From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds as US Tariffs Loom and Plant Activity Dips

Asia’s steel market is showing signs of strain amid renewed US tariff threats. Observed declines in steel plant activity coincide with escalating trade tensions reported in “Trumps US-Zölle im FAZ-Liveticker: EU-Handelspolitiker droht den USA mit Gegenzöllen | FAZ” and “Donald Trumps Zölle plötzlich wieder in Kraft: US-Berufungsgericht hebt Urteil auf“. Although a direct causal link between the tariff news and the observed plant activity could not explicitly be established based solely on the provided information, the overall negative market sentiment is reinforced by these developments.

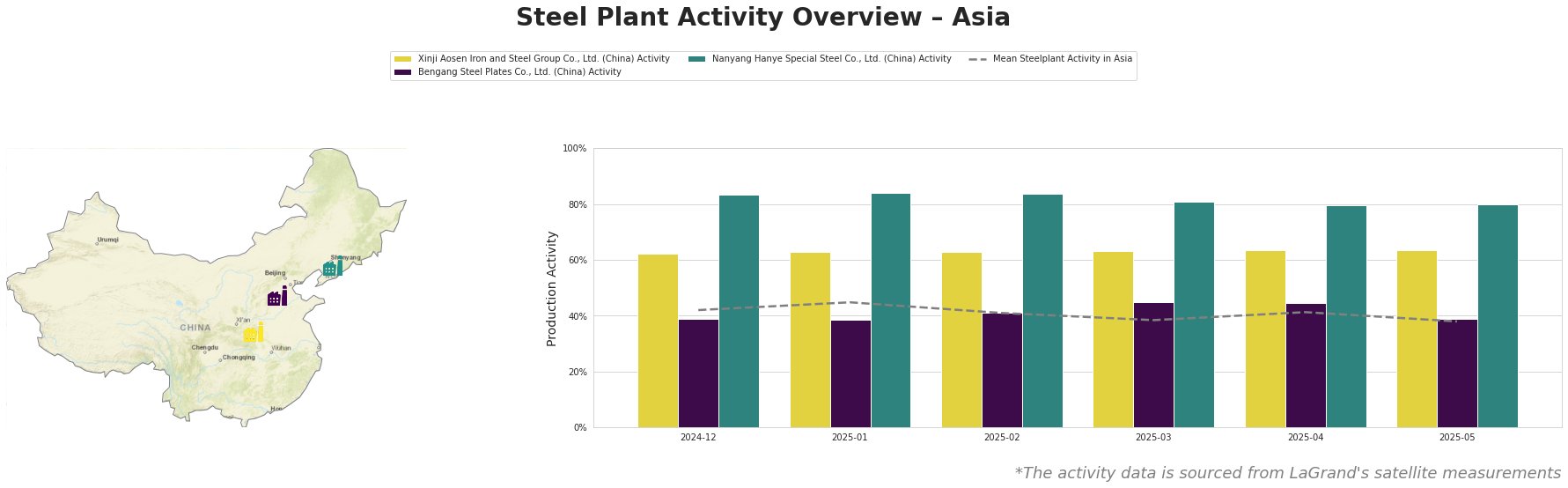

The mean steel plant activity in Asia has fluctuated, experiencing a notable dip to 38.0% in March 2025 and again in May 2025. Xinji Aosen Iron and Steel Group Co., Ltd. maintained a relatively stable activity level above the mean, peaking at 64% in April and May. Bengang Steel Plates Co., Ltd. saw a rise to 45% in March and April before falling back to 39% in May. Nanyang Hanye Special Steel Co., Ltd. experienced a consistent high activity level, with a gradual decline from 84% in January and February to 80% in May. While these fluctuations occurred concurrently with trade tension news reported in “Trumps US-Zölle im FAZ-Liveticker: US-Finanzminister: Gespräche zwischen USA und China „ins Stocken geraten“,” a direct connection between the specific activity changes and the news articles cannot be explicitly established from the given data.

Xinji Aosen Iron and Steel Group Co., Ltd., a Hebei-based integrated BF/BOF producer with a crude steel capacity of 3.6 million tonnes, mainly produces semi-finished products like billets and slabs, as well as finished rolled high-speed wire rods and hot-rolled strip products. Despite the overall market volatility, its activity remained relatively stable at a high level above the mean, at 64% in April and May. No direct connection can be established between this stable activity and the provided news articles.

Bengang Steel Plates Co., Ltd., located in Liaoning, is another integrated BF/BOF steel plant, but with a significantly larger crude steel capacity of 12.8 million tonnes. It produces finished rolled products, including automotive, home appliance, oil pipeline, and container plates. Its activity increased to 45% in March and April before falling back to 39% in May. Given their product mix, potential tariffs, as reported in “Donald Trumps Zölle plötzlich wieder in Kraft: US-Berufungsgericht hebt Urteil auf“, could impact demand for automotive and appliance plates, but a specific correlation with the observed activity drop cannot be explicitly confirmed.

Nanyang Hanye Special Steel Co., Ltd., situated in Henan, is an integrated BF/BOF steel plant with a crude steel capacity of 2.588 million tonnes. They produce medium-thick, special, extra-thick, and extra-heavy steel plates. The plant showed high activity levels that started to decline from 84% in January to 80% in May. No direct connection to the trade tension news can be explicitly established, though the plant’s specialization in heavy plates could make it vulnerable to shifts in infrastructure demand related to broader economic uncertainty.

Given the negative market sentiment, potential supply disruptions from tariff impacts (as indicated in “Trumps US-Zölle im FAZ-Liveticker: EU-Handelspolitiker droht den USA mit Gegenzöllen | FAZ“), and the fluctuations observed at Bengang Steel Plates Co., Ltd., steel buyers should closely monitor inventory levels of automotive, home appliance, oil pipeline, and container plates. Consider diversifying suppliers and exploring alternative sourcing options to mitigate potential risks linked to trade policy changes. While Xinji Aosen Iron and Steel Group Co., Ltd. showed stable activity, monitor overall mean activity trends for broader market signals.