From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Poised for Growth: Green Steel Investments and Production Shifts Shape Outlook

Asia’s steel market shows positive momentum, driven by significant investments in green steel production and evolving production dynamics. “Japan’s Nippon Steel finalises $6bn EAF investment” and “Nippon Steel to invest $6 billion in electric arc furnaces at three plants in Japan” signal a strong push towards decarbonization and increased EAF capacity. While these articles highlight future production capabilities, no direct connection to the recent observed satellite activity of the selected plants can be explicitly established.

Measured Activity Overview:

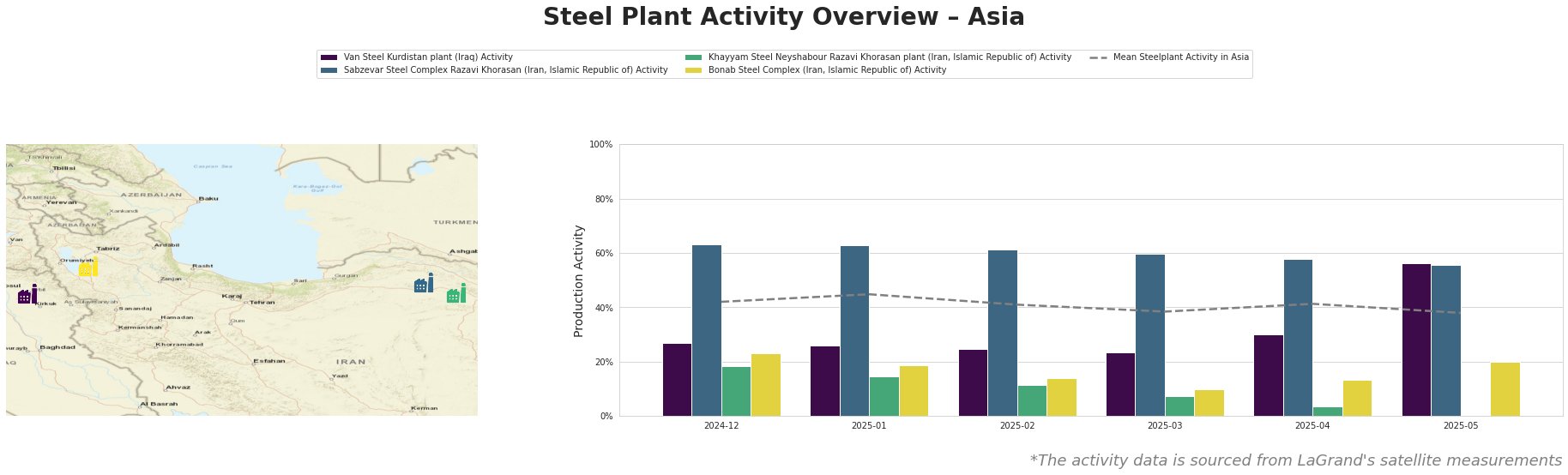

Overall, the mean steel plant activity in Asia has fluctuated, showing a slight decreasing trend from 45% in January 2025 to 38% in May 2025. Van Steel Kurdistan plant’s activity significantly increased to 56% in May 2025, from 30% the previous month, deviating significantly from the mean. Sabzevar Steel Complex maintained relatively high activity, albeit with a gradual decrease. Khayyam Steel Neyshabour experienced a steep decline, reaching a low of 1% in May 2025. Bonab Steel Complex showed some volatility, ending at 20% in May 2025.

Van Steel Kurdistan plant, an EAF-based steel plant with a 750 ttpa crude steel capacity, saw a substantial increase in activity to 56% in May 2025. This represents a notable recovery from a low of 23% in March 2025. This plant has Responsible Steel Certification. There is no explicit connection in the provided news articles to explain this increase in activity.

Sabzevar Steel Complex, another EAF-based plant with an 800 ttpa capacity, exhibited a gradual decline in activity from 63% in December 2024 to 55% in May 2025. This plant has Responsible Steel Certification. There is no explicit connection in the provided news articles to explain this decrease in activity.

Khayyam Steel Neyshabour, producing steel via EAF with a 500 ttpa crude steel capacity and Responsible Steel Certification, experienced a dramatic drop in activity, plummeting to 1% in May 2025. This suggests a significant operational challenge or strategic shift. No direct relationship can be established between this observation and the provided news articles.

Bonab Steel Complex, also operating EAFs with a 1400 ttpa crude steel capacity and Responsible Steel Certification, showed volatility in its activity levels, ending at 20% in May 2025. The activity was at its highest in December at 23%, it decreased gradually until March 2025, after which it slightly recovered. There is no explicit connection in the provided news articles to explain the activity fluctuation.

Evaluated Market Implications:

The finalized $6 billion EAF investment by Nippon Steel, detailed in “Japan’s Nippon Steel finalises $6bn EAF investment” and “Nippon Steel to invest $6 billion in electric arc furnaces at three plants in Japan,” indicates a long-term shift towards green steel production in Japan. In the short term, these investments are unlikely to directly impact current steel availability.

The observed sharp decline in activity at Khayyam Steel Neyshabour plant to 1% in May 2025 could indicate a localized supply disruption, which might affect regional buyers relying on this plant.

Procurement Recommendations:

- Monitor Khayyam Steel Neyshabour: Steel buyers who rely on Khayyam Steel Neyshabour should immediately assess their supply chain risks and consider diversifying sources, given the plant’s significantly reduced activity.

- Factor in Green Steel Premiums: Given JSW Steel’s launch of “GreenEdge” (“India’s JSW Steel launches its own low-emission steel brand“) and Nippon Steel’s emphasis on a “green steel market,” procurement professionals should anticipate and budget for potential price premiums associated with low-emission steel products. Conduct detailed cost-benefit analysis when sourcing green steel.