From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn Amid US Tariff Reversal, Plant Activity Declines

The Asian steel market faces headwinds following the reversal of US tariffs, with observed steel plant activity showing signs of contraction. The impact of the US court’s decision in “US court throws out Trump’s worldwide tariffs” is anticipated to negatively affect steel demand and prices in the region, potentially exacerbating existing downward pressure. The court’s ruling, as described in “USA: Zollverbot ist herbe Niederlage für Donald Trump” may lead to decreased export opportunities for Asian steel producers, although a direct relationship between this news and specific plant activity levels cannot be explicitly established.

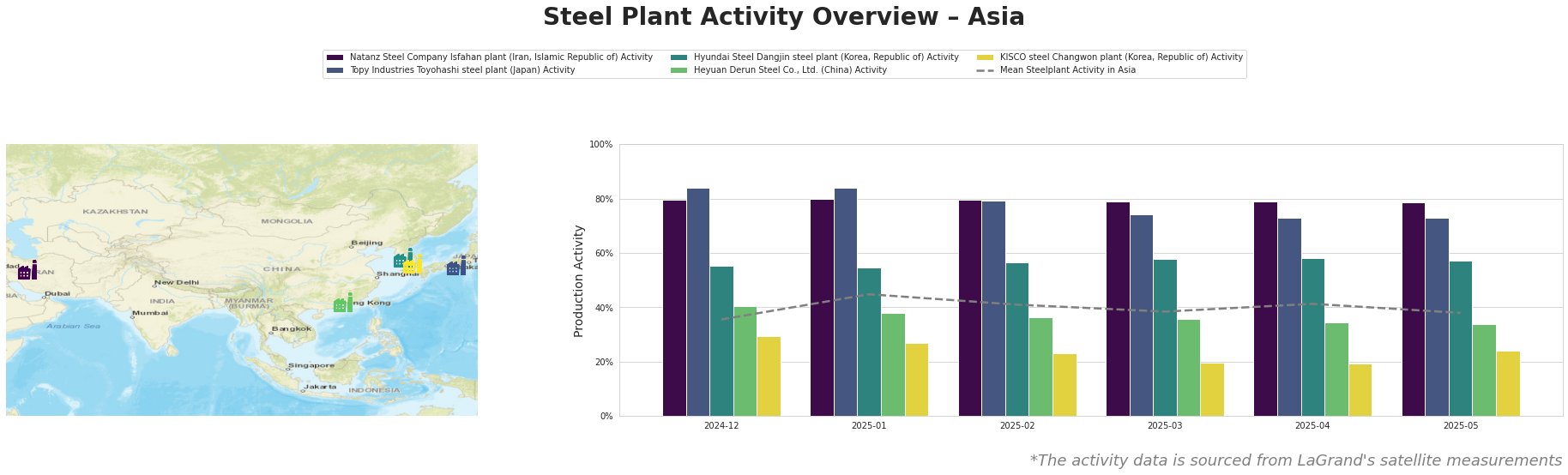

The mean steel plant activity in Asia shows a fluctuating trend, peaking at 45.0 in January 2025 and then declining to 38.0 by May 2025. Natanz Steel Company Isfahan plant maintains a consistently high activity level around 80% throughout the period, significantly above the Asian mean. Topy Industries Toyohashi steel plant also operates above average, with activity decreasing from 84.0 to 73.0 from December 2024 to May 2025. Hyundai Steel Dangjin steel plant shows relatively stable activity around 55-58%, also above the mean. Heyuan Derun Steel Co., Ltd. shows lower activity levels, declining from 40.0 to 34.0 over the same period. KISCO steel Changwon plant displays the lowest activity, reaching a low of 19.0 in April 2025, before increasing slightly to 24.0 in May 2025. No direct connection between these activity trends and the cited news articles can be explicitly established based on the provided information.

Natanz Steel Company Isfahan plant: This Iranian plant, focused on DRI-based EAF steelmaking with a capacity of 1 million tonnes of crude steel and 1.5 million tonnes of DRI, maintains high activity levels around 80%. Despite fluctuations in the broader Asian market, its sustained output suggests relative insulation from the immediate impacts of the US tariff reversal described in articles like “US court throws out Trump’s emergency tariffs: Update“. There is no explicit connection between the high plant activity and the mentioned news articles.

Topy Industries Toyohashi steel plant: This Japanese EAF-based plant, producing 960,000 tonnes of crude steel annually for automotive and infrastructure sectors, has seen a gradual activity decrease from 84.0 to 73.0 between December 2024 and May 2025. This decline does not coincide directly with the US tariff ruling; therefore, no explicit connection can be stated.

Hyundai Steel Dangjin steel plant: A major integrated steel producer in South Korea, using both BF-BOF and EAF processes, with a large capacity of 16.6 million tonnes of crude steel, shows relatively stable activity around 55-58%. As this production facility with its diverse range of processes and a wide range of products serves the automotive and infrastructure sectors the stable activity levels are a sign for the stability of the South Korean Market. No explicit connection between the US tariff ruling and the stability of plant activity can be established.

Heyuan Derun Steel Co., Ltd.: This Chinese EAF-based plant, producing 1.2 million tonnes of crude steel, has experienced a gradual decline in activity, from 40.0 to 34.0. As the “US court throws out Trump’s worldwide tariffs” aims to reduce the export options of chinese steel plants, this development aligns with the news, however no explicit relationship can be established.

KISCO steel Changwon plant: This South Korean EAF-based plant, with a capacity of 3 million tonnes of crude steel, shows the lowest activity levels among the observed plants. The sharp decline to 19.0 in April 2025, followed by a slight increase in May 2025, suggests potential operational challenges or market-specific factors unrelated to the US tariff decision, for which reason no explicit connections can be stated.

The reversal of US tariffs, as reported in “Was bedeutet der gerichtlichen Dämpfer für Trumps Zollpolitik?“, could alleviate some pressure on Asian steel exports in the long term. However, the immediate impact appears to be a dampening effect on overall market sentiment, as reflected in the declining average plant activity. Given the observed trends and the potential for increased market volatility, steel buyers and analysts should:

- Closely monitor price fluctuations: The uncertainty introduced by the US tariff reversal may lead to short-term price volatility. Buyers should actively track price movements and consider hedging strategies to mitigate risk.

- Diversify sourcing: Given the potential for supply chain disruptions, especially from plants showing declining activity such as Heyuan Derun Steel Co., Ltd., buyers should explore alternative sourcing options to ensure supply security.

- Negotiate flexible contracts: To navigate the uncertain market conditions, procurement professionals should seek flexible contracts with suppliers that allow for adjustments based on market changes and potential trade policy shifts.

- Carefully monitor KISCO steel Changwon plant: Given the activity levels of KISCO steel Changwon plant, any reliance on this supplier bears an increased risk of supply chain disruptions. Buyers should reduce dependency or seek alternative suppliers.