From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism: India’s Trade Deals Boost Plant Activity Amidst Fluctuations

Asia’s steel market shows a very positive outlook, influenced by India’s active pursuit of Free Trade Agreements. Specifically, the satellite-observed activity increase in the Kalyani Steels Hospet plant in India may be related to ongoing trade discussions as mentioned in “India-EU FTA Talks Enter Final Leg As Goyal Heads To Brussels, EU Team Lands In Delhi“. There is no direct relationship between the other news articles and changes in activity at other plants.

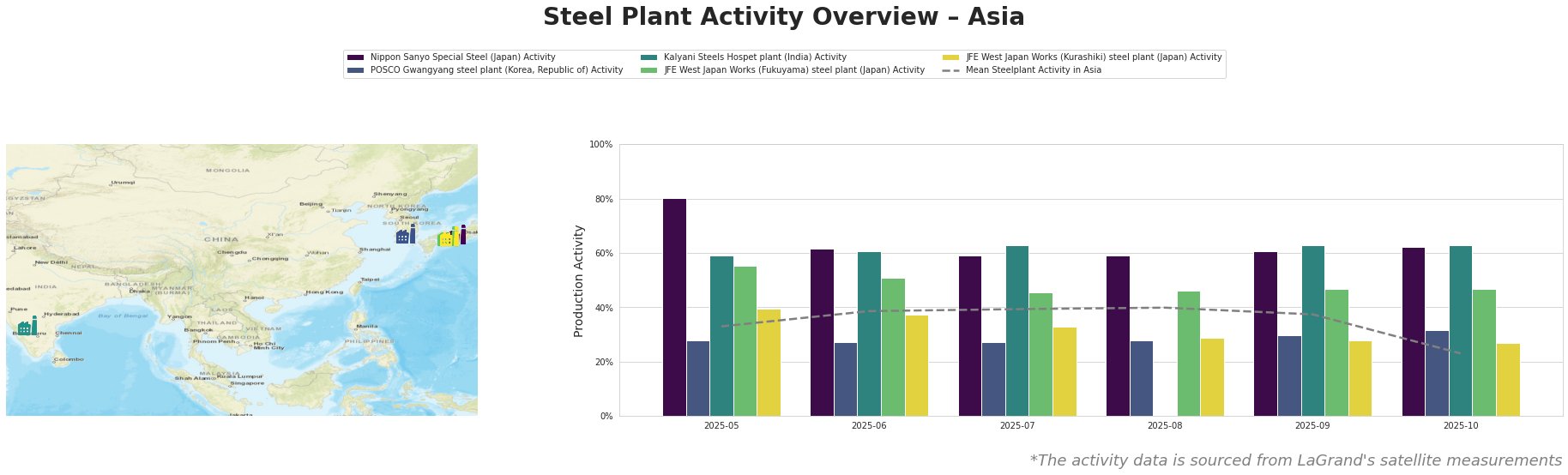

Across Asia, the mean steel plant activity witnessed a significant drop in October to 23% after remaining relatively stable between 33% and 40% from May to September. Nippon Sanyo Special Steel consistently operated above the Asian mean, maintaining activity between 59% and 80%, showing relative stability. POSCO Gwangyang steel plant operated consistently below the mean, with only a slight increase in activity up to 32% in October. Kalyani Steels Hospet plant activity increased from 59% in May to a stable 63% from July onwards, performing significantly above the mean. JFE West Japan Works (Fukuyama) steel plant activity decreased from 55% in May to 47% in October. JFE West Japan Works (Kurashiki) steel plant showed a continuous decline from 39% in May to 27% in October.

Nippon Sanyo Special Steel, located in the Kansai region of Japan, operates primarily with Electric Arc Furnaces (EAF) to produce 1.596 million tonnes of crude steel annually, focusing on semi-finished and finished rolled products, including bars and tubes, for the automotive, energy, and machinery sectors. Activity has been relatively stable from May to October. There is no direct relationship between the satellite-observed activity at Nippon Sanyo Special Steel and the provided news articles.

POSCO Gwangyang steel plant in South Jeolla, South Korea, is an integrated steel plant with a capacity of 23 million tonnes of crude steel using Blast Furnace-Basic Oxygen Furnace (BF-BOF) processes, also employing EAFs. It produces a range of finished rolled products, including hot and cold-rolled steel, galvanized steel, and stainless steel, serving various sectors from automotive to construction. Activity remains below the Asian mean, with only a slight increase in activity up to 32% in October. There is no direct relationship between the satellite-observed activity at POSCO Gwangyang steel plant and the provided news articles.

Kalyani Steels Hospet plant in Karnataka, India, utilizes both Blast Furnace (BF) and Direct Reduced Iron (DRI) processes, along with BOF and EAF technologies, to produce 0.86 million tonnes of crude steel. It focuses on semi-finished and finished rolled products like rolled and machined bars for automotive and engineering applications. Activity remained stable at 63% from July to October, significantly above the Asian mean. The ongoing India-EU FTA negotiations, as mentioned in “India-EU FTA Talks Enter Final Leg As Goyal Heads To Brussels, EU Team Lands In Delhi,” may be contributing to the consistently high activity at this plant due to anticipated export opportunities.

JFE West Japan Works (Fukuyama) steel plant, located in the Chūgoku region of Japan, is an integrated BF-BOF plant with a crude steel capacity of 13 million tonnes. It manufactures a wide array of products, including hot and cold-rolled sheets, plates, and structural sections, catering to diverse sectors. Activity decreased from 55% in May to 47% in October. There is no direct relationship between the satellite-observed activity at JFE West Japan Works (Fukuyama) steel plant and the provided news articles.

JFE West Japan Works (Kurashiki) steel plant, also in the Chūgoku region of Japan, is another integrated BF-BOF steelmaking facility, producing 10 million tonnes of crude steel annually. Its product portfolio mirrors that of the Fukuyama plant, with a focus on flat and long products for various industries. Activity has shown a continuous decline from 39% in May to 27% in October. There is no direct relationship between the satellite-observed activity at JFE West Japan Works (Kurashiki) steel plant and the provided news articles.

India’s focus on securing trade deals, as highlighted by “India-US Trade Talks: Piyush Goyal Says Working Towards Fair, Equitable Deal” and “Intense, But Productive: Piyush Goyal Wraps Up Brussels Talks As EU FTA Nears ‘Fruition’“, suggests a strategic move to boost domestic steel production and exports.

Evaluated Market Implications:

The sustained high activity at Kalyani Steels Hospet plant, potentially linked to India’s FTA negotiations, indicates a possible advantage for steel buyers sourcing from this plant. Given the overall positive sentiment surrounding India’s trade deals, potential supply disruptions are limited.

Recommended Procurement Actions:

- Steel Buyers focused on Indian steel should prioritize Kalyani Steels Hospet plant: The consistent high activity level (63% from July to October) and possible FTA benefits suggest reliable supply and potentially favorable pricing.

- Market Analysts should monitor India-EU FTA developments closely: Success in these negotiations could further enhance the competitiveness of Indian steel producers, impacting regional trade flows.