From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surge: Nvidia’s China Return & Strong Indian Production Signal Bullish Outlook

Asia’s steel market displays strong positive momentum, driven by resurgent demand and robust production. This report analyzes these trends using recent news and satellite-observed plant activity. “Wall Street Cheers Nvidia’s Return To China AI Market” points to a potential boost in steel demand in China’s tech sector, though we currently lack direct satellite observation evidence linking this to increased steel plant activity in the region.

Recent activity data reveals a complex picture:

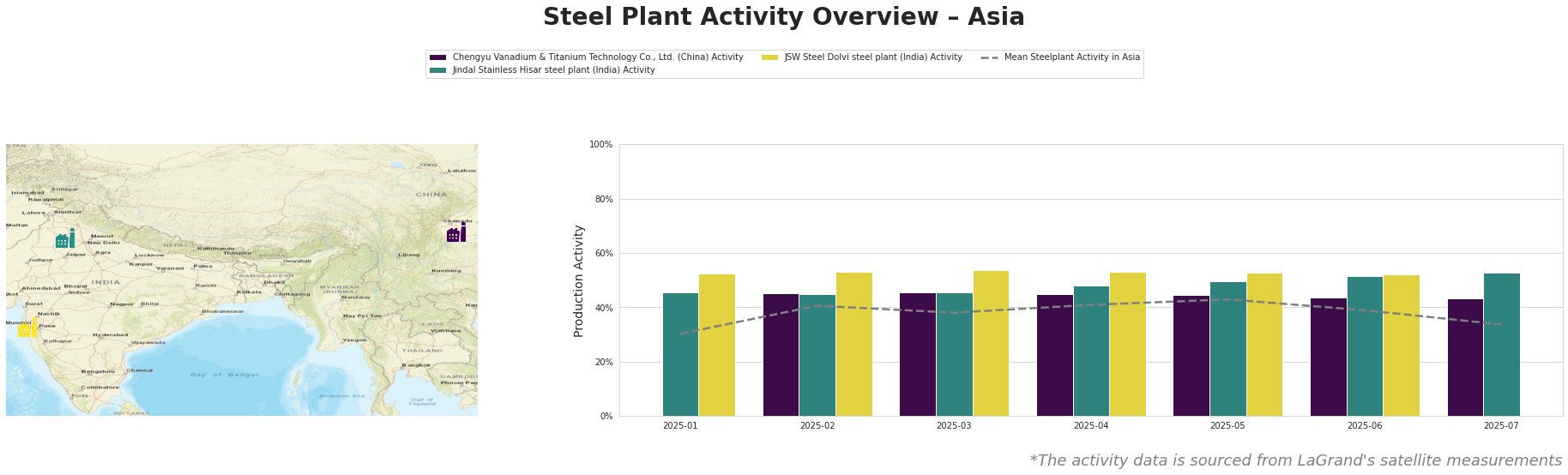

The mean steel plant activity across Asia shows a decline to 34.0% in the most recent period.

Chengyu Vanadium & Titanium Technology Co., Ltd., a major Chinese steel producer in Sichuan province with a 6,000 ttpa crude steel capacity primarily using BOF technology, saw a slight decrease in activity from 44% in May to 43% in July. While “Wall Street Cheers Nvidia’s Return To China AI Market” suggests a positive outlook for Chinese industries, there is no direct correlation between the satellite data and a rise in activity levels at Chengyu Vanadium & Titanium Technology Co., Ltd.

Jindal Stainless Hisar, an Indian stainless steel plant with an 800 ttpa EAF-based capacity, exhibits consistently strong activity. The plant’s activity steadily increased from 46% in January to 53% in July, significantly above the Asian mean. This surge in activity may indicate strong domestic demand, though no direct link to specific news events like “Stock market today: S&P 500, Nasdaq climb on Nvidia boost, with CPI inflation, bank earnings in focus” can be established.

JSW Steel Dolvi, an Indian plant with a 5,000 ttpa capacity utilizing both BF and DRI processes, maintained a consistently high activity level around 53% throughout the observed period, peaking at 54% in March. This stability could reflect JSW Steel’s diversified product portfolio and established market position, though its relation to any particular article like “Analysis-High-priced stocks and bonds raise tariff threat for markets” remains unconfirmed.

Evaluated Market Implications:

The differing activity levels highlight regional dynamics. While the Chengyu plant shows moderate fluctuation, consistent with the uncertainty flagged in “Analysis-High-priced stocks and bonds raise tariff threat for markets”, the robust performance of Jindal Stainless Hisar and JSW Steel Dolvi indicates strong domestic demand in India.

Recommended Procurement Actions:

- Monitor Indian Stainless Steel Prices: The consistent high activity at Jindal Stainless Hisar, producing stainless steel for various sectors, suggests potential upward pressure on stainless steel prices. Buyers should proactively negotiate contracts to mitigate price increases and diversify suppliers to ensure supply security.

- Assess China’s Demand Impact: Closely monitor future steel activity near the Chengyu plant. If “Wall Street Cheers Nvidia’s Return To China AI Market” results in increased steel demand for AI chip manufacturing or related infrastructure, this could impact regional steel prices. Establish flexible procurement strategies.