From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Resilient Amid EV Sector Uncertainty: Tata Steel Activity Remains High

Asia’s steel market demonstrates overall resilience despite concerns in the automotive sector. The observed activity levels at key plants coincide with global automotive shifts. Specifically, while news articles like “Why the US auto industry is bracing for an EV winter” and “Auto Industry Faces ‘EV Winter’ Amid Policy Shifts and Supply Chain Woes” highlight challenges in the EV market, this is not directly reflected in reduced activity at all Asian steel plants.

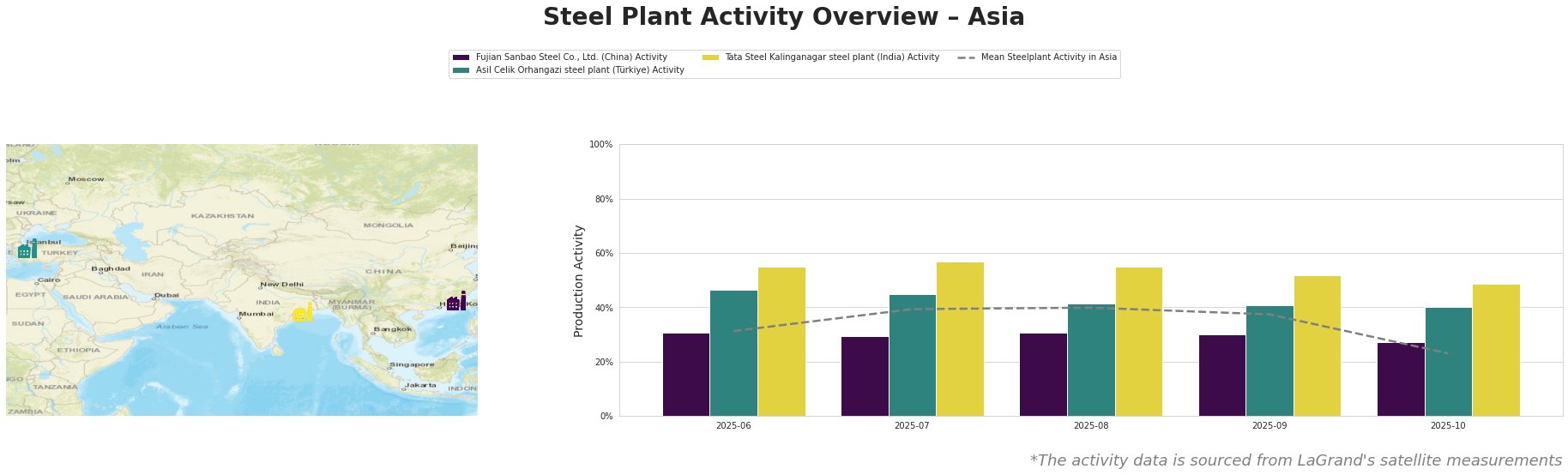

The mean steel plant activity in Asia decreased from 31% in June to 23% in October. Fujian Sanbao Steel Co., Ltd. (China) Activity showed a decline from 31% in June to 27% in October. Asil Celik Orhangazi steel plant (Türkiye) Activity levels have been relatively stable, decreasing from 46% in June to 40% in October. Tata Steel Kalinganagar steel plant (India) Activity was the highest among the observed plants, but it decreased from 55% in June to 49% in October, remaining consistently above the Asian average, even in October.

Fujian Sanbao Steel Co., Ltd., an integrated steel plant in Fujian, China, with a crude steel capacity of 4.62 million tonnes, produces finished rolled and semi-finished products for sectors including automotive. The plant’s activity declined from 31% in June to 27% in October, falling slightly below the Asian mean. While “Why the US auto industry is bracing for an EV winter” highlights challenges in the automotive sector, there is no explicit evidence from the provided news or data to definitively link this US-centric trend directly to the observed decrease in activity at Fujian Sanbao.

Asil Celik Orhangazi steel plant in Bursa, Türkiye, operates an electric arc furnace (EAF) with a crude steel capacity of 550,000 tonnes, producing crude, semi-finished, and finished rolled products. The plant’s activity has been relatively stable, decreasing from 46% in June to 40% in October, consistently above the mean. Despite concerns about the EV sector, there is no direct correlation between the observed stable activity at Asil Celik and the trends described in “Auto Industry Faces ‘EV Winter’ Amid Policy Shifts and Supply Chain Woes“. The plant caters to multiple end-user sectors, possibly buffering it against automotive-specific downturns.

Tata Steel Kalinganagar steel plant, an integrated steel plant in Odisha, India, has a crude steel capacity of 3 million tonnes and supplies the automotive industry. Its activity decreased from 55% in June to 49% in October. Despite the overall decline, Tata Steel Kalinganagar consistently maintained the highest activity levels. While “Should You Buy Ford While It’s Below $14?” discusses shifting strategies in the US auto industry, including scaling back EV investments, and even though Tata Steel Kalinganagar produces for the automotive sector, there is no explicit evidence in the provided data to link these shifts directly to the observed activity decrease at the Kalinganagar plant.

Despite concerns raised in the news, specifically regarding the automotive sector and EV demand, overall Asian steel plant activity shows resilience, particularly at Tata Steel Kalinganagar. Steel buyers should:

- Closely monitor Tata Steel Kalinganagar’s output: Given its consistently high activity, ensure continued engagement to secure supply in the face of potential broader market fluctuations. This is based on the observed high activity levels of Tata Steel Kalinganagar compared to other observed steel plants.

- Evaluate diversification options within Türkiye: The relatively stable activity at Asil Celik, despite market uncertainties, suggests Türkiye as a potentially reliable source. Explore opportunities to diversify procurement strategies.