From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Poised for Growth: India-Russia FTA Talks and Increased Plant Activity Signal Bullish Outlook

Asia’s steel market demonstrates a very positive sentiment, driven by potential trade agreements and high production activity. Specifically, the ongoing Free Trade Agreement (FTA) discussions between India and the EU, as reported in “EU Team Lands In India This Week As Push For FTA Deal By Year-End Intensifies“, and between India and Russia, detailed in “PM Modi-Putin Press Meet: India, Russia Agree To Turbocharge Economic Ties By 2030, Push For FTA” and “India-Russia Trade May Touch $100 Billion Before 2030, Says PM Modi“, suggest increased trade flows. Satellite-observed activity changes at specific steel plants show varying trends, some aligning with these developments.

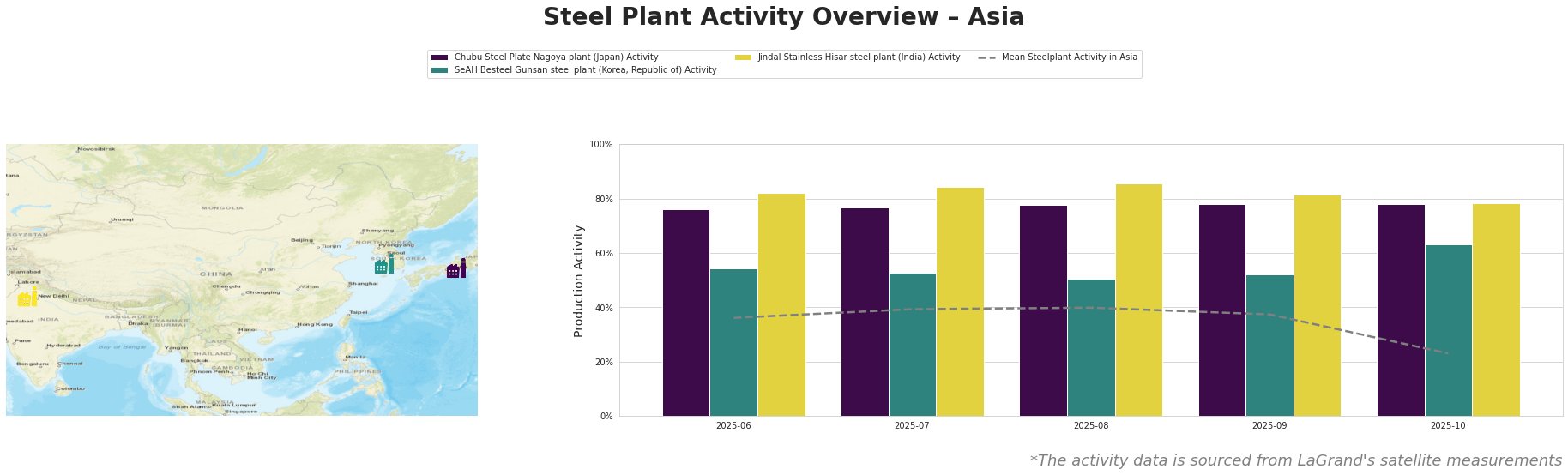

Overall, the mean steel plant activity in Asia decreased significantly in October, dropping to 23.0% from a high of 40.0% in August. Chubu Steel Plate Nagoya plant maintained a stable activity level of approximately 78% throughout the observed period. SeAH Besteel Gunsan steel plant activity decreased from 54.0% in June to 51.0% in August, but then spiked to 63.0% in October. Jindal Stainless Hisar steel plant showed high activity, peaking at 86.0% in August but decreasing to 78.0% in October.

Chubu Steel Plate Nagoya plant, a Japanese steel plant producing 700 ttpa of crude steel via EAF technology, focuses on finished rolled plate products for the automotive, building & infrastructure, tools & machinery, and transport sectors. Its activity has remained consistently high at around 78% from August to October. No direct connection to the cited news articles can be established for this stable, high activity.

SeAH Besteel Gunsan steel plant, a South Korean plant producing 2100 ttpa of crude steel via EAF, specializes in special steel, heavy forged steel, and auto parts. The plant showed a rise of activity from 52.0% in September to 63.0% in October, recovering some of the loss it suffered in the previous months. No direct connection to the cited news articles can be established for this recent increase.

Jindal Stainless Hisar steel plant, an Indian plant producing 800 ttpa of crude steel using EAF technology, produces both semi-finished and finished rolled products, including stainless steel, for diverse sectors. While the plant shows high activity levels, exceeding the Asia mean, the slight decrease to 78% in October doesn’t directly correlate with the FTA news. It’s possible that increased domestic demand, separate from the potential impact of the FTA negotiations, is driving overall production levels at this plant.

Evaluated Market Implications:

The potential FTAs between India and the EU and Russia, as indicated by “EU Team Lands In India This Week As Push For FTA Deal By Year-End Intensifies,” “PM Modi-Putin Press Meet: India, Russia Agree To Turbocharge Economic Ties By 2030, Push For FTA,” and “India-Russia Trade May Touch $100 Billion Before 2030, Says PM Modi,” may lead to increased demand for Indian steel, specifically impacting plants like Jindal Stainless Hisar.

Recommended Procurement Actions:

- Steel Buyers focused on Indian Stainless Steel: Closely monitor the progress of the India-EU and India-Russia FTA negotiations. Given the consistently high activity at Jindal Stainless Hisar, coupled with the potential demand increase from the FTA, proactively secure contracts to mitigate potential price increases.

- Steel Market Analysts: Track specific product segments of the Jindal plant to identify the demand drivers, if any, related to the FTA announcements as these FTAs may influence the demand and prices of plates, strips, and coils. The high activity levels could strain supply, potentially leading to price increases, particularly for stainless steel products.