From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: US Tariff Uncertainty and Fluctuating Plant Activity

Steel markets in Asia face increasing uncertainty due to the ongoing legal battles surrounding US tariffs. According to news articles like “Trump’s tariff push overstepped presidential powers, appeals court says“, “US-Gericht erklärt Donald Trumps Strafzölle für illegal” and “US court rules against Trump emergency tariffs,” a US appeals court has ruled against the legality of these tariffs, creating instability as the US government appeals to the Supreme Court. However, direct links between these tariff-related news and the observed Asian plant activity data are not explicitly evident.

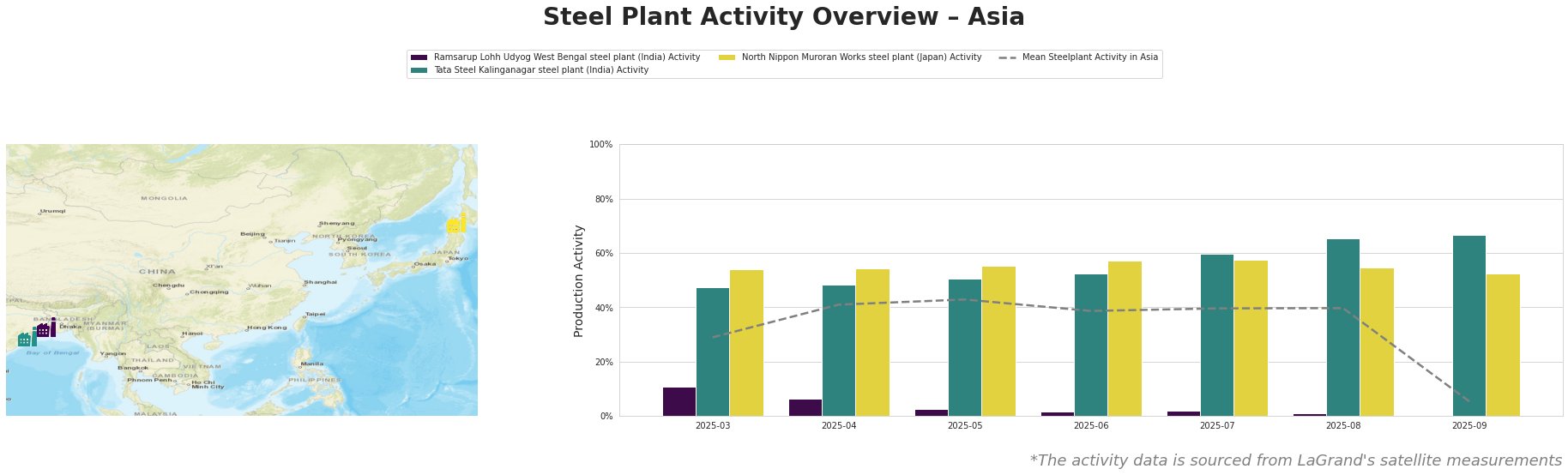

The mean steel plant activity in Asia has been volatile, dropping significantly to 5% in September after hovering around 40% for several months.

Ramsarup Lohh Udyog West Bengal steel plant, an integrated steel plant in West Bengal, India, utilizing both BF and DRI processes, shows a continuous decline in activity, reaching a low of 1% in August. This plant produces billets, transmission lines, and wires, mainly for the energy sector. The decreasing activity levels don’t immediately correlate to the named news articles about US tariffs, suggesting plant-specific or local market factors might be at play.

Tata Steel Kalinganagar steel plant, a large integrated BF-BOF steel plant in Odisha, India, primarily serving the automotive sector, demonstrates consistent increases in activity, peaking at 67% in September. This increasing production trend does not show an immediate adverse impact of the news surrounding potential alterations to US tariff policies, indicating the plant’s focus on domestic or non-US export markets.

North Nippon Muroran Works steel plant, an integrated BF-BOF-EAF steel plant in Hokkaido, Japan, producing semi-finished and finished rolled products for the automotive sector, exhibits relatively stable activity levels, fluctuating between 52% and 58%. The drop to 52% in September could signal a potential slight decrease in production but does not show an immediate adverse impact of the news surrounding potential alterations to US tariff policies, suggesting plant-specific or local market factors might be at play.

Evaluated Market Implications:

The significant drop in overall mean activity levels in Asia during September, in combination with the uncertainty surrounding US tariffs (“Trump’s tariff push overstepped presidential powers, appeals court says“), despite a lack of conclusive links with observed steel plant data, warrants a cautious approach. Specifically, given the Ramsarup Lohh Udyog plant’s continuous decline, buyers dependent on this plant should consider diversifying their billet, transmission line, and wire supply sources to mitigate potential disruptions. While Tata Steel Kalinganagar shows strong performance, the overall market uncertainty advises steel buyers to maintain close communication with their suppliers and explore hedging strategies where possible to buffer against potential price volatility arising from the US tariff situation.