From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Uncertainty Amid US Tariff Threats: Production Adjustments Observed

Asia’s steel market faces growing uncertainty driven by potential US tariffs on EU goods, as evidenced by the news articles “Nach Trump-Brief: EU legt neue Liste für Gegenzölle vor“, “Zollstreit mit den USA: Was droht der deutschen Wirtschaft?“, and “Trumps US-Zölle im Liveticker: Merz: Brauchen im Zollstreit schnell eine Lösung | FAZ“. Satellite data reveals recent activity shifts at key steel plants in the region. However, no direct relationship between the news articles and the observed activity changes at the selected steel plants can be explicitly established.

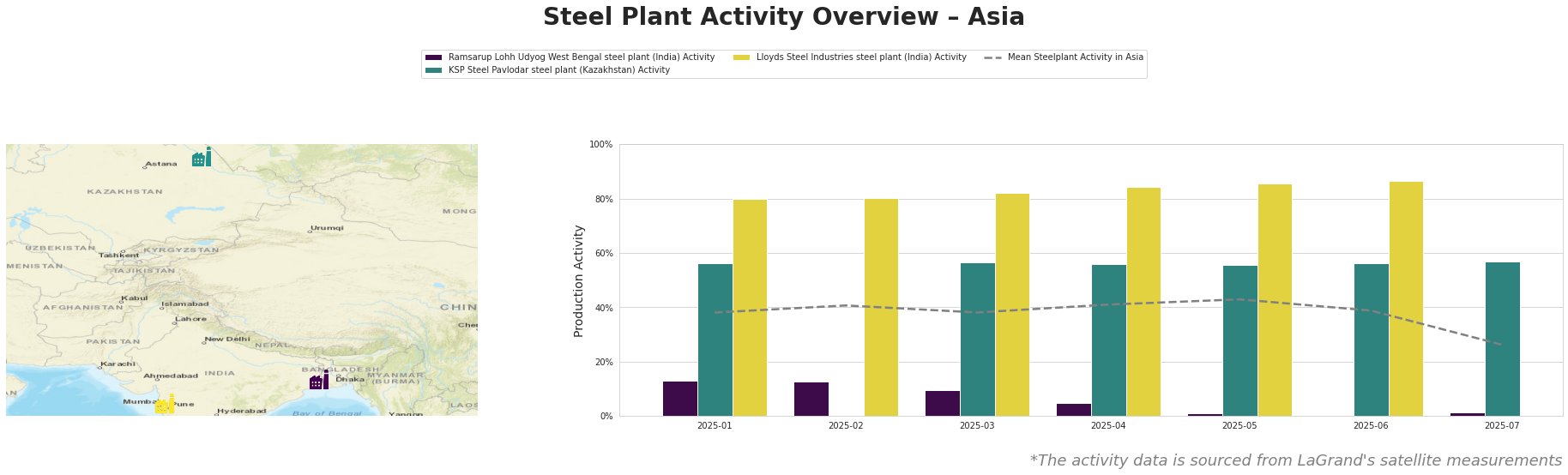

The mean steel plant activity in Asia experienced a significant drop in July, falling to 26% from a high of 43% in May. Ramsarup Lohh Udyog West Bengal steel plant showed a continuous decline in activity, reaching 0% in June before a slight increase to 1% in July. KSP Steel Pavlodar steel plant maintained relatively stable activity levels around 56-57%. Lloyds Steel Industries steel plant has seen a consistent increase in activity from January (80%) to July (87%). The current mean activity is now substantially below the levels seen in the first half of the year.

Ramsarup Lohh Udyog West Bengal steel plant, an integrated plant with both BF and DRI processes and an EAF, focuses on semi-finished and finished rolled products, including billets, transmission lines, and wires for the energy sector. Activity at Ramsarup Lohh Udyog experienced a steep decline from 13% in January and February to a low of 0% in June, followed by a slight uptick to 1% in July. Given the plant’s product focus on the energy sector and its integrated production, there is no direct link could be established from this plants output and the news articles.

KSP Steel Pavlodar steel plant, which produces 800 ttpa of crude steel using EAF technology, focuses on semi-finished and finished rolled products like billets, pipes, and rebar, catering to the energy and machinery sectors. The plant maintained stable activity around 56-57% throughout the observed period. This stability offers a degree of reassurance regarding the plant’s output; however, no direct connection to the mentioned news articles can be made to justify production levels, particularly as the plant’s primary markets are domestic, and not focused on export to the EU or US.

Lloyds Steel Industries steel plant, with 641 ttpa crude steel capacity via EAF, produces slabs, cold-rolled coils, and sheets, primarily for the energy and machinery sectors. Lloyds Steel demonstrated a consistent upward trend in activity, from 80% in January to 87% in July. This growth suggests a potentially insulated position or strategic inventory build-up. No direct connection to the mentioned news articles can be made to justify production levels, particularly as the plant’s primary markets are domestic, and not focused on export to the EU or US.

Given the overall negative market sentiment driven by potential tariffs and the significant drop in average regional steel plant activity, coupled with stable activity at KSP Steel Pavlodar and increasing activity at Lloyds Steel Industries, procurement professionals should consider the following:

- Prioritize Domestic Supply Chains: For buyers sourcing rebar, pipes, and other products from KSP Steel or slabs, coils, and sheets from Lloyds Steel for domestic projects, current supply may be relatively stable. However, monitor these plants closely for any future disruptions if the trade war escalates.

- Ramsarup Lohh Udyog Alternatives: Buyers dependent on Ramsarup Lohh Udyog for billets or wire should immediately identify alternative suppliers, given the near-cessation of activity at this plant and the inability to directly link this to the new EU/US tarrif negotiations. Consider diversifying sourcing to mitigate risk.

- Hedging Strategies: Given the uncertainty highlighted in “Zollstreit mit den USA: Was droht der deutschen Wirtschaft?”, explore hedging strategies to protect against potential price volatility stemming from tariff-induced supply chain disruptions. Consider short-term contracts.

- Closely Monitor Policy Developments: Track US-EU trade negotiations, as reported in “Trumps US-Zölle im Liveticker: Merz: Brauchen im Zollstreit schnell eine Lösung | FAZ”, to anticipate potential market impacts.

- Re-evaluate inventory: Ensure sufficient material is on hand to cover expected demand fluctuations.