From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: India Coking Coal Uptick Offset by China Import Declines, Saudi Arabia Plant Surges

Asia’s steel market presents a mixed picture, influenced by shifting import dynamics and varying plant activity. While India’s coking coal imports show a slight increase, China faces declining iron ore and coal imports, as detailed in “China’s iron ore imports decrease by 2.3 percent in January-July 2025” and “China’s coal imports decrease by 13 percent in January-July 2025“. No direct relationship to plant activity changes can be established with the provided data. However, India’s increased coking coal imports as noted in “India’s coking coal import port traffic up 0.75 percent in April-July” may be supporting steady production in some regions.

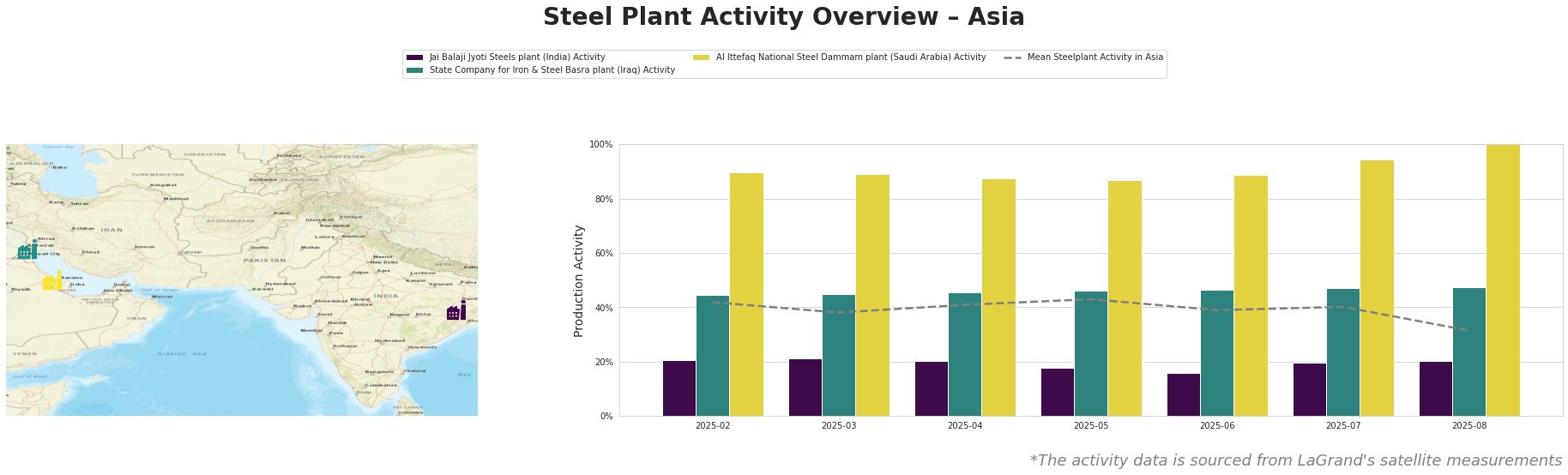

The average steel plant activity in Asia fluctuated, starting at 42% in February and decreasing to 31% by August, indicating an overall softening trend. Jai Balaji Jyoti Steels plant in India shows relatively stable activity around 20%, below the Asian mean, potentially influenced by broader economic factors. The State Company for Iron & Steel Basra plant in Iraq shows a stable activity trend around 46%, consistently above the average. Al Ittefaq National Steel Dammam plant in Saudi Arabia shows a strong upward trend, culminating in 100% activity in August, significantly higher than the mean. The drop in the average activity can be primarily attributed to declines in other regions, not the plants explicitly tracked here.

Jai Balaji Jyoti Steels, an integrated DRI-EAF based steel plant in Odisha, India with a crude steel capacity of 92 ttpa, demonstrates consistent but low activity levels around 20% from February to August. This suggests steady operations, although at a reduced capacity compared to the Asian average. There is no clear relationship between these levels and the import trends noted in “India’s coking coal import port traffic up 0.75 percent in April-July”.

The State Company for Iron & Steel Basra plant, an EAF-based billet producer in Basra, Iraq with a 500 ttpa crude steel capacity, maintains a consistently higher-than-average activity level, hovering around 46-47%. The stability could be attributable to regional demand dynamics independent of the broader Asian import trends. No explicit connections can be drawn between observed activity levels and the provided news articles.

Al Ittefaq National Steel Dammam plant, an integrated DRI-EAF based billet producer in the Eastern Province of Saudi Arabia with a 1000 ttpa crude steel capacity and 2500 ttpa pelletizing capacity, exhibits a strong activity increase, from 90% in February to 100% in August. This surge suggests a significant ramp-up in production. No explicit connections can be drawn between observed activity levels and the provided news articles.

Given the decline in overall Asian steel plant activity coupled with reduced Chinese imports, procurement professionals should closely monitor inventories and diversify sourcing to mitigate potential price volatility. The Al Ittefaq National Steel Dammam plant’s surge in activity may indicate an increased supply of billets from Saudi Arabia, presenting a potential alternative for buyers. Given the consistent activity at the Basra plant, this may be a reliable source for buyers as well. Buyers relying on the Indian market for supply should monitor the coking coal import trends, and factor in the stable but low activity levels at Jai Balaji Jyoti Steels in their procurement strategies.