From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Nippon Steel’s US Acquisition Fuels Optimism Amid Fluctuating Plant Activity

The Asian steel market remains very positive, with Nippon Steel’s strategic moves impacting sentiment. Recent satellite observations show varied activity across key Asian steel plants. The approval of “Trump approves Nippon Steel’s acquisition of USS“ and related articles indicates potentially stronger US demand for Nippon Steel, but no direct impact on observed Asian plant activity can be explicitly established based on provided data.

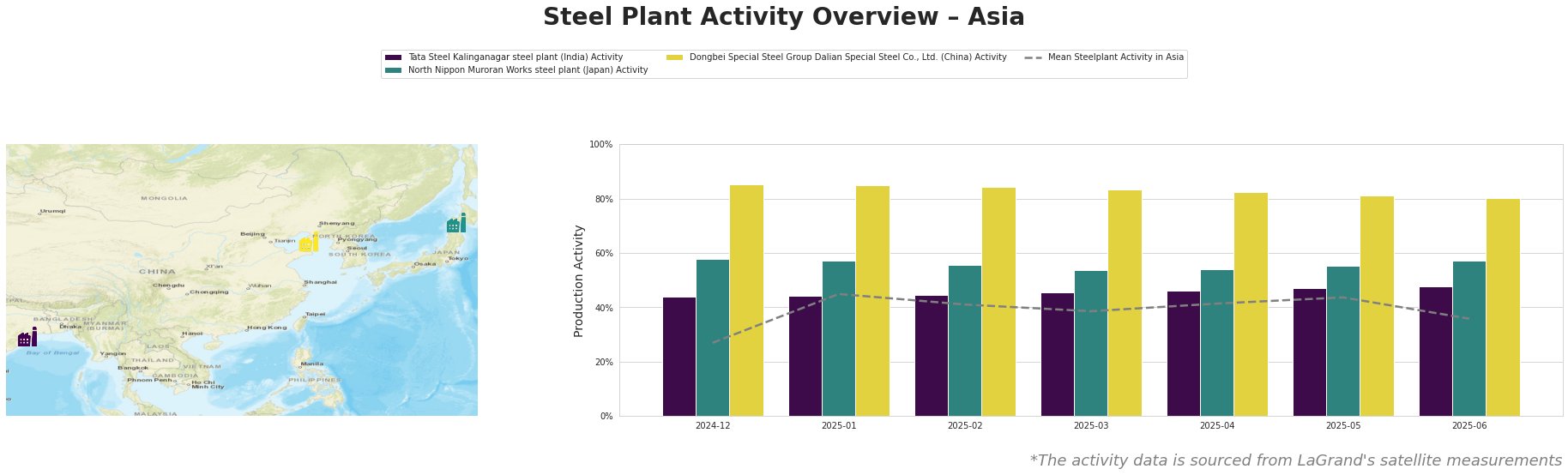

Overall, the mean steel plant activity in Asia has fluctuated, starting at a low of 27.0% in December 2024, peaking at 45.0% in January 2025, and then trending downwards to 36.0% by June 2025.

The Tata Steel Kalinganagar plant in India, an integrated BF steel plant with a 3000 ktpa crude steel capacity, shows steadily increasing activity, from 44.0% in December 2024 to 48.0% in June 2025, consistently outperforming the Asian average. No direct link between this increase and the Nippon Steel acquisition news can be established.

The North Nippon Muroran Works plant in Japan, operating with both BF and EAF technologies and a 2598 ktpa crude steel capacity, saw its activity decrease from 58.0% in December 2024 to 54.0% by April 2025, before increasing to 57.0% in June 2025. It is a plant that manufactures semi-finished and finished rolled bars and wires primarily for the automotive industry. Its activity has been consistently above the overall Asian average. While “Trump approves Nippon Steel’s acquisition of USS” emphasizes Nippon Steel’s focus on the US market and potential investments there, a direct causal relationship between that news and the observed activity fluctuations at the Muroran plant cannot be established.

Dongbei Special Steel Group’s Dalian Special Steel plant in China, an integrated BF plant with EAF capacity producing stainless and automotive steel, showed high activity, starting at 85.0% in December 2024 and gradually declining to 80.0% by June 2025. Despite the general positive sentiment surrounding the Nippon Steel acquisition as per articles like “Trump Approves Nippon Steel’s US$14.9 Billion Purchase of U. S. Steel“, no direct connection to this specific plant’s activity trend can be derived from the provided information.

Given the approval of Nippon Steel’s acquisition of US Steel, as highlighted in “Trump approves $14.9 billion takeover of US Steel by Japan’s Nippon Steel“, and the potential shift in Nippon Steel’s focus and investment towards the US market, steel buyers should:

- Monitor Japanese steel export prices closely: The increased investment in US Steel could lead to adjustments in Nippon Steel’s production and export strategies from its Japanese plants, potentially affecting steel prices and availability in Asia.

- Assess alternative supply sources: Buyers who heavily rely on Nippon Steel should evaluate and diversify their supplier base, considering the possibility of shifted priorities and potential supply adjustments due to the acquisition.

- Closely monitor market impact on Automotive steel: Considering the automotive industry is a Key End User Sector for both Tata Steel Kalinganagar and North Nippon Muroran Works, changes in export policy could have a significant impact.