From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism: Vietnam’s Imports Surge Amidst Stable Plant Activity

Vietnam’s increasing steel imports, as highlighted in “Vietnam’s steel imports up 11.6 percent in April from March,” contrast with generally stable steel plant activity levels observed across key Asian producers. While the article itself does not directly explain regional plant activity levels, satellite data offers insights into production trends that help contextualize Vietnam’s import behavior. No direct relationship could be established between the other US-focused news articles and the presented Asian steel plant activities.

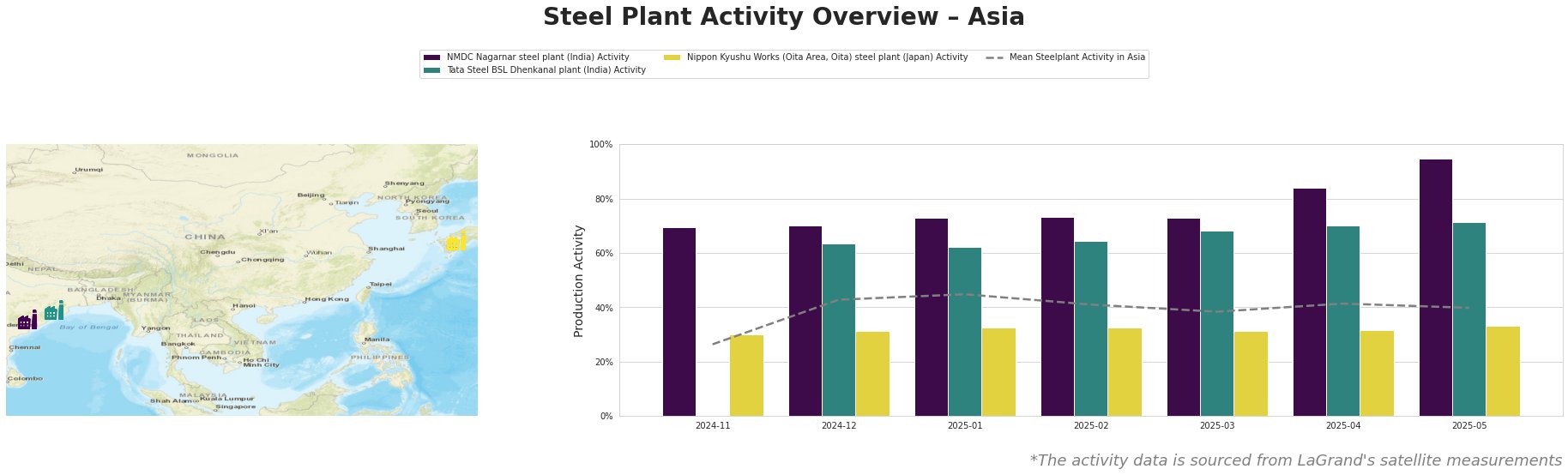

Overall, average steel plant activity in Asia has fluctuated moderately, remaining between 38% and 45% since December 2024, with a slight dip in March 2025. NMDC Nagarnar steel plant consistently operates well above the mean, showing a significant increase to 95% activity in May 2025. Tata Steel BSL Dhenkanal plant shows stable activity between 62% and 71%. Nippon Kyushu Works activity shows very little change and activity is substantially below the mean.

NMDC Nagarnar steel plant, an integrated BF-BOF operation in Chhattisgarh, India, primarily produces finished rolled products like hot rolled coils, sheets, and plates. Its activity has shown consistent growth, reaching 95% in May 2025. The observed high activity levels were not explicitly linked to any of the provided news articles.

Tata Steel BSL Dhenkanal plant, located in Odisha, India, employs both BF and DRI processes. Its activity levels remained relatively stable, fluctuating between 62% and 71% over the observed period. As with NMDC Nagarnar, no direct connection between the plant’s activity and news articles could be established.

Nippon Kyushu Works (Oita Area, Oita) steel plant, a major integrated BF-BOF producer in Japan, focuses on semi-finished and finished rolled products. Its activity remained consistently low, around 30-33% throughout the period. No direct connection could be established between the plant’s stable, below-average activity and any specific news events.

The increase in Vietnam’s steel imports, coupled with the stable to increasing activity at key Indian steel plants (NMDC Nagarnar and Tata Steel BSL Dhenkanal), suggests that regional supply is likely sufficient to meet demand. However, the “Vietnam’s steel imports up 11.6 percent in April from March” article indicates a possible shift in sourcing dynamics, especially considering China’s reduced steel exports to Vietnam in the January-April period.

Procurement Action:

Steel buyers should carefully monitor Vietnamese import data and regional production trends. Given the increase in Vietnamese imports as reported in “Vietnam’s steel imports up 11.6 percent in April from March“, combined with high activity at the NMDC Nagarnar steel plant, it is recommended to explore potential partnerships with Indian suppliers, especially for hot rolled coils, sheets, and plates. Further, buyers should closely monitor supply chains originating in Indonesia, since this country saw remarkable growth in steel exports to Vietnam.