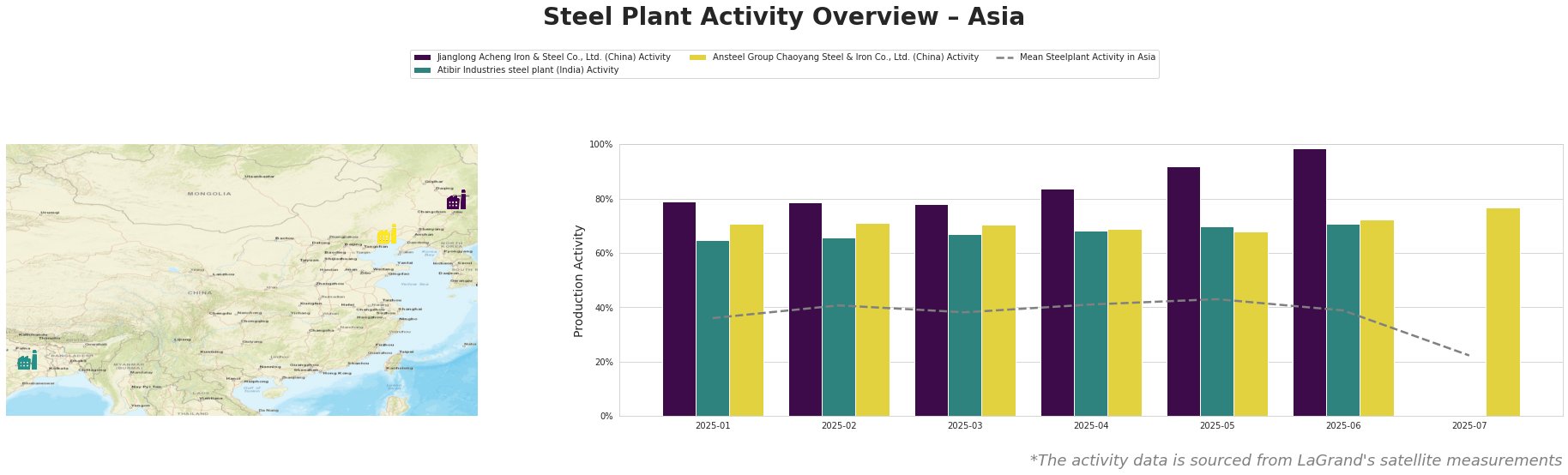

Overall, mean steel plant activity in Asia experienced a sharp decline in July, falling to 22% from 39% in June. This drop contrasts with generally increasing activities between January and May.

* Jianglong Acheng Iron & Steel Co., Ltd. (China): Maintains consistently high activity, peaking at 99% in June before no data for July. This integrated (BF) plant with a 1,100ktpa BOF capacity focuses on finished rolled products for automotive and energy sectors. No direct connection can be established between the recent news and this plants activity.

* Atibir Industries steel plant (India): Shows steadily increasing activity from 65% in January to 71% in June. However, data is missing for July. This integrated (BF) plant, with a 600ktpa BOF capacity and a 300ktpa pelletizing plant, produces crude, semi-finished, and finished rolled products. The Indian capacity expansion news, specifically “India’s OMC plans pellet plant as value addition to its iron ore mining,” could potentially support Atibir Industries pelletizing operations, but no direct link to observed activity can be established.

* Ansteel Group Chaoyang Steel & Iron Co., Ltd. (China): Shows relatively stable activity between 68% and 72% from January through June, followed by a rise to 77% in July, defying the overall market downturn. This integrated (BF) plant with a 2,100ktpa BOF capacity produces steel plate and pipe. No direct connection can be established between the recent news and this plants activity.

Evaluated Market Implications:

The sharp drop in average Asian steel plant activity in July, coupled with missing data from Jianglong Acheng and Atibir Industries, suggests a potential, short-term supply disruption. However, the Indian capacity expansions announced, specifically the new rebar mill by Jeevaka Industries and the JIL steel plant, signal increased future supply.

Recommended Procurement Actions:

Steel buyers should:

- Monitor Chinese Steel Production: Closely monitor Chinese steel production and export data for August and September to assess the extent and duration of the July downturn.

- Assess Indian Steel Availability: Investigate the specific product offerings (rebar, coated steel) of the upcoming Jeevaka and JIL plants. Contact these companies directly to explore future supply contracts and diversification opportunities.

- Review Inventory Levels: Evaluate current inventory levels and consider a slight increase in short-term orders to mitigate potential supply shortages arising from the July decline, particularly for products not manufactured by the new Indian plants.