From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn: Plant Activity Declines Amidst EU Anti-Dumping Measures

The Asian steel market is facing a negative outlook, primarily influenced by EU trade policies. Recent satellite observations show a decline in steel plant activity across the region. While a direct causal link to the “EU imposes final anti-dumping duties on goods from Japan, Egypt, Vietnam“ and “EU imposes definitive anti-dumping duties on HRC from Japan, Egypt, Vietnam“ news articles cannot be definitively established through the activity data alone, the timing of the activity decrease coincides with the imposition of these duties, suggesting a potential impact on overall Asian steel production. The investigation into Indian imports was terminated as no dumping was found, as noted in “EU imposes definitive anti-dumping duties on HRC from Japan, Egypt, Vietnam”.

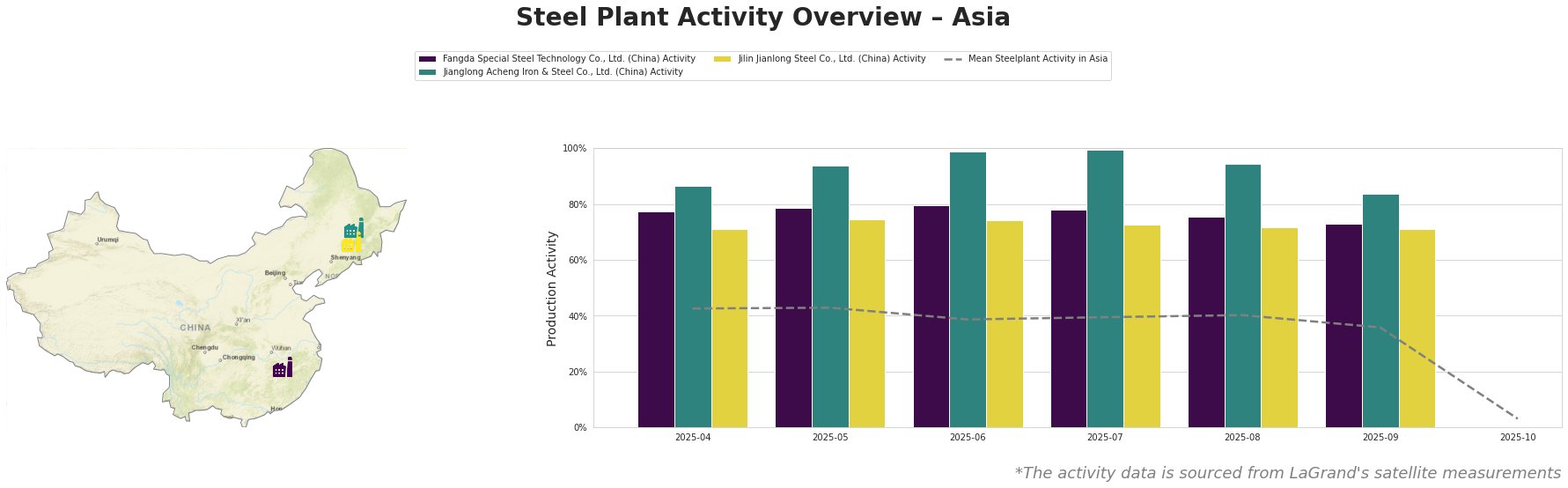

The mean steel plant activity in Asia shows a steady decline, dropping from 43% in April and May to a low of 3% in October. Jianglong Acheng Iron & Steel Co., Ltd. consistently showed high activity levels, peaking at 100% in July before dropping to 84% in September. Fangda Special Steel Technology Co., Ltd.’s activity has decreased steadily, from 78% in April to 73% in September. Similarly, Jilin Jianlong Steel Co., Ltd. saw a slight decrease from 71% in April to 71% in September. The dramatic drop in the mean in October is significant, but data for individual plants is missing, making specific analysis difficult.

Fangda Special Steel Technology Co., Ltd., located in Jiangxi and operating with a 3.6 million tonne BOF-based crude steel capacity, has shown a gradual decrease in activity. The plant produces finished rolled products, including spring flat steel and alloy structural round steel. A reduction from 78% in April to 73% in September does not have a clear relationship to the EU anti-dumping news, since it is likely more domestic-market focused.

Jianglong Acheng Iron & Steel Co., Ltd., based in Heilongjiang, operates with a 1.1 million tonne BOF-based crude steel capacity. Specializing in hot rolled and coated steel products for the automotive, energy, and machinery sectors, its activity peaked at 100% in July but declined to 84% in September. The observed decrease in activity at Jianglong Acheng, while potentially influenced by broader market conditions, cannot be directly and causally linked to the EU’s anti-dumping measures based solely on the provided data.

Jilin Jianlong Steel Co., Ltd., with a 3 million tonne BOF-based crude steel capacity in Jilin, produces automotive structural steel, pipeline steel, and other hot-rolled products. The plant demonstrated a relatively stable activity level, decreasing from 71% in April to 71% in September. Similar to Fangda Special Steel, the activity trend cannot be explicitly related to the EU anti-dumping duties.

Evaluated Market Implications:

The EU’s imposition of anti-dumping duties, as reported in the cited news articles, creates a challenging environment for Asian steel exporters. While a direct causal link between these duties and the observed decline in activity at Fangda Special Steel and Jilin Jianlong Steel cannot be definitively established, the decreased activity across multiple plants and regions within Asia, combined with the duties imposed on countries such as Japan and Vietnam, signal overall market unease and increased uncertainty.

Recommended Procurement Actions:

- Steel Buyers: Given the uncertainty surrounding the Asian steel market and potential supply disruptions, buyers should diversify their sourcing strategies and explore alternative suppliers outside of Asia. The terminated investigation into India, as cited in “EU imposes definitive anti-dumping duties on HRC from Japan, Egypt, Vietnam”, may present opportunities for procurement in that region.

- Market Analysts: Closely monitor trade flows between Asia and other regions to assess the true impact of the EU’s anti-dumping duties. Further investigation into the October data point (3% average activity) is urgently needed to determine the cause of the drop, which might be an indicator of an unfulfilled structural change.