From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Jindal’s ThyssenKrupp Bid & Mixed Plant Activity Signals Cautious Outlook

The Asian steel market presents a neutral outlook, influenced by India’s Jindal Steel’s strategic moves in Europe and fluctuating domestic plant activity. The potential acquisition of ThyssenKrupp Steel Europe by Jindal, as reported in “India’s Jindal Steel submits offer to acquire Thyssenkrupp steel business in Germany,” “India’s Jindal bids for ThyssenKrupp Steel Europe,” and “Jindal Steel prepared to continue thyssenkrupp’s green transformation,” signals a long-term shift in global steel production dynamics, though its immediate impact on Asian supply is not directly observable in current plant activity data.

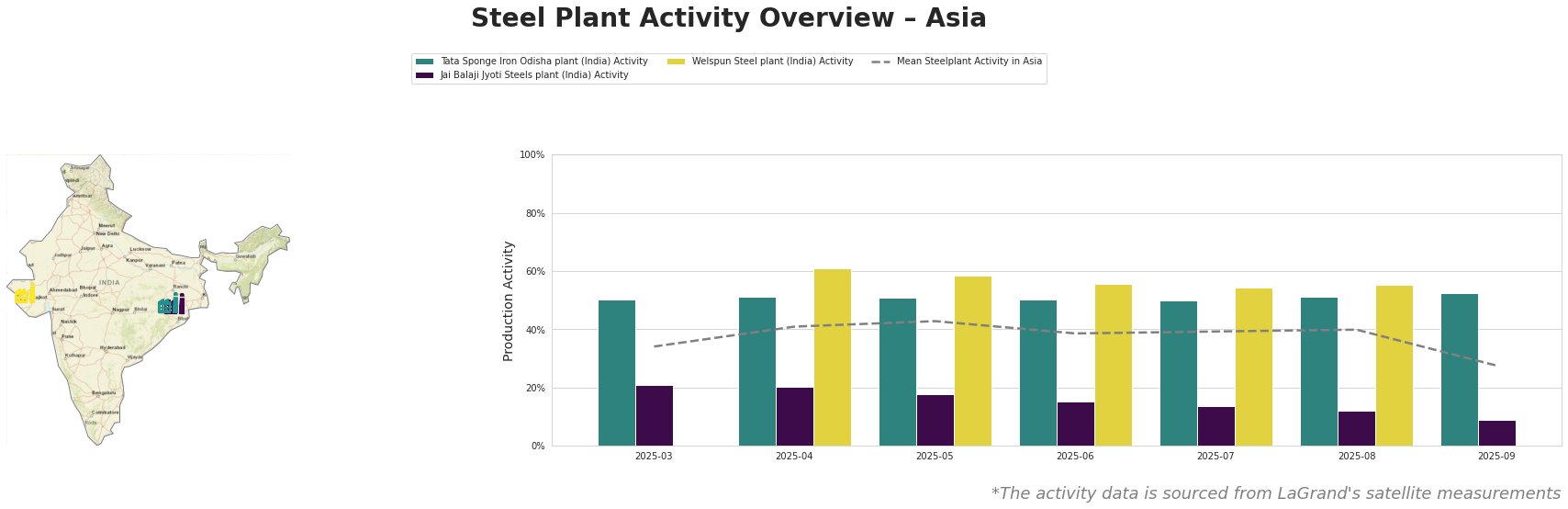

The mean steel plant activity in Asia saw a decrease from 40% in August to 28% in September. The Tata Sponge Iron Odisha plant showed a slight increase, ending at 53% in September, contrasting with the overall downward trend. The Jai Balaji Jyoti Steels plant experienced a continuous decline, reaching a low of 9% in September. Welspun Steel plant activity was last measured in August at 55%, showing a moderate decline from April to August.

Tata Sponge Iron Odisha plant, a DRI-focused facility in Odisha with 400ktpa iron capacity and ResponsibleSteel certification, showed relatively stable activity between March and August (50-51%) and a slight increase to 53% in September. No direct link can be established between this stable-to-increasing activity and the news surrounding Jindal’s bid for ThyssenKrupp.

Jai Balaji Jyoti Steels plant, also in Odisha, with 92ktpa crude steel capacity (EAF-based with DRI) and ResponsibleSteel certification, demonstrates a consistent decline in activity from 21% in March to 9% in September. The decline does not show a direct correlation to the news regarding Jindal Steel.

Welspun Steel plant, located in Gujarat, features 120ktpa DRI capacity and 288ktpa crude steel capacity. It produces TMT rebars, ingots, and billets primarily for the building and infrastructure sector. The plant activity decreased from 61% in April to 55% in August (last available data). There is no obvious direct relationship between this plant’s activity trend and Jindal’s activities concerning ThyssenKrupp.

Given the overall decline in mean Asian steel plant activity and the specifics of plant-level activity changes, steel buyers should:

- Closely monitor supply from Jai Balaji Jyoti Steels: The significant decline in activity (21% to 9% from March to September) at the Jai Balaji Jyoti Steels plant in Odisha indicates a potential disruption in the supply of DRI, billets, bars, and wire rods. Buyers reliant on this plant should explore alternative sources and assess inventory levels to mitigate risks.

- Consider regional price volatility: The reduced average activity across Asia (40% to 28% from August to September) may create upward pressure on regional steel prices, despite the neutral sentiment, particularly for products similar to those produced by the specified Plants.

- Factor in long-term European market shifts: While Jindal’s potential acquisition of ThyssenKrupp doesn’t have immediately obvious impacts on Asian plants, buyers should be aware of the potential for long-term shifts in global steel trade flows if the deal progresses as outlined in “India’s Jindal Steel submits offer to acquire Thyssenkrupp steel business in Germany,” with focus on green production capacities.