From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimistic Amid Earnings Season; Plant Activity Shows Mixed Signals with Focus on Tariffs

Asia’s steel market presents a positive outlook, driven by anticipation of strong tech earnings, as highlighted in “Stock market today: Dow jumps, S&P 500 and Nasdaq pace toward records to start Big Tech-dominated earnings week“. Simultaneously, ongoing trade negotiations, detailed in “US stock futures dip with earnings, tariff talks in focus“, could introduce volatility. Satellite data reveals fluctuations in regional steel plant activity, though a direct connection to these articles cannot be definitively established for all plants.

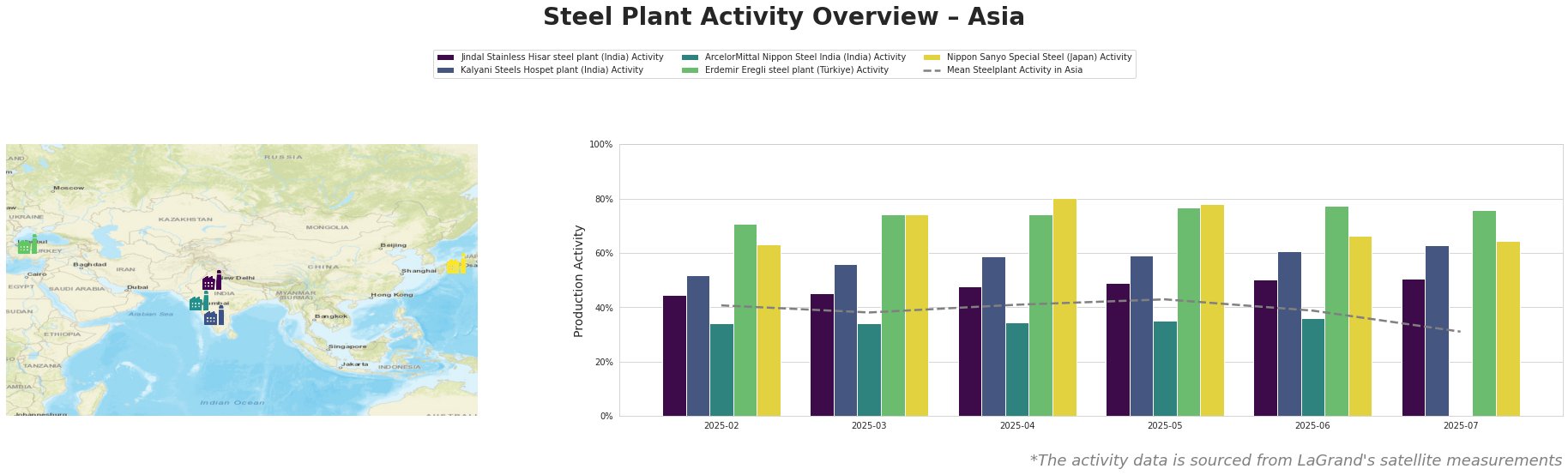

Across Asia, the mean steel plant activity decreased significantly in July, dropping to 31.0% from 39.0% in June, signalling a possible slowdown in regional output. Jindal Stainless Hisar maintained a consistently above-average activity level, reaching 51.0% in July, while Kalyani Steels also showed strong activity, peaking at 63.0% in July. Erdemir Eregli consistently operated at high activity levels (above 70%). Nippon Sanyo Special Steel showed a decrease in activity in July. Data for ArcelorMittal Nippon Steel India is unavailable for July, limiting trend analysis.

Jindal Stainless Hisar, an 800,000 tonnes per annum (ttpa) EAF-based stainless steel producer, has shown a consistent upward trend in activity, reaching 51% in July, well above the Asian average. Specializing in stainless steel products for various sectors, including automotive and infrastructure, this sustained activity could indicate strong domestic demand, but no explicit connection to the provided news articles can be established.

Kalyani Steels Hospet, an integrated steel plant with 860 ttpa crude steel capacity using both BF/BOF and DRI/EAF routes, has demonstrated strong activity growth, reaching 63% in July, also above the regional average. Their focus on rolled bars for automotive and construction suggests resilient demand in these sectors, but there is no direct link to the named news articles.

ArcelorMittal Nippon Steel India, a large integrated steel plant with a 9,600 ttpa crude steel capacity, had relatively low activity levels (around 35%) until June. However, the absence of July data prevents trend analysis. Operating BF, DRI, and EAF technologies and producing diverse flat products, any disruption here could significantly impact regional supply. Without July data, drawing explicit connections to news articles is not possible.

Erdemir Eregli, a 4,000 ttpa integrated BF/BOF steel plant, has consistently demonstrated high activity (above 70%) which went down slightly in July. Specializing in flat steel products for automotive and other sectors, this consistent output indicates stable market demand for their products. The fact that “Stock market today: Nasdaq, S&P 500 slide amid wave of earnings as tariffs bite GM profit“, mentions tariffs biting into GM profit, could mean potential challenges for Erdemir Eregli as it targets the automotive industry.

Nippon Sanyo Special Steel, a 1,596 ttpa EAF-based special steel producer, experienced a notable drop in activity from 78% in May to 64% in July, although remaining above the mean for Asia. Producing specialized bars and tubes, a potential slowdown here might reflect sector-specific challenges, but a direct link to the news articles cannot be confirmed.

Given the potential impact of tariffs on specific sectors, as highlighted in “Stock market today: Nasdaq, S&P 500 slide amid wave of earnings as tariffs bite GM profit“, steel buyers are advised to closely monitor trade policy developments and their potential impact on material costs and supply chains. The high and stable activity observed at Erdemir Eregli suggests it could be a reliable source of flat steel products, but potential tariff implications should be considered. The reduced activity for Nippon Sanyo should trigger an analysis of their product availability.