From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts Positively to US Tariff Uncertainty; Select Plant Activity Rises

In Asia, steel markets are reacting positively to uncertainty surrounding US trade policies. News articles titled “USA: Zollverbot ist herbe Niederlage für Donald Trump,” “US-Zollpolitik gebremst – Das bedeutetet der Gerichtsentscheid für Trumps Zollpolitik,” and “Washington: Hin und Her um Trumps Zölle vor Gericht – was bedeutet das?” report on the legal challenges to US tariffs, which have created market optimism in Asia. Satellite data shows increasing activity at some Chinese steel plants, though a direct causal relationship to the US tariff news cannot be explicitly established from the available data.

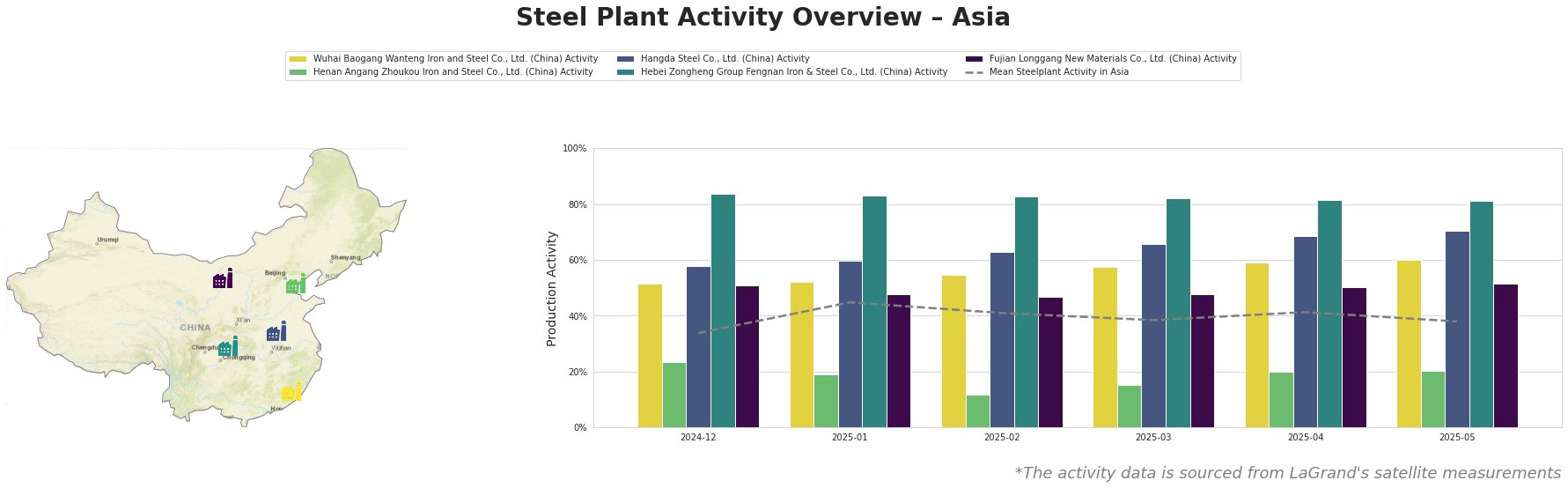

The mean steel plant activity in Asia fluctuated, peaking at 45.0 in January 2025 and ending the period at 38.0 in May 2025. Wuhai Baogang Wanteng Iron and Steel Co., Ltd., an integrated BF/BOF producer in Inner Mongolia with a 2000ktpa crude steel capacity, showed a steady increase in activity from 52.0 in December 2024 to 60.0 in May 2025, significantly above the Asian average. Henan Angang Zhoukou Iron and Steel Co., Ltd., another integrated BF/BOF plant in Henan with 1750ktpa crude steel capacity, experienced a fluctuating activity, starting at 24.0 and decreasing to a low of 12.0 in February 2025, before recovering to 20.0 in May 2025, consistently below the Asian average. Hangda Steel Co., Ltd., a Sichuan-based EAF producer with 1000ktpa crude steel capacity, showed consistent growth, rising from 58.0 in December 2024 to 70.0 in May 2025, well above the regional mean. Hebei Zongheng Group Fengnan Iron & Steel Co., Ltd., a major integrated BF/BOF plant in Hebei with a large 7700ktpa crude steel capacity, maintained high activity, beginning at 84.0 and declining slightly to 81.0 in May 2025, consistently exceeding the Asian average. Fujian Longgang New Materials Co., Ltd., an integrated BF/BOF steel plant with a 1210ktpa crude steel capacity, showed moderate growth from 51.0 to 52.0 over the observed period, consistently performing above the Asian mean. No direct link between plant activity and the news articles can be established based on the information provided.

Evaluated Market Implications:

The news articles “USA: Zollverbot ist herbe Niederlage für Donald Trump,” “US-Zollpolitik gebremst – Das bedeutetet der Gerichtsentscheid für Trumps Zollpolitik,” and “Washington: Hin und Her um Trumps Zölle vor Gericht – was bedeutet das?” highlight the uncertainty around future US trade policies. While no direct link to specific plant activity can be established, the overall positive market reaction coupled with consistently high or increasing activity at plants like Wuhai Baogang Wanteng Iron and Steel and Hangda Steel suggests potential for stable supply.

Recommended Procurement Actions:

- For buyers sourcing from Hangda Steel: Given the consistent increase in activity at Hangda Steel, secure contracts early to capitalize on their increased production capacity and hedge against potential price increases driven by market optimism.

- For buyers relying on Hebei Zongheng Group Fengnan Iron & Steel: While activity remains high, the slight decline warrants close monitoring. Diversify your supply base to mitigate risks associated with potential future production adjustments.