From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Japanese Output Surges Amidst Global Trade Uncertainty

In Asia, steel market sentiment remains neutral amidst fluctuating plant activity and ongoing global trade tensions. While a direct link cannot be established between the observed steel plant activity and the news articles, global trade uncertainties as reported in “Trumps US-Zölle im FAZ-Liveticker: Nvidia entgehen 15 Milliarden Dollar durch US-Exporthürden | FAZ” and general market optimism outlined in “Neues Rekordhoch: DAX mit 30 Prozent Gewinn seit dem Crash-Tief” are potentially influencing market dynamics.

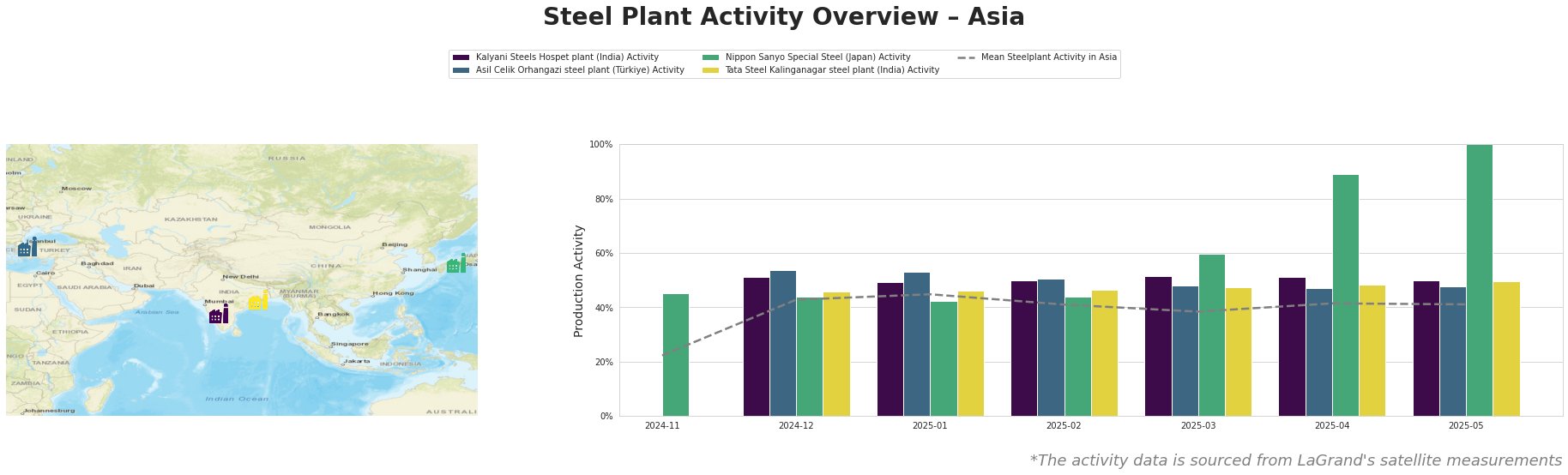

The mean steel plant activity in Asia experienced an initial rise from November (22.0%) to December (43.0%), followed by a slight increase to 45.0% in January. However, it then declined to 38.0% by March before recovering slightly to stabilize at 41.0% in April and May. Kalyani Steels Hospet plant shows stable activity at around 50-52%, consistently above the Asian mean. Asil Celik Orhangazi steel plant shows a similar behavior, also consistently above the Asian mean. Nippon Sanyo Special Steel shows a strong activity increase to 100.0% in May, which is the most significant change in the observed period and stands out from all other plants. Tata Steel Kalinganagar steel plant has consistent activity around 46-50%, also above the Asian mean.

Kalyani Steels Hospet plant, located in Karnataka, India, operates with both BF/BOF and DRI/EAF technology. The plant’s activity has remained relatively stable around 50-52% from December 2024 to May 2025, indicating consistent production levels. It has a crude steel capacity of 860 ttpa with 50 ttpa of EAF. No direct connection can be established between this stable activity and the provided news articles.

Asil Celik Orhangazi steel plant, situated in Bursa, Türkiye, relies on EAF technology. Its activity has shown a moderate decrease from 54.0% in December 2024 to 48.0% in May 2025. No direct connection can be established between this plant’s activity and the provided news articles.

Nippon Sanyo Special Steel, located in Kansai, Japan, utilizes EAF technology with a crude steel capacity of 1596 ttpa. The plant’s activity has increased sharply, reaching 100% in May 2025. The plant produces semi-finished and finished rolled products. No direct connection can be established between this significant surge in plant activity and the provided news articles.

Tata Steel Kalinganagar steel plant in Odisha, India, an integrated BF/BOF plant with a 3000 ttpa capacity, has maintained a relatively stable activity level around 46-50% throughout the observed period. No direct connection can be established between this plant’s activity and the provided news articles.

Given the significant surge in activity at Nippon Sanyo Special Steel in Japan, steel buyers should closely monitor spot prices for specialized steel products like tubes and bars originating from Japan. While “Marktbericht: Pattsituation im DAX” highlights market uncertainties, the increased production at Nippon Sanyo suggests potentially increased supply, which may lead to competitive pricing from this specific plant in the short term. Steel buyers should engage in short-term negotiations with Nippon Sanyo Special Steel to capitalize on the increased production and potentially secure favorable prices. Due to uncertainty caused by US trade policies described in “Trumps US-Zölle im FAZ-Liveticker: Nvidia entgehen 15 Milliarden Dollar durch US-Exporthürden | FAZ” caution is warranted when engaging in longer-term contracts.