From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Shows Production Strength Despite Shifting US Trade Flows

Asia’s steel market demonstrates underlying production strength despite shifts in US steel trade patterns, as indicated by satellite-observed plant activity. The rise in US imports of certain products, such as “US cut-length plate imports up 18.0 percent in May 2025” and “US tool steel exports up 24.2 percent in May 2025“, do not appear to have significantly hampered activity at major Asian steel plants, at least in the short term based on current observations. While “US structural pipe and tube exports down 6.3 percent in May 2025” and other export declines suggest potential shifts in global demand, the impact on observed Asian production has been limited.

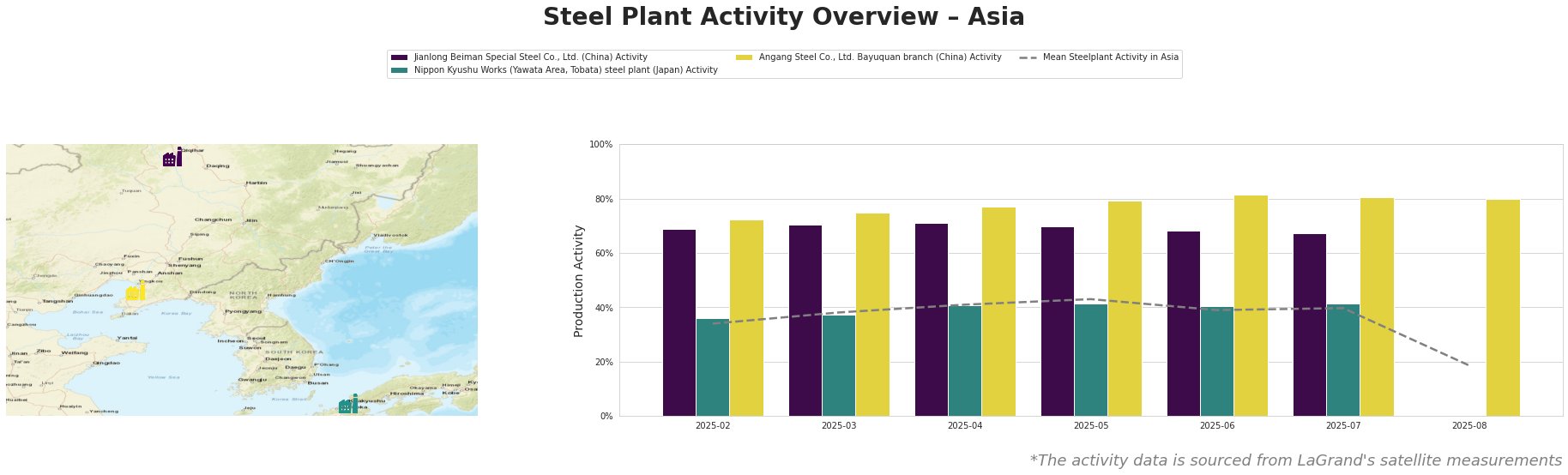

Overall, the mean steel plant activity in Asia showed a gradual increase from February (34.0%) to May (43.0%), followed by a slight dip to 39.0% in June and a rebound to 40.0% in July. August experienced a significant drop to 19.0%. Individual plant activity varied.

Jianlong Beiman Special Steel Co., Ltd., an integrated steel plant in Heilongjiang producing semi-finished and finished rolled products like tool steel, bearing steel, and stainless heat-resistant steel, exhibited relatively high activity levels, ranging from 67.0% to 71.0% between February and July. There was a slight decrease from April (71.0%) to July (67.0%), but this decline cannot be explicitly linked to the news articles provided.

Nippon Kyushu Works (Yawata Area, Tobata) steel plant, an integrated BF-BOF producer in Kyūshū making thin plate, steel bars and wires, rail, steel sheet pile, and steel pipe, showed consistently lower activity relative to the mean, ranging from 36.0% in February to 42.0% in July. The slow but steady increase in observed activity between February and July does not seem to correlate with the provided news articles.

Angang Steel Co., Ltd. Bayuquan branch, a major integrated steel plant in Liaoning producing finished rolled products such as container steel, pipeline steel, and ship plate, demonstrated the highest activity levels, steadily increasing from 72.0% in February to a peak of 81.0% in June, remaining at 80% in July and August. This plant’s activity levels consistently outperformed the Asian mean. The trends observed at Angang Steel do not appear to be directly impacted by the reported changes in US steel trade flows in the provided news articles.

The observed activity at Angang Steel Co., Ltd. Bayuquan branch remains high, suggesting strong regional demand in China. Given the rise in “US tool steel exports up 24.2 percent in May 2025”, procurement professionals should closely monitor the availability and pricing of tool steel from Jianlong Beiman Special Steel, as potential increased demand in the US market might affect regional availability. The general downturn in Asian steel production in August could be indicative of an increase in supply pressure. Therefore, it would be wise for buyers to explore potential cost savings with suppliers that were previously less negotiable.