From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Output Stable Amidst Oil Price Volatility, Plant-Specific Declines Observed

In Asia’s steel market, overall activity remained relatively stable, but with notable plant-specific variations amidst fluctuating global oil market forecasts. The IEA’s revised oil demand forecasts, as indicated in “IEA trims global oil demand forecasts again,” do not yet appear to have a direct, measurable impact on observed steel plant activity in Asia. However, the EIA’s prediction in “US EIA forecasts crude oil to average below $60 by 2026” for lower oil prices by late 2025 and OPEC’s supply adjustments mentioned in “Opec cuts US supply view, Brazil to lead in 2026“, have potential long-term implications on energy costs and, consequently, steel production costs. No direct relationship can be established to plant activity at this point.

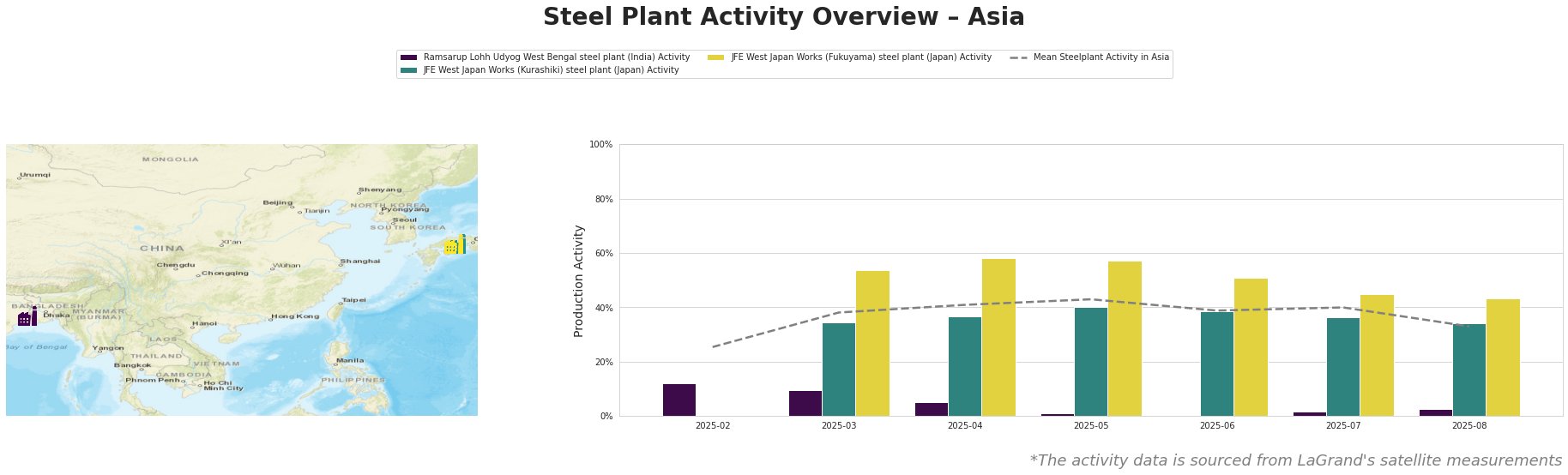

The mean steel plant activity in Asia shows a peak in May 2025 at 43%, declining to 33% by August 2025.

Ramsarup Lohh Udyog West Bengal steel plant: This integrated steel plant in West Bengal, India, operates with both BF and DRI technologies, producing billets, transmission lines, and wires primarily for the energy sector. Activity levels have steadily declined from 12% in February 2025 to 0% in June 2025, before slightly recovering to 3% in August 2025. This represents a significant underperformance compared to the mean Asian activity. There is no direct relationship between the observed activity decline and the provided news articles.

JFE West Japan Works (Kurashiki) steel plant: Located in the Chūgoku region of Japan, this integrated BF steel plant, producing a range of flat and long steel products. Its activity has fluctuated, reaching a peak of 40% in May 2025, before declining to 34% in August 2025. Activity remained close to the mean Asian activity level. There is no direct relationship between the observed activity decline and the provided news articles.

JFE West Japan Works (Fukuyama) steel plant: Also in the Chūgoku region, this large integrated BF steel plant has a crude steel capacity of 13 million tonnes per annum. Its activity has shown a steady decline from a high of 58% in April 2025 to 43% in August 2025, a reduction of 15 percentage points. While consistently outperforming the mean Asian activity, the drop suggests potential adjustments in production. There is no direct relationship between the observed activity decline and the provided news articles.

The observed decline in activity at Ramsarup Lohh Udyog West Bengal steel plant warrants careful monitoring. Although no direct link to the oil market news is established, procurement professionals sourcing from this plant should proactively engage with the supplier to understand the reasons behind the reduced output and assess potential delivery delays. Steel buyers should closely monitor the JFE West Japan Works (Fukuyama) plant, because the significant drop in activity can lead to future price increases.