From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Resilient Despite Automotive Sector Woes: Tariffs and Production Shifts Impacting Plant Activity

Asia’s steel market demonstrates resilience despite headwinds in the automotive sector due to tariffs impacting production costs, as highlighted in news articles such as “GM boosts sales, takes $1.1bn tariff hit in 2Q” and “Volkswagen stung by tariffs, but trade deal based on US investments may be coming“. While these articles primarily focus on the financial impact on automotive manufacturers, they indirectly suggest potential shifts in demand for steel used in automotive production within Asia. However, these shifts cannot be directly and conclusively linked to the plant activity changes observed by satellite.

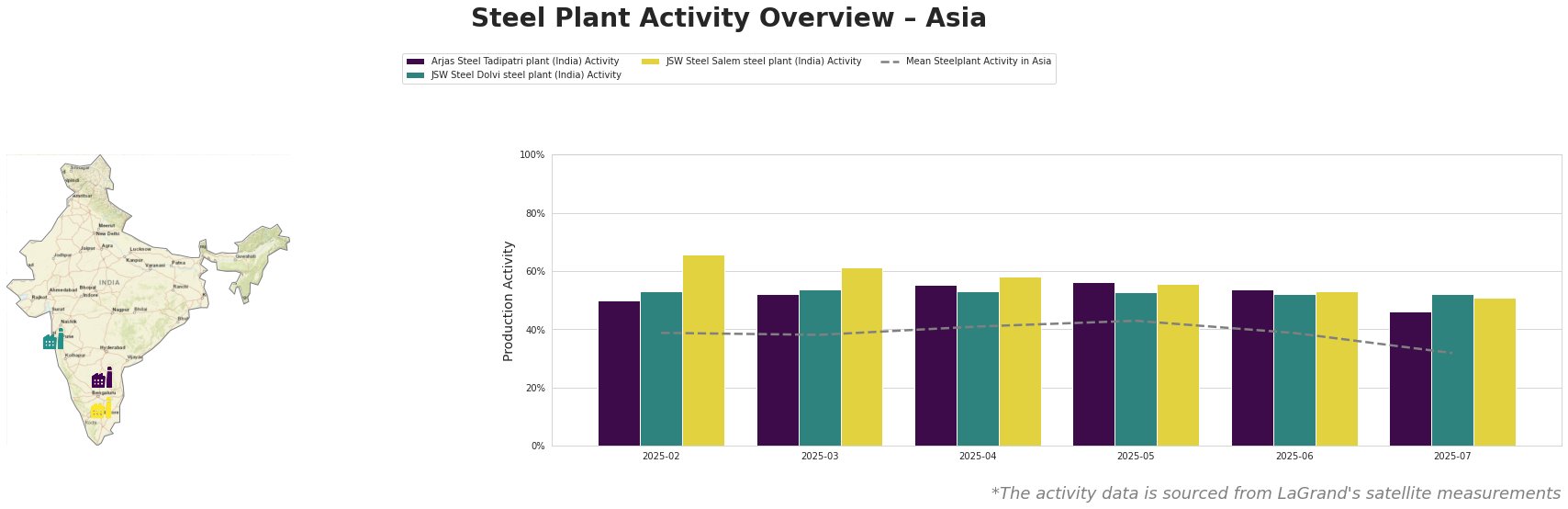

Here’s a table summarizing the observed monthly plant activity:

The average steel plant activity in Asia experienced a decrease in July, dropping to 32% after peaking at 43% in May. Arjas Steel Tadipatri plant showed a consistent activity level that peaked at 56% in May before decreasing to 46% in July. JSW Steel Dolvi steel plant activity remained relatively stable, fluctuating between 52% and 54% throughout the observed period, ending at 52% in July. JSW Steel Salem steel plant displayed the highest activity among the observed plants, but it also experienced a steady decline from 66% in February to 51% in July.

Arjas Steel Tadipatri plant, located in Andhra Pradesh, India, is an integrated steel plant with a capacity of 325 thousand tonnes per annum (ttpa) of crude steel, utilizing a BF-BOF process. The plant primarily produces finished rolled and semi-finished products such as bars, squares, and rounds, catering to the energy, building and infrastructure, transport, tools and machinery, steel packaging, and automotive sectors. The plant activity decreased from 56% in May to 46% in July. While the automotive end-user sector is listed for Arjas Steel Tadipatri, no direct correlation between the observed activity decrease and the news articles mentioning tariffs and automotive production can be definitively established.

JSW Steel Dolvi steel plant, located in Maharashtra, India, has a larger capacity of 5000 ttpa of crude steel, employing both BF and DRI processes. The plant produces a wide range of products, including wire rod, cold rolled, bar, hot rolled, specialty steel, and galvanized steel, serving similar end-user sectors as Arjas Steel. Its activity remained relatively stable around 53%, with a slight decrease to 52% in June and July. While the automotive end-user sector is listed for JSW Steel Dolvi, no direct correlation between the observed activity and the news articles mentioning tariffs and automotive production can be definitively established.

JSW Steel Salem steel plant, located in Tamil Nadu, India, has a crude steel capacity of 1030 ttpa using an integrated BF process. It produces semi-finished and finished rolled products such as hot rolled bars and flats, serving similar end-user sectors. The plant’s activity saw a significant decline from 66% in February to 51% in July. While the automotive end-user sector is listed for JSW Steel Salem, no direct correlation between the observed activity decrease and the news articles mentioning tariffs and automotive production can be definitively established.

Based on the provided information, the decline in activity observed across all three steel plants, coupled with the news articles detailing the financial strain on automotive manufacturers due to tariffs, suggests a potential shift in steel demand within the automotive sector. While a direct correlation cannot be definitively proven, the timing of the activity decline coincides with the period of increased tariff impact reported in the news.

Evaluated Market Implications:

Potential Supply Disruptions:

A potential decrease in demand from the automotive sector may lead to a temporary oversupply of certain steel products, particularly those used in automotive manufacturing. This oversupply could affect plants like Arjas Steel Tadipatri, JSW Steel Dolvi, and JSW Steel Salem steel plant, given that they list the automotive industry as a key end-user sector.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor inventory levels and production schedules of automotive manufacturers that source steel from these plants. Negotiate flexible supply contracts that allow for adjustments based on actual demand. Consider diversifying steel sources to mitigate potential supply disruptions or price volatility.

- Market Analysts: Track automotive sales data and production forecasts in Asia, particularly in regions where these steel plants operate. Analyze the impact of tariffs on automotive manufacturing costs and pricing strategies. Monitor steel inventory levels and pricing trends to identify potential buying opportunities.

It is important to note that these recommendations are based on the limited information provided and the absence of direct links between the news articles and the observed plant activity. Further investigation and data analysis are needed to confirm these findings and refine these recommendations.