From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

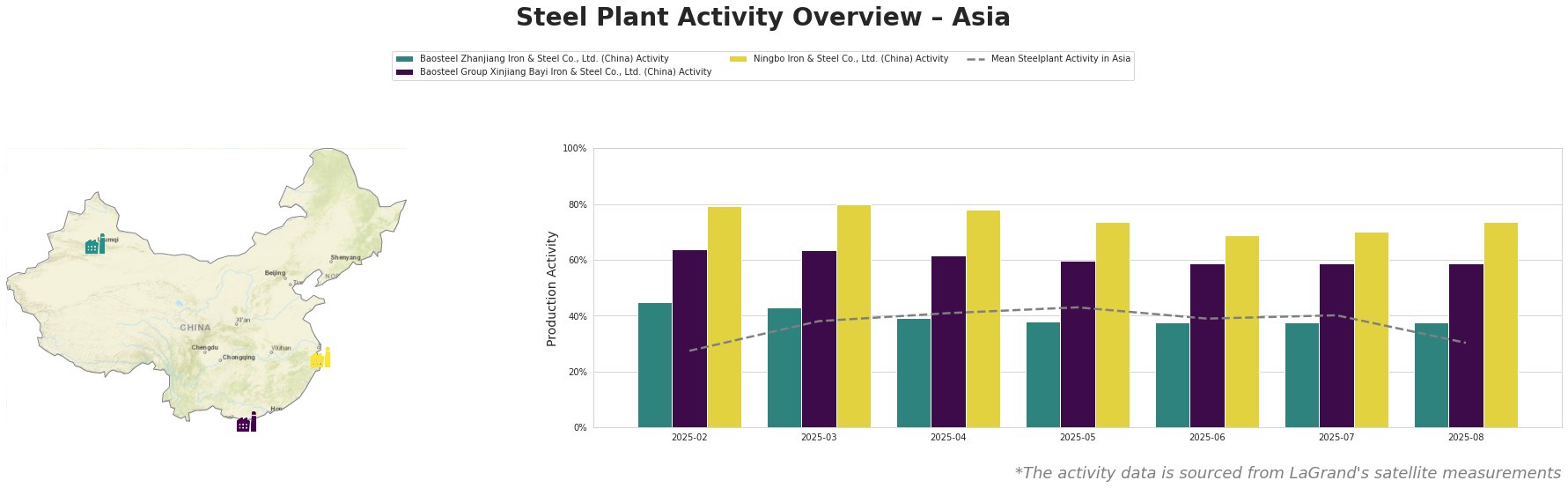

Try the Free AI Search EngineAsia Steel Market: Strong Ningbo Activity Offsets Regional Dip Amidst Positive Outlook

Asia’s steel market demonstrates resilience despite a recent activity slowdown, particularly with Ningbo Iron & Steel maintaining high production levels. While no direct connections can be established between observed Asian steel plant activity and the news articles “Klöckner expands electrical steel capacity in US,” “Klöckner anticipates rising shipments,” or “Metallus reports higher net sales for Q2,” the overall positive sentiment from these articles, particularly regarding rising shipments and demand, suggests continued strength in the global steel market that could indirectly impact Asian steel demand.

Here’s a breakdown of observed activity:

The mean steel plant activity in Asia has seen fluctuations, peaking at 43% in May before declining to 30% in August.

Baosteel Zhanjiang Iron & Steel Co., Ltd., a large integrated BF-BOF steel plant in Guangdong with a crude steel capacity of 12.5 million tonnes, has maintained a stable activity level around 38% from May to August. This level is significantly above the regional mean in August (30%), despite the recent drop in the regional average. There is no direct link between this steady activity and the news articles provided.

Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd., another integrated BF-BOF steel producer located in Xinjiang with a 7.3 million tonne capacity, has also shown relatively stable activity, hovering around 60% from May to August. This is significantly higher than the regional average. There is no direct link between this steady activity and the news articles provided.

Ningbo Iron & Steel Co., Ltd., a BF-BOF integrated steel plant in Zhejiang with a 4 million tonne crude steel capacity, producing carbon, low-alloy, automotive, and electrical steel, consistently demonstrates the highest activity level among the observed plants. While experiencing a slight dip from 80% in March to 69% in June, activity rebounded to 74% in August. This plant’s output, including electrical steel, positions it favorably to potentially indirectly benefit from increased demand mentioned in “Klöckner expands electrical steel capacity in US,” although a direct link to the observed activity cannot be established based on the information provided.

Evaluated Market Implications:

The recent drop in the mean activity level across observed Asian steel plants, coupled with consistently high activity at Ningbo Iron & Steel, suggests a possible shift in regional production dynamics.

- Potential Supply Considerations: The drop in average activity warrants close monitoring of potential supply constraints, especially outside of Ningbo.

- Recommended Procurement Actions: Steel buyers should consider diversifying their sources within Asia, particularly focusing on producers like Ningbo Iron & Steel which maintain high activity levels. Monitoring spot prices for electrical steel from Ningbo and other producers that maintained stable high activity is recommended. Buyers should maintain close contact with their suppliers in the region.