From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Miyaneh Steel Ramps Up as US Tariffs Cloud Global Trade

Asia’s steel market reflects a complex interplay of global trade dynamics, notably influenced by potential shifts in US trade policy. The activity data indicates increasing steel production, even as uncertainty looms in the global market due to changes in US tariffs. The news article “Uncertainty over new tariffs ‘killing’ US steel demand” highlights a potential slowdown in US steel demand, with “President Trump’s potential tariffs…raising raw material costs for US steelmakers, putting upward pressure on prices.” There is no direct evidence that the increase in production activity in Asia is connected to a decline in US demand due to tariffs.

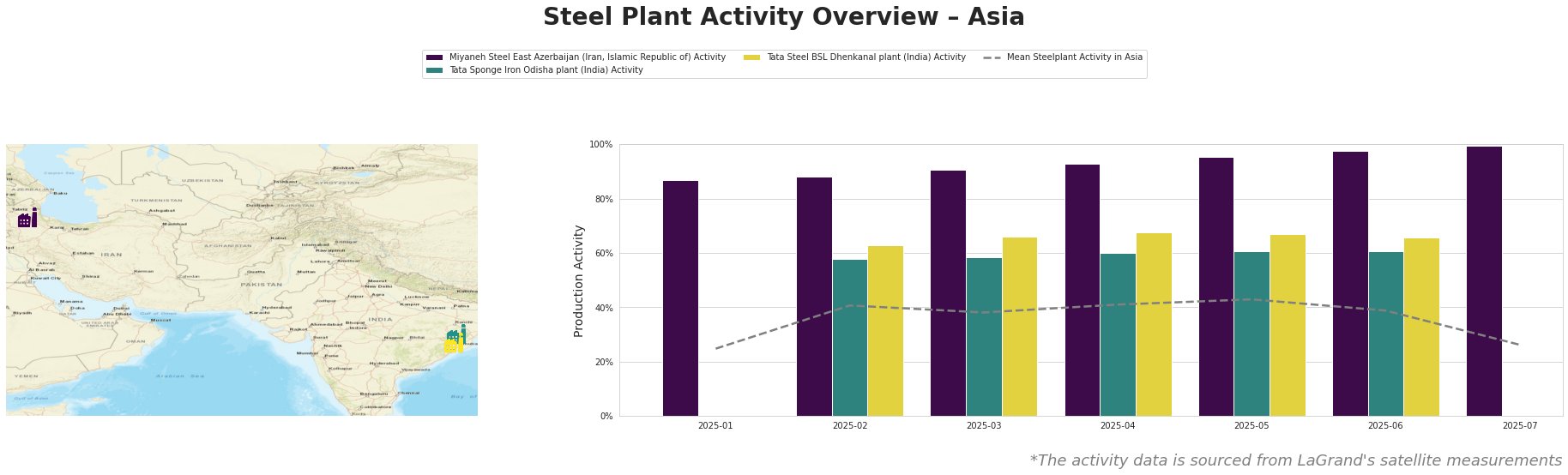

The average steel plant activity in Asia fluctuated throughout the first half of the year, with a peak in May (43%) and a noticeable drop to 26% in July.

Miyaneh Steel East Azerbaijan, an 800,000 tonne per year DRI-EAF based plant in Iran, shows consistently high and increasing activity. Starting at 87% in January 2025, its activity steadily increased to 100% by July 2025, significantly exceeding the Asian average. There is no explicit connection between its performance and the news articles provided.

Tata Sponge Iron Odisha plant, a 400,000 tonne per year DRI plant in India, showed stable activity from February to June 2025, ranging between 58% and 61%. The activity levels are clearly above the Asian average, but there is no explicit connection between its performance and the news articles provided.

Tata Steel BSL Dhenkanal plant, an integrated BF-DRI plant in India with a 5.6 million tonne crude steel capacity, showed consistent activity between 63% and 67% from February to June 2025. The activity levels are clearly above the Asian average, but there is no explicit connection between its performance and the news articles provided.

The potential disruption to the US scrap market, as described in “Trump’s new tariffs could restrict scrap supplies to the US from the EU,” might indirectly influence global steel prices, potentially increasing demand for steel and DRI from other sources. Given the consistent and high activity levels at Miyaneh Steel and the Tata Plants, purchasing professionals seeking to diversify their supply chains should assess the potential for DRI and steel procurement from these facilities, especially if US tariffs continue to disrupt established trade routes.