From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Report: Negative Sentiment Amidst Declining Activity Levels

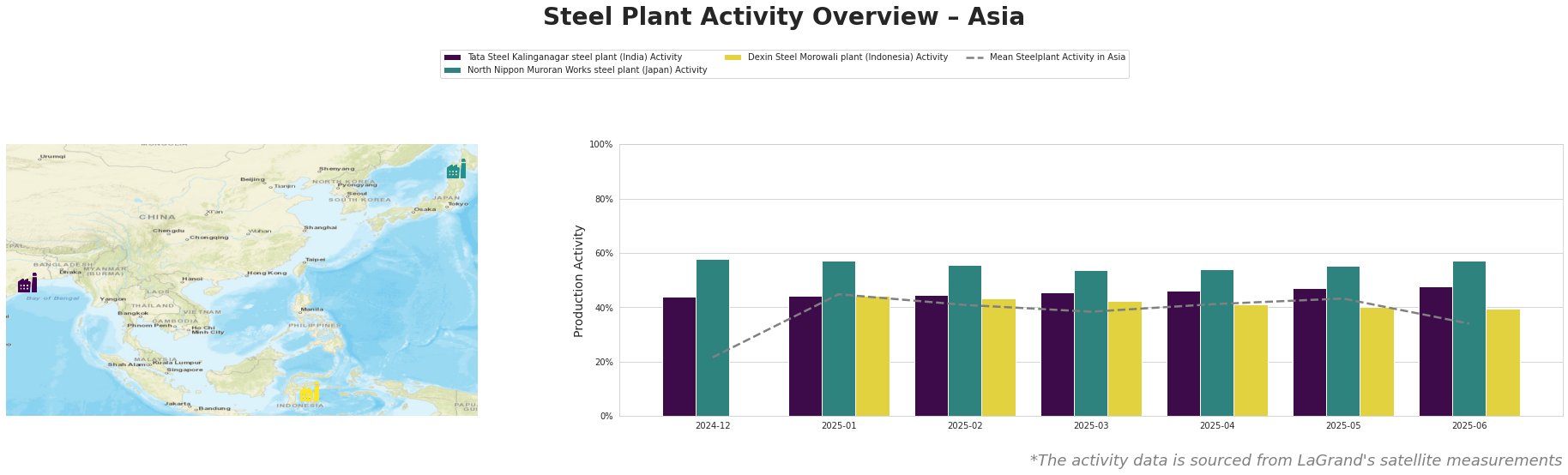

In Asia, the steel market sentiment remains negative due to falling activity levels at various steel plants. Recent insights from the articles titled “European steel demand will recover only modestly“ and “Eurofer: US friction delays EU demand recovery“ indicate a troubling backdrop for Asian steel exports, despite specific local conditions. The satellite-observed activity data shows notable declines across major plants, correlating with the market’s downturn.

The Tata Steel Kalinganagar plant in India has shown activity levels increasing from 44% to 48% in June 2025. However, the overall mean activity for the region decreased from 41% to 34% during the same timeframe, indicating a misalignment with sector trends highlighted in “European steel demand will recover only modestly”, where high energy costs and geopolitical tensions are expected to hinder market recovery.

North Nippon Muroran Works in Japan shows a relatively stable activity range between 54% and 58% but is susceptible to shifts in demand due to trade relations, as discussed in “Eurofer: US friction delays EU demand recovery.” Meanwhile, the Dexin Steel Morowali plant in Indonesia, while initially active at 44%, has not benefit from recent trends, as indicated by a decline to 39% in June 2025.

Potential supply disruptions are anticipated, especially for regions heavily reliant on automotive demand. Buyers should focus on sourcing from Tata Steel Kalinganagar, which demonstrated slight resilience, and stay agile to monitor changes in North Nippon Muroran’s production given its consistent activity. Procurement strategies should also consider hedging against fluctuations in energy costs and geopolitical impacts that may further exacerbate procurement challenges in an overarching negative market sentiment.