From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Signals Amidst Production Cuts and Export Shifts

Asia’s steel market presents a mixed picture, with production adjustments in key regions and shifting export dynamics impacting supply and demand. “China reduced steel production by 2.8% in 8 months” indicates a potential supply constraint, while “Japan’s steel exports down 4.2 percent in January-August 2025” points to a changing competitive landscape. The satellite data provides insights into individual plant activity, but at this time a direct correlation between these broad trends and observed changes in specific steel plant activity can not be definitively established.

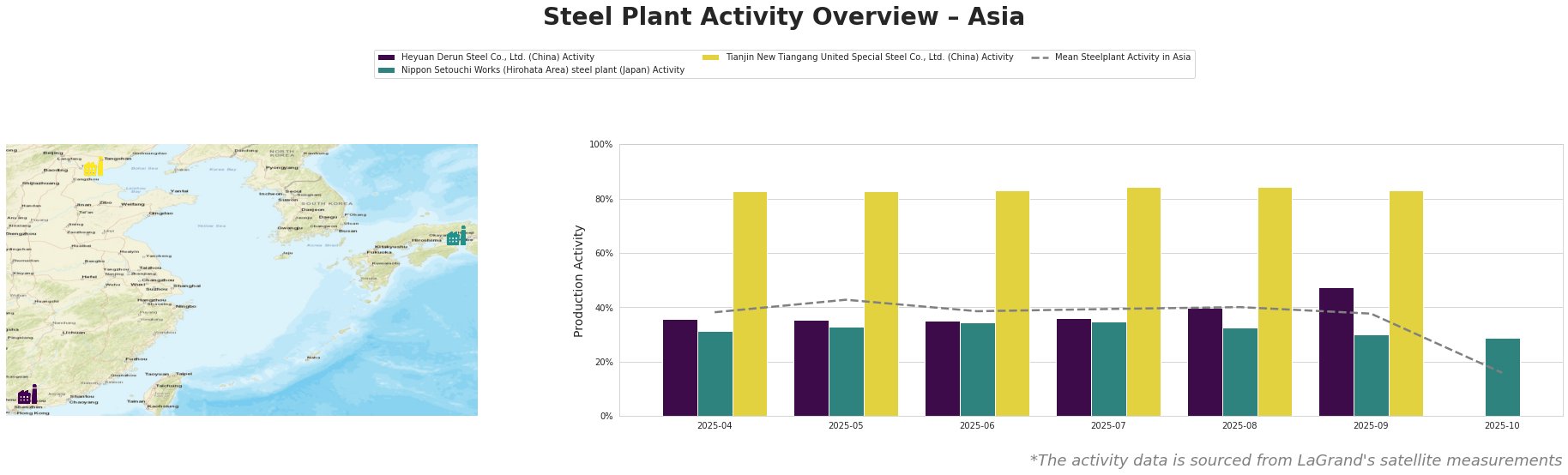

The mean steel plant activity in Asia shows fluctuation between 38% and 43% from April to September, then a significant drop to 16% in October.

Heyuan Derun Steel Co., Ltd., a Chinese EAF-based steel plant with a capacity of 1.2 million tons of crude steel, primarily produces hot-rolled rebar and billets. Its activity level remained relatively stable between April and August, fluctuating between 35% and 40%. A notable increase to 48% was observed in September, exceeding the Asian average. Given China’s overall steel production decrease reported in “China reduced steel production by 2.8% in 8 months”, this localized increase at Heyuan Derun suggests a potential shift in regional production dynamics within China, and/or this plant increased production.

Nippon Setouchi Works (Hirohata Area) steel plant, a Japanese BOF-based plant with a capacity of 2.816 million tons of crude steel, which primarily produces sheets. The plant activity showed a generally decreasing trend from April (31%) to October (29%). These level are below the Asian mean activity. This decline might correlate with the overall decrease in Japanese steel exports reported in “Japan’s steel exports down 4.2 percent in January-August 2025,”.

Tianjin New Tiangang United Special Steel Co., Ltd., a Chinese integrated BF-BOF steel plant with a capacity of 4.5 million tons of crude steel, focuses on angle steel and continuous casting billets. This plant maintained a consistently high activity level around 83-84% from April to September, far exceeding the Asian average. While “China reduced steel production by 2.8% in 8 months,” this plant appears to be operating at a high capacity, potentially offsetting some of the overall production cuts.

Evaluated Market Implications:

-

Potential Supply Disruptions: The reduction in Japanese steel exports, combined with the drop in overall Chinese steel production, could lead to regional supply constraints, particularly in areas traditionally served by these producers.

-

Recommended Procurement Actions:

- Steel Buyers focused on Rebar: Given the increasing activity at Heyuan Derun Steel Co., Ltd. (+8% between August and September), and its focus on rebar production, procurement professionals should consider this plant a reliable source, especially in light of overall Chinese production cuts. This is further substantiated by the Turkish news article “Turkish rebar exports up 21 percent in January-August 2025”, suggesting that global demand for rebar is up, so Heyuan Derun Steel Co., Ltd.’s increase in activity could be advantageous to procurement professionals, as the increased demand for rebar may offset the general steel decrease in Asia.

- Diversification for Japanese Steel Customers: Procurement professionals reliant on steel sheets from Japan, given the declining activity at Nippon Setouchi Works and the overall export decline, should actively diversify their supply base to mitigate potential disruptions. Consider alternative suppliers from countries not experiencing similar export declines.