From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: Anti-Dumping Probes and Shifting Production Dynamics

Asia’s steel market is facing downward pressure due to increased trade friction and fluctuating production activity. Anti-dumping investigations are increasing across the region as evidenced by titles such as “Japan launches AD probe on HDG from South Korea and China” and “Indian stainless steel producers seek antidumping levy on imports“. While these investigations aim to protect domestic producers, they also contribute to market uncertainty. No direct relationship to changes in plant activity levels could be established.

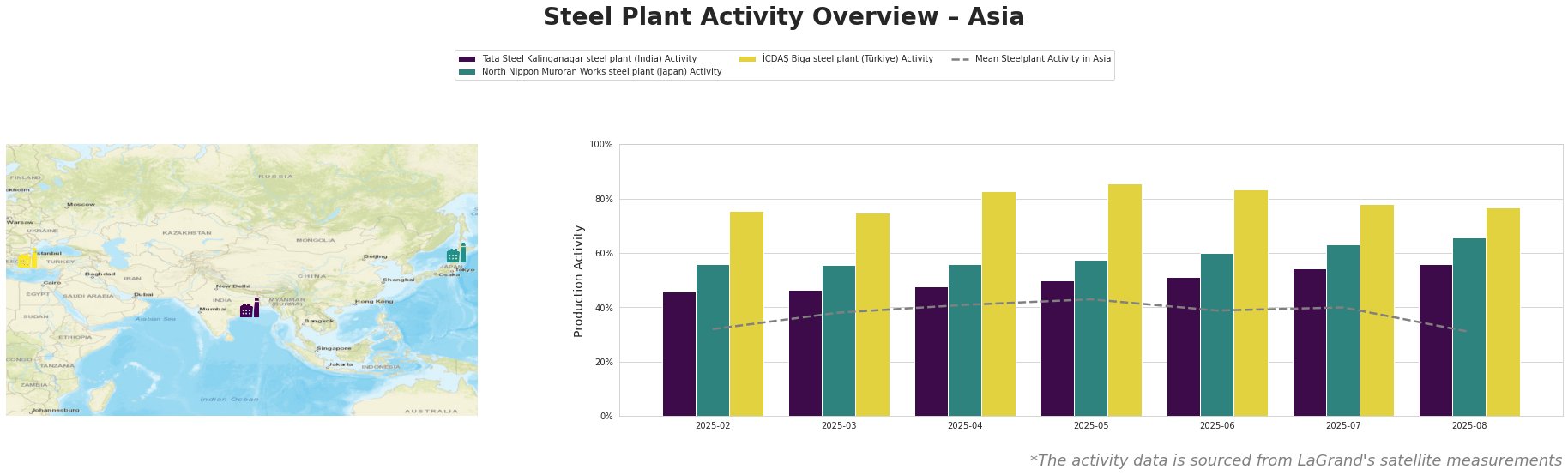

Here’s a summary of recent activity based on satellite observations:

The mean steel plant activity in Asia experienced a notable decline in August, dropping to 31.0% after a period of relative stability around 40%. Tata Steel Kalinganagar steel plant in India shows the highest relative activity increase. İÇDAŞ Biga steel plant initially exhibited strong performance, peaking in May, but has since seen a decline in activity. North Nippon Muroran Works in Japan is exhibiting the most stable activity percentage.

Tata Steel Kalinganagar steel plant, located in Odisha, India, is an integrated steel plant with a crude steel capacity of 3 million tons per annum (TTPA) using BF and BOF technologies. Its activity has steadily increased over the observed period, reaching 56% in August, significantly above the Asian average. This rise could be related to the recent U.S. DOC preliminary findings in “US assigns zero preliminary dumping margin for steel threaded rod from India“, although a direct link cannot be confirmed. With a primary focus on automotive end-user sector, buyers should anticipate stable supplies, but monitor potential capacity issues arising from increased Indian domestic demand linked to anti-dumping duties.

North Nippon Muroran Works steel plant, situated in Hokkaidō, Japan, has a crude steel capacity of 2.598 million TTPA, employing both BF/BOF and EAF technologies. While the plant’s activity has remained relatively stable and is above average, it shows an increase to 66% in August. The “Japan launches AD probe on HDG from South Korea and China” announcement could positively influence the production in the long term, however, no immediate correlation could be established. Buyers should monitor the outcome of the anti-dumping probe and prepare for potential price increases in HDG steel.

İÇDAŞ Biga steel plant, located in Çanakkale, Türkiye, is an electric arc furnace (EAF) based plant with a crude steel capacity of 2.5 million TTPA. While not located in Asia, the activity is being monitored. Its activity decreased significantly in August to 77% from a peak of 86% in May. The decline in activity could indicate softening demand in its primary end-user sectors (building & infrastructure, energy, and transport) or potential maintenance shutdowns. There is no clear link established with the provided news articles. Buyers should monitor for continued decrease and potential supply disruption, especially for alloyed steel, bars, and rebar products.

Evaluated Market Implications

Based on the news and observed plant activity:

- Potential Supply Disruptions: Monitor İÇDAŞ Biga for potential supply disruptions due to declining activity.

- Procurement Actions:

- Steel buyers sourcing HDG steel in Japan should closely monitor the “Japan launches AD probe on HDG from South Korea and China” and prepare for potential price increases.

- Buyers sourcing from Tata Steel Kalinganagar should expect stable supplies.