From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: OPEC+ Output Hike and Plant Activity Slowdown Signal Potential Supply Disruptions

Asia’s steel market is facing downward pressure due to rising energy costs and fluctuating plant activity. According to “Opec+ eight bring forward policy meeting: Update,” “Oil drops for second day as traders brace for another OPEC+ hike,” and “Opec+ 8 speeds up output hike to 548,000 b/d for August” and “Opec+ 8 likely to speed up output hike for August,” OPEC+ is accelerating crude production increases, impacting energy costs for steel production. These increasing crude production are likely going to impact the energy costs needed for steel production in the region. While no direct connection to steel plant activity can be definitively established from these news articles, the increased energy costs may be indirectly influencing production levels.

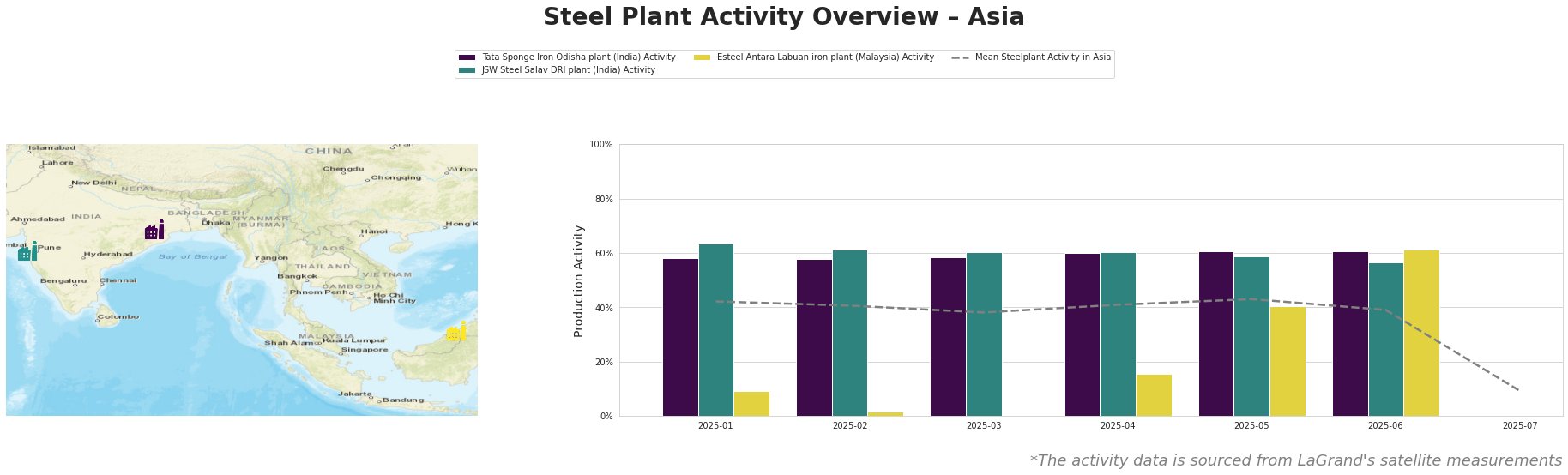

The mean steel plant activity in Asia showed a decline, ending at 9.0% in July, sharply down from 39.0% in June. Tata Sponge Iron Odisha plant maintained a relatively stable activity level between 58% and 61% from January to June. JSW Steel Salav DRI plant activity saw some fluctuation, starting at 63% in January and decreasing to 57% in June. Esteel Antara Labuan iron plant showed more significant variation, with activity ranging from 0% to 61% over the observed period. No direct correlation could be established between the activity levels and the named news articles.

Tata Sponge Iron Odisha plant, located in Odisha, India, operates a 400 ttpa DRI facility and relies on two captive power plants. Its activity remained relatively stable between January and June, fluctuating between 58% and 61%. There is no evident connection to the OPEC+ news articles, indicating that the activity level is likely influenced by factors specific to the Indian market, independent of the short-term energy price fluctuations driven by the OPEC+ decisions.

JSW Steel Salav DRI plant, based in Maharashtra, India, produces 1000 ttpa of DRI and HBI using a gas-based HYL-III process. The plant’s activity decreased from 63% in January to 57% in June. Similar to the Tata plant, there is no direct link that can be explicitly established between this decline and the OPEC+ announcements; the plant’s activity may be responding to local or regional demand factors.

Esteel Antara Labuan iron plant in Malaysia, a 900 ttpa DRI facility producing HBI, demonstrated the most volatile activity. Starting at 9% in January, it dropped to 0% in March before peaking at 61% in June. These fluctuations cannot be directly linked to the news concerning OPEC+ output changes, suggesting plant-specific issues or regional market dynamics are at play.

The sharp drop in average activity across the observed Asian steel plants in July, coupled with the OPEC+ decision to increase crude oil production, creates a negative outlook.

Evaluated Market Implications:

-

Potential Supply Disruption: The significant drop to 9% for the average steel plant activity in Asia in July suggests potential supply disruptions across the region. While the OPEC+ news primarily impacts energy costs, which are a key input for steel production, the reduced plant activity, particularly the observed volatility at Esteel Antara Labuan iron plant in Malaysia, further amplifies supply uncertainty.

-

Recommended Procurement Actions: Steel buyers and analysts should:

- Monitor DRI and HBI Pricing: Given the DRI production focus of the observed plants, closely monitor pricing trends for DRI and HBI, particularly from Malaysian and Indian suppliers.

- Diversify Sourcing: Evaluate diversifying sourcing options, especially for HBI, considering the Esteel Antara Labuan iron plant’s fluctuating activity.

- Engage with Suppliers: Proactively engage with existing suppliers, especially Tata Sponge Iron Odisha plant and JSW Steel Salav DRI plant, to understand their production outlook and potential impact from increased energy costs.

- Consider Forward Purchasing: Given the uncertainties and the downward market sentiment, investigate forward purchasing opportunities to secure current pricing, particularly if steel demand is expected to increase in the coming months.