From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Kazakhstan HBI Boost Offsets China Slowdown, Creating Opportunities

Asia’s steel market presents a mixed landscape. A major capacity expansion in Kazakhstan, indicated by the news articles “ERG to build $1.2 billion HBI plant in Kazakhstan with Primetals and Midrex,” “Eurasian Resources Group to become global supplier of HBI,” and “ERG to build HBI plant in Kazakhstan worth more than $1.2 billion,” is occurring amidst a recent dip in average regional steel plant activity. While these news articles highlight future production capacity, no direct, immediate impact can be established in observed Asian plant activity, since this capacity will only come online in 2029. However, these articles are very positive, indicating increased long-term supply and potentially downward price pressure on HBI.

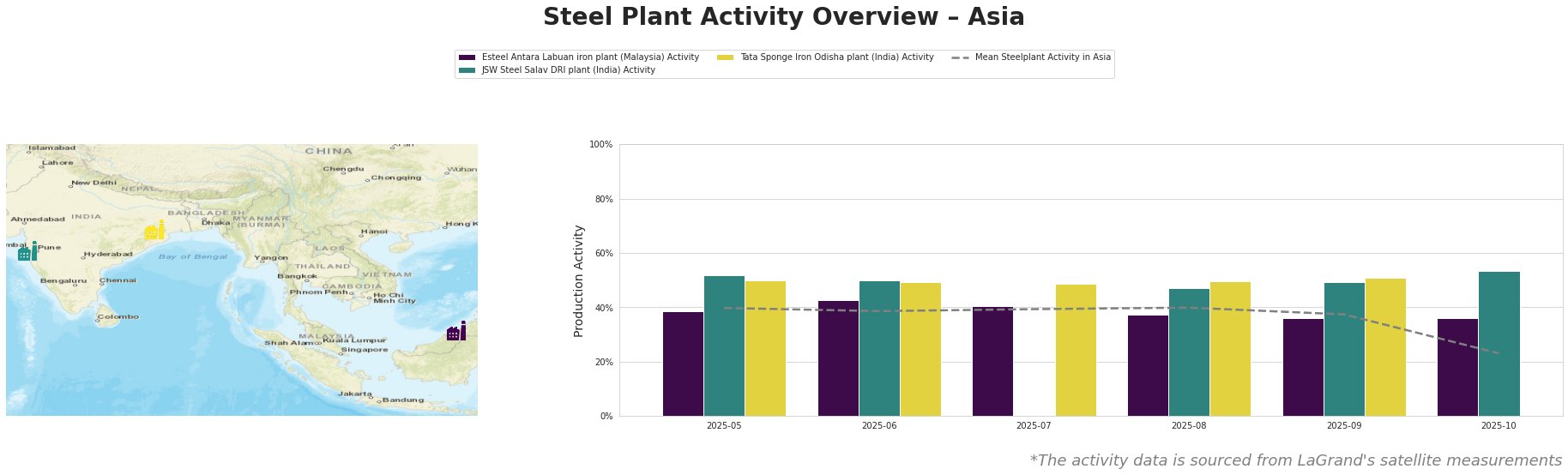

Across all Asian plants the overall mean activity shows a significant drop to 23% in October.

Esteel Antara Labuan iron plant, JSW Steel Salav DRI plant and Tata Sponge Iron Odisha plant show different activity levels.

Esteel Antara Labuan iron plant (Malaysia), primarily producing HBI via DRI with a capacity of 900 ttpa of Iron, experienced relatively stable activity from May to October, fluctuating between 36% and 43%. The most recent activity in October stands at 36%. This is below the regional average in all months and significantly below the average in October. No direct connection can be established between this activity and the provided news articles.

The JSW Steel Salav DRI plant (India), a 1000 ttpa DRI/HBI producer, displayed relatively stable activity, at or above the Asian average until October. The plant shows the highest October activity level of all plants in the observation set, at 53%. No direct relationship can be established between this activity and the provided news articles.

Tata Sponge Iron Odisha plant (India), with a DRI capacity of 400 ttpa, also shows relative stability above the mean until October, when it was not observed. No direct connection can be established between this activity and the provided news articles.

The significant drop in overall Asian steel plant activity in October does not appear to be directly related to capacity expansions in Kazakhstan. However, the news articles “HBIS Tangsteel accepts world’s largest push-pull pickling line from Primetals” and “Primetals implements advanced process automation systems at Rizhao Steel plant” highlight efficiency and quality improvements at Chinese steel plants. These improvements may be associated with temporary shutdowns, which could partially explain the overall decline. However, there is no direct, explicit connection and more data points are needed for full understanding.

Evaluated Market Implications:

The forthcoming HBI production from Kazakhstan (2 million tons annually starting in 2029) may eventually alleviate some supply pressure in the HBI market. However, the drop in mean Asian activity in October could indicate a potential supply disruption in the short term, specifically with hot-rolled coil, as indicated by the “HBIS Tangsteel accepts world’s largest push-pull pickling line from Primetals” article; the observed activity drop might be linked with shut downs of similar pickling lines in other plants. Given the high degree of uncertainty, steel buyers should:

- Monitor HBI prices closely: Track HBI market prices for signals of anticipated supply changes based on the planned Kazakhstan production.

- Diversify HBI supply: Explore alternative HBI suppliers to mitigate potential disruptions from planned or unplanned shutdowns.

- Assess hot-rolled coil supply chains: Evaluate current hot-rolled coil suppliers for potential impacts from the implementation of new technologies. Contact current suppliers and proactively discuss their plans to adopt process automation technologies and resulting downtime.