From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn: Plant Activity Declines Amidst Global Economic Uncertainty

Steel demand in Asia is facing headwinds as indicated by declining steel plant activity, potentially impacting supply chains. The news article “Stock market today: S&P 500, Nasdaq pull back from records as Fed rate decision looms” highlights concerns about the global economic outlook, which may be a factor influencing steel production decisions in the region. While this article discusses the US market, it reflects global economic concerns that could impact steel demand in Asia. However, a direct link between this article and specific Asian plant activity cannot be definitively established.

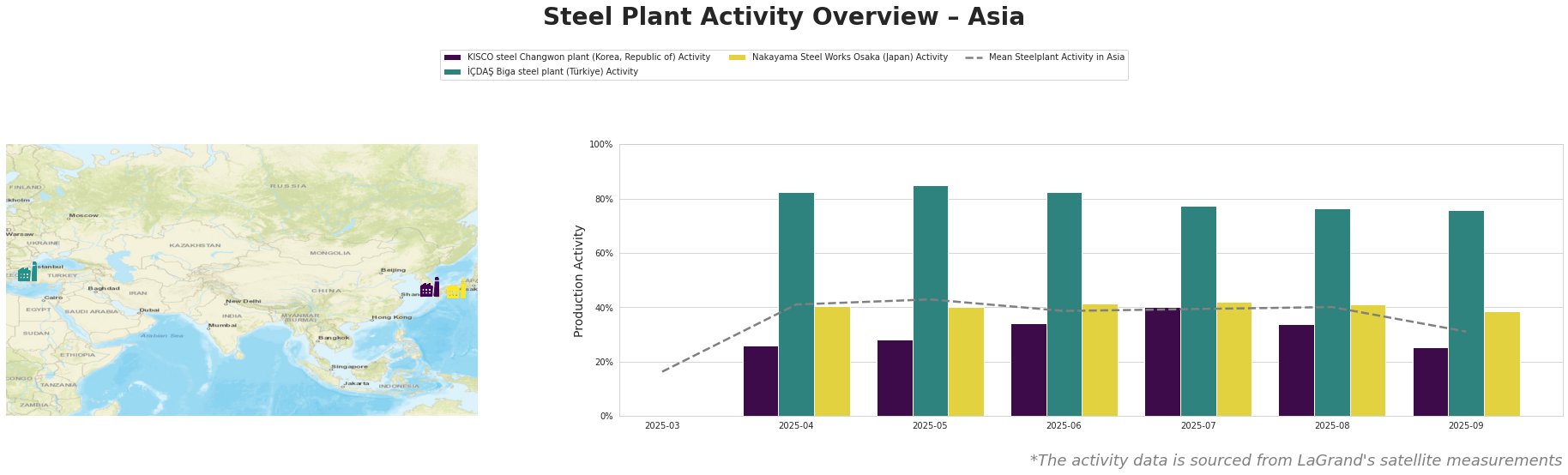

The mean steel plant activity in Asia shows a decreasing trend, dropping from 40% in August to 31% in September. The İÇDAŞ Biga steel plant in Türkiye consistently exhibited the highest activity levels compared to other observed plants and the regional mean, remaining relatively stable at 76% in September. The KISCO steel Changwon plant in South Korea, with a 3 million tonne EAF-based capacity focusing on rebar and billets, experienced a significant drop in activity from 40% in July to 25% in September, underperforming compared to the regional mean. The Nakayama Steel Works Osaka in Japan, a smaller EAF-based plant producing coil, plate, bars, and wire rods, also saw a slight activity decrease to 38% in September.

KISCO steel Changwon plant, an EAF-based plant in South Korea with a 3 million tonne capacity focused on rebar and billets, experienced a noticeable decline in activity, dropping from 40% in July to 25% in September. Given its reliance on the building and infrastructure sector, a potential explanation of the observed activity drop might be related to concerns around interest rate hikes. The news article “US 30-year mortgage rate drops, refinances jump, MBA data shows” suggests a softening housing market in the US due to high borrowing costs. This trend, while focused on the US, could reflect broader global economic uncertainties impacting the building and infrastructure sector in Asia.

İÇDAŞ Biga steel plant in Türkiye, operating a 2.5 million tonne EAF-based facility producing various long products, maintained a relatively high and stable activity level around 76% in September. No direct connection could be established between the observed activity levels at the plant and the provided news articles.

Nakayama Steel Works Osaka, a smaller EAF-based plant in Japan with a 660,000 tonne capacity producing coils, plates, bars, and wire rods, experienced a slight decrease in activity to 38% in September. No direct connection could be established between the observed activity levels at the plant and the provided news articles.

Evaluated Market Implications:

The observed decline in average steel plant activity in Asia, particularly the sharp drop at KISCO steel Changwon plant, indicates potential supply disruptions for rebar and billets, primarily impacting the building and infrastructure sectors.

Recommended Procurement Actions:

- Steel Buyers focusing on rebar and billets from South Korea should proactively engage with KISCO steel Changwon plant to understand the reasons behind the production slowdown and assess potential impacts on order fulfillment.

- Market Analysts should closely monitor the utilization rates of EAF-based plants in Asia, as these might be more vulnerable to fluctuations in demand compared to plants relying on other steel-making technologies. The relative stability of İÇDAŞ Biga steel plant, in contrast to KISCO, might reveal market- or company-specific strategies which should be investigated.