From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rising Erdemir Activity Offsets US Economic Concerns, Creates Procurement Opportunities

Asia’s steel market shows continued positive sentiment, particularly driven by activity increases in some mills, contrasting with concerns related to the US economy. This report examines recent developments, combining news insights with satellite-observed plant activity. The “Stocks Pressured as Bond Yields Climb on Strong US Economic News” and “Stocks Mixed on Weak US Labor Market News” articles highlight potential economic headwinds from the US that could indirectly influence global steel demand, but no direct correlation to observed Asian plant activity levels can be established from these articles. In contrast, no direct relationship could be established between the satellite observed activity and the article: “Stock Index Futures Slip With Focus on Trump’s Tax Bill and Trade Deals, U.S. JOLTs Report and Powell’s Remarks on Tap“.

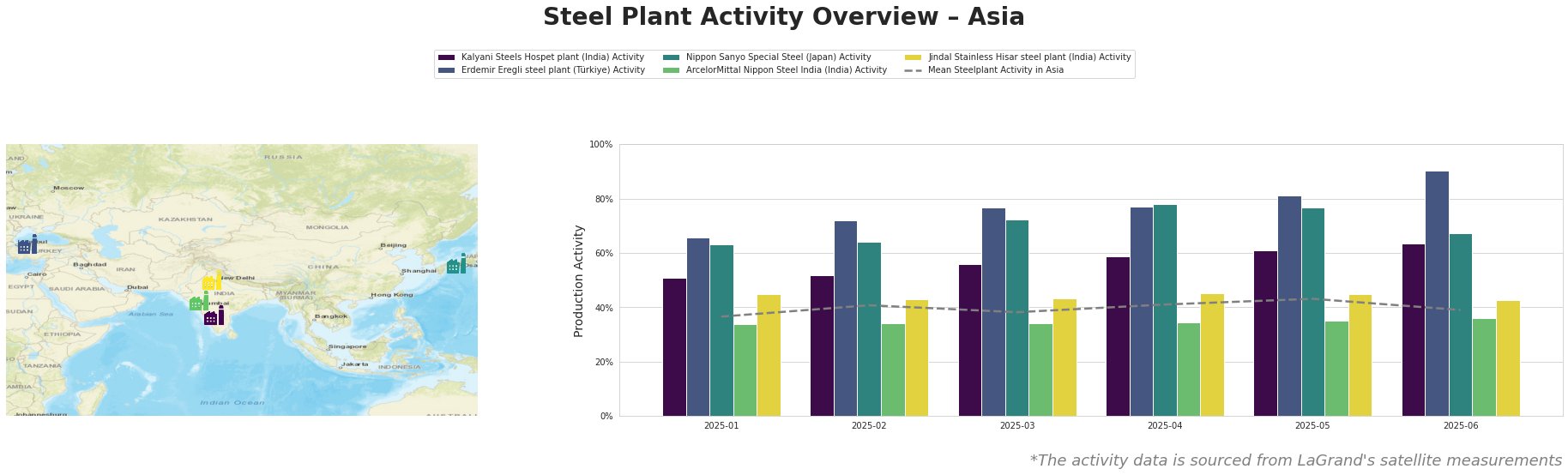

The mean steel plant activity across the observed Asian plants fluctuated, peaking at 43% in May and dropping to 39% in June. Kalyani Steels Hospet plant has shown a steady increase, reaching 64% activity in June, exceeding the mean, and showcasing consistent growth. Erdemir Eregli steel plant demonstrates the most significant increase in activity, climbing to 90% in June, substantially above the mean. Nippon Sanyo Special Steel shows fluctuating activity, peaking in April at 78% and then decreasing to 67% in June. ArcelorMittal Nippon Steel India demonstrates a relatively stable, below-average activity level, ranging between 34% and 36%. Jindal Stainless Hisar steel plant shows stable activity around the average, remaining in the low to mid-40s.

Kalyani Steels Hospet plant, an integrated steel plant in Karnataka, India, with both BF and DRI capabilities and a crude steel capacity of 860 ttpa, has displayed a consistent upward trend in activity, reaching 64% in June. This may indicate a strengthening domestic demand for their semi-finished and finished rolled products used in the automotive, building, and energy sectors. No explicit connection could be established with provided news articles.

Erdemir Eregli steel plant, a major integrated steel producer in Türkiye with 4000 ttpa crude steel capacity, has shown the most significant surge in activity, reaching 90% in June. This likely reflects increased production to meet demand for their hot and cold-rolled products, plates, and coated flat steel, especially in the automotive and construction sectors. No explicit connection could be established with provided news articles.

Nippon Sanyo Special Steel, operating an electric arc furnace (EAF) with a capacity of 1596 ttpa in the Kansai region of Japan, experienced fluctuating activity, decreasing to 67% in June after a peak in April. This could reflect adjustments in production based on specific orders for billets, rolled products, tubes, and bars. No explicit connection could be established with provided news articles.

ArcelorMittal Nippon Steel India, an integrated steel plant in Gujarat with significant DRI and EAF capacity (9600 ttpa crude steel), shows stable but below-average activity. Its focus on hot-rolled, cold-rolled, galvanized, pipe, and plate products for diverse sectors might explain the consistent production levels. No explicit connection could be established with provided news articles.

Jindal Stainless Hisar steel plant, an EAF-based plant in Haryana, India, producing stainless steel and various rolled products with a capacity of 800 ttpa, shows relatively stable activity levels, suggesting steady demand for its specialized products. No explicit connection could be established with provided news articles.

Given the high activity observed at Erdemir Eregli, Turkish steel exports could become more competitive in the short term. Procurement professionals should:

- Monitor Turkish Steel Prices: Closely track Erdemir Eregli’s pricing and export strategies.

- Diversify Supply: Given the fluctuations in other plants and concerns of US markets, explore alternative steel sources, but prioritize those with stable or increasing production, such as Kalyani Steels.

- Negotiate Contracts: Leverage the potential for increased Turkish supply to negotiate favorable contract terms with existing suppliers in regions where economic headwinds are of concern.