From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Supply Concerns Amidst US Tariffs and Production Slowdowns

In Asia, steel markets are bracing for potential disruptions following new US tariffs and observable production slowdowns in key plants. The imposition of new import duties by the US, as detailed in “Trump ordnet neue Zölle für 67 Länder an,” introduces uncertainty, even if no direct correlation to plant activity levels in Asia can be explicitly established. The impact of “Hohe US-Zölle in Kraft: So reagiert die Schweizer Politik” and “US-Zölle: Politiker fordern WTO-Klage gegen Strafzölle” could indirectly affect Asian steel demand if trade patterns shift, though no immediate impact on plant activity is evident.

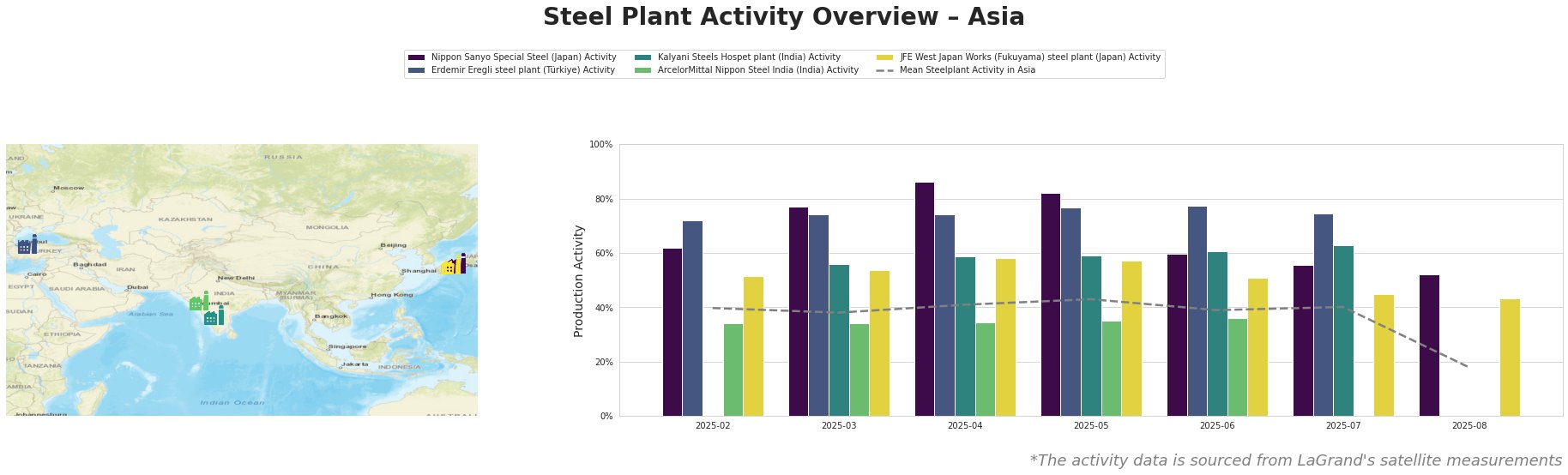

Observed Asian steel plant activity averaged 40% until July 2025, before dropping sharply to 18% in August.

Nippon Sanyo Special Steel, a Japanese EAF steelmaker producing 1596 ttpa of crude steel, showed a gradual decline in activity from a peak of 86% in April to 52% in August. This decline does not appear to have a direct connection to the cited news articles regarding US tariffs.

The Erdemir Eregli steel plant in Türkiye, an integrated BF-BOF producer with a crude steel capacity of 4000 ttpa, maintained a relatively stable activity level between 72% and 77% from February to July. There is no available data for August. Again, no connection can be established between the provided news articles and the observed activity.

The Kalyani Steels Hospet plant in India, with integrated BF and DRI operations and a crude steel capacity of 860 ttpa, experienced gradually increasing activity from 56% in March to 63% in July. There is no available data for August. No direct link to the provided news can be established.

ArcelorMittal Nippon Steel India, operating an integrated BF-DRI plant with a large EAF capacity of 9600 ttpa, maintained low activity levels in the range of 34-36% between February and June. There is no available data for July and August. No direct impact from the named news articles can be substantiated.

JFE West Japan Works (Fukuyama) steel plant, a major integrated BF-BOF producer with 13000 ttpa crude steel capacity, exhibited a decline in activity from 58% in April to 43% in August. Similar to Nippon Sanyo, this decrease doesn’t show an explicit connection to the US tariff news.

The significant drop in mean activity across all observed Asian plants to 18% in August, coupled with declines at Nippon Sanyo and JFE West Japan Works, warrants caution. While direct links to the named news articles about US tariffs aren’t explicitly observable in plant-level activity up to July, the overall negative sentiment induced by trade uncertainties may be contributing to this recent downturn.

Evaluated Market Implications:

The sudden drop in overall Asian steel plant activity in August signals potential supply disruptions, particularly if this trend continues. Although direct causation from US tariff news is not definitively established in the data up to July, the observed decline in August, particularly at the JFE West Japan Works, coincides with the implementation of these tariffs. This warrants a cautious approach.

Recommended Procurement Actions:

- Steel Buyers: Immediately assess inventory levels and diversify sourcing options to mitigate potential supply shortages originating from Japan. Given the activity declines at Nippon Sanyo and JFE West Japan Works, consider increasing orders from plants in India.

- Market Analysts: Closely monitor activity levels at JFE West Japan Works and Nippon Sanyo in the coming months to confirm whether the decline is a short-term adjustment or the start of a longer-term trend. Track policy responses to US Tariffs (especially by Japan).