From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Activity Amidst Global Uncertainty

Asia’s steel market presents a mixed picture, with variations in plant activity observed across the region. While no direct links can be established between the provided news articles focused on US political developments, such as “Liveblog USA unter Trump: US-Richterin stoppt Trumps Massenentlassungen im „Shutdown“ | FAZ” and recent changes in plant activity levels, the US developments might influence global trade and steel demand indirectly, which requires monitoring.

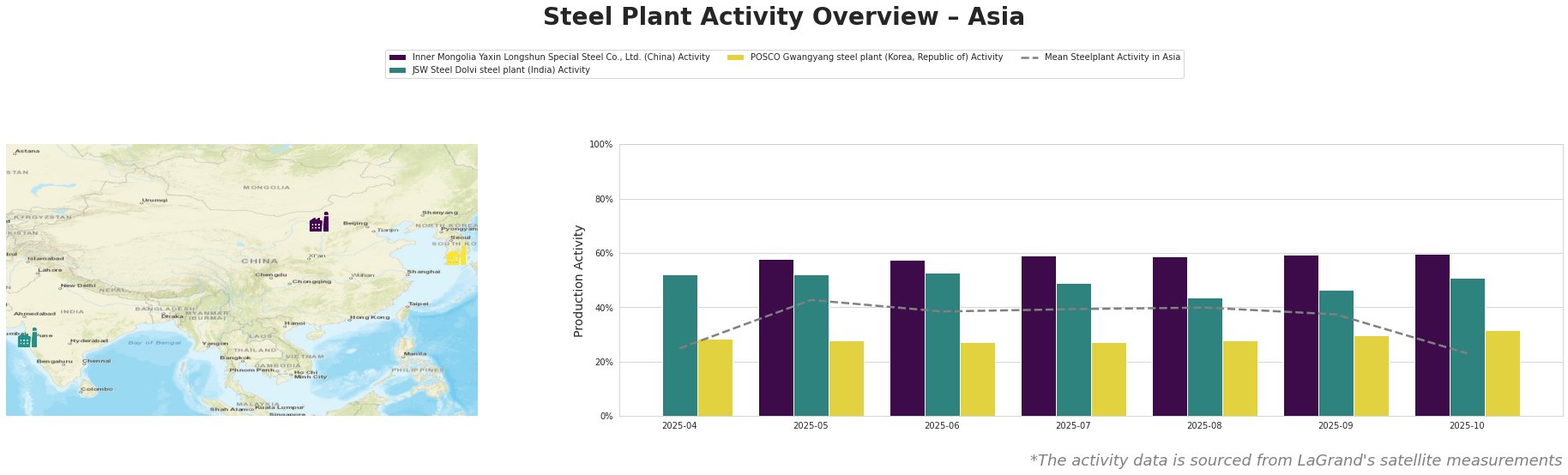

The mean steel plant activity in Asia shows a significant dip in October to 23.0%, after hovering between 37% and 43% for the previous five months. This broad downward trend could indicate weakening regional demand, though further investigation is needed to confirm this.

Inner Mongolia Yaxin Longshun Special Steel Co., Ltd.: This Chinese integrated steel plant, relying on BF and BOF technologies and boasting a 2,000kt crude steel capacity, shows consistently high activity. Its activity levels remained stable around 58-60% from May to October, even as the Asian mean dropped in October. This suggests sustained demand for its high-strength rebar and wire products, independent of the broader regional trend. No direct connection to the provided news articles can be established.

JSW Steel Dolvi steel plant: This Indian plant, with a 5,000kt crude steel capacity and integrated BF and DRI processes, demonstrated fluctuations in activity. From a high of 53% in June, it dropped to 44% in August before recovering to 51% in October. These variations may reflect changing domestic demand for its diverse product range, including wire rod, hot-rolled, and galvanized steel. Given the plant’s reliance on both BF and DRI, variations may stem from operational adjustments, such as capacity expansions. No direct connection to the provided news articles can be established.

POSCO Gwangyang steel plant: This major South Korean plant, possessing a 23,000kt crude steel capacity primarily using BOF technology, operated at relatively low activity levels ranging from 27% to 32%. It showed the largest relative increase in the last reported month. The moderate activity, significantly below its capacity, could be due to several factors, including export market dynamics, domestic demand, or maintenance schedules. No direct connection to the provided news articles can be established.

Evaluated Market Implications:

The satellite data shows high volatility.

- Potential Supply Disruptions: The significant drop in the average steel plant activity across Asia in October, coupled with the consistent high activity at Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., suggests that while the overall regional supply might be decreasing, specific plants might be experiencing higher demand.

- Recommended Procurement Actions:

- Steel buyers should monitor the trend change in POSCO Gwangyang. The increased activity in October might signal a potential increase in finished steel availability for specific products like hot-rolled, plate, and galvanized steel. Buyers should check if the increased production would lead to lower prices.

- Given the high, consistent activity at Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., buyers seeking high-strength rebar and wire should consider securing contracts with this supplier to ensure a stable supply, particularly if the broader regional decline in steel production continues.