From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Report: Neutral Sentiment Amid CBAM Uncertainties

Recent developments in the Asian steel market indicate a neutral sentiment largely influenced by the implementation of the EU’s Carbon Border Adjustment Mechanism (CBAM). The articles “Indian steel exports to the EU could decline significantly after the launch of CBAM“ and “CBAM uncertainty suppresses Asian steel flows to Europe; long-term prospects remain positive“ highlight a marked decrease in exports, particularly from India, where shipments to Europe have dropped by 33.4% amid procurement hesitance from European buyers. However, the implications of this uncertainty can be tied to observable trends in steel plant activity.

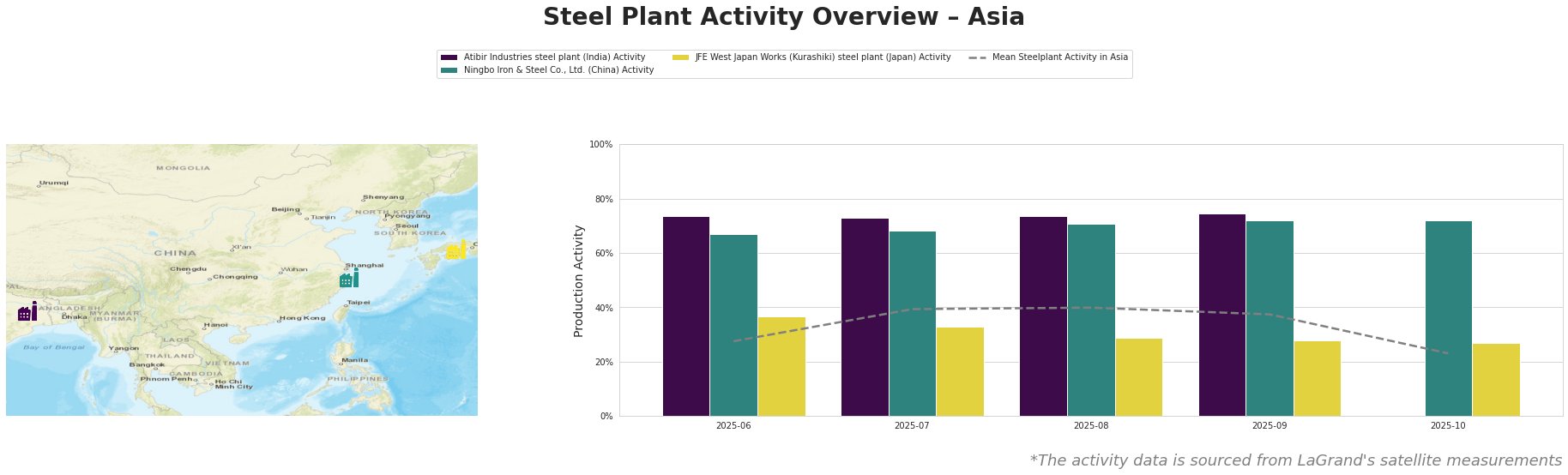

Atibir Industries in India demonstrated stable activity levels above 70% until a notable drop in October (from 75.0% in September to not recorded in October), potentially illustrating the impact of anticipated market conditions due to CBAM. This aligns with the anticipated export declines noted in the aforementioned articles.

Ningbo Iron & Steel Co., Ltd. in China maintained relatively stable activity but reflects a ceiling around 72% in October. It highlights industry caution amidst speculation related to Asian steel flows to Europe, reiterating the strained market conditions communicated in the article.

Conversely, JFE West Japan Works shows a consistent decline from September (28.0% to 27.0% in October), potentially echoing the broader sentiment of weak demand reflected in “IREPAS Short Range Outlook: December 2025.”

Supply disruptions could stem from the anticipated struggles of Indian plants like Atibir, focusing on shifting markets as described in “Indian steel exports to the EU could decline significantly after the launch of CBAM.” This may lead to a further loss of competitive edge without transitioning to carbon-friendly production practices.

For steel buyers, a strategic pivot towards securing procurement from regions less impacted by CBAM uncertainty, such as China, is vital. Specific emphasis should be placed on assessing compliance capabilities, as noted in “The European steel market is weighing a new trading regime amid volatile demand and CBAM uncertainty,” encouraging procurement decisions that anticipate impending regulatory frameworks. Monitoring shifts in activity levels closely will be essential to secure favorable pricing before anticipated supply cuts solidify.