From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Remains Robust Despite Automotive Sector Headwinds: Plant Activity Analysis

Asia’s steel market demonstrates underlying strength despite challenges in the automotive sector linked to US tariffs, as reported in articles such as “Volkswagen stung by tariffs, but trade deal based on US investments may be coming,” “Audi cuts forecast over US tariffs and restructuring costs,” “Porsche AG: Prognose runter – wie reagiert die Aktie?,” and “Wegen US-Zöllen und China BMW-Gewinn bricht um ein Drittel ein“. While these articles highlight the negative impact of tariffs on European automakers’ profitability and forecasts, there’s no direct evidence within these articles to suggest an immediate corresponding downturn in Asian steel production. Satellite-observed activity levels, detailed below, indicate ongoing operations.

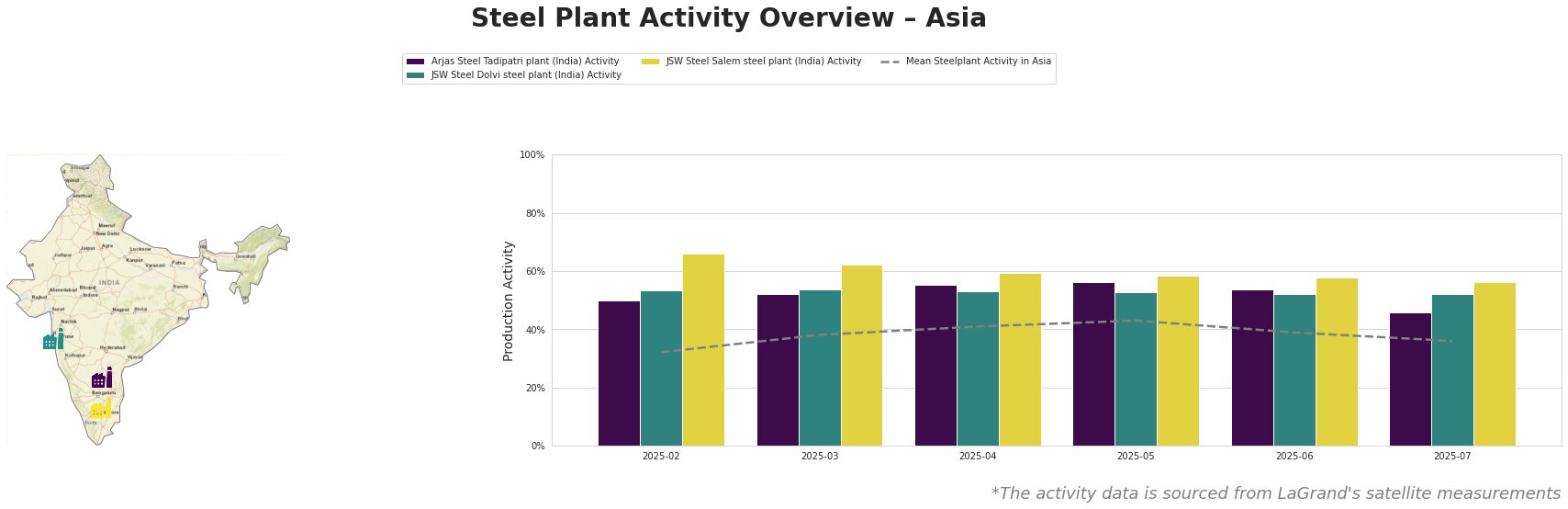

The mean steel plant activity in Asia shows a peak in May (43.0%) followed by a slight decline in June (39.0%) and July (36.0%). Activity at all three observed steel plants mirrors this general downward trend in the months of June and July, but maintains activity levels above the Asia mean.

Arjas Steel Tadipatri plant, located in Andhra Pradesh, India, utilizes integrated BF-BOF processes and has a crude steel capacity of 325 ttpa. It produces finished and semi-finished rolled products like bars and squares for various sectors, including automotive. The plant’s activity decreased to 46.0% in July, down from a high of 56.0% in May. There is no direct link between this drop and the news articles regarding automotive tariffs.

JSW Steel Dolvi steel plant in Maharashtra, India, has a larger capacity of 5000 ttpa crude steel, employing both BF and DRI processes. It produces a wider range of products, including wire rod, cold-rolled steel, and galvanized steel, also serving the automotive sector. The activity level remained relatively stable at 52.0% in July, a slight decrease from 54.0% in March. No direct connection to the automotive tariff news can be established.

JSW Steel Salem steel plant in Tamil Nadu, India, with a 1030 ttpa crude steel capacity and integrated BF process, focuses on hot-rolled products. Its activity decreased to 56.0% in July from a high of 66.0% in February. There is no direct evidence linking this decrease to the news articles about automotive tariffs.

Evaluated Market Implications:

Despite reduced profits in the Automotive sector due to US tariffs as reported in “Volkswagen stung by tariffs, but trade deal based on US investments may be coming,” “Audi cuts forecast over US tariffs and restructuring costs,” “Porsche AG: Prognose runter – wie reagiert die Aktie?,” and “Wegen US-Zöllen und China BMW-Gewinn bricht um ein Drittel ein,” the Asian steel market currently shows no immediate signs of supply disruption. While the news indicates the automotive industry is experiencing financial strain, the satellite-observed data from Indian steel plants do not reflect any significant plant shutdowns or production decreases linked to these automotive market headwinds.

Procurement Actions:

- Monitor Automotive Steel Demand: Steel buyers should closely monitor demand from automotive clients, particularly those exporting to the U.S., for indications of reduced orders stemming from tariff impacts.

- Diversify Steel Procurement: Given the uncertainty surrounding the automotive sector, steel buyers in Asia should diversify their steel procurement portfolio across multiple sectors such as infrastructure and construction, to de-risk against potential demand slowdown from the auto industry.

- Maintain Existing Supplier Relationships: Continue relationships with existing suppliers like Arjas Steel and JSW Steel (Dolvi and Salem) with a continued demand monitoring, as the automotive market adapts to trade adjustments.